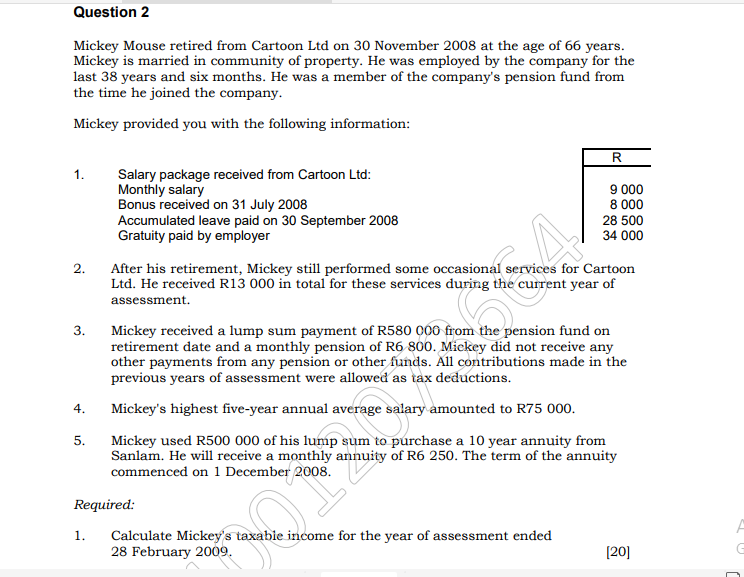

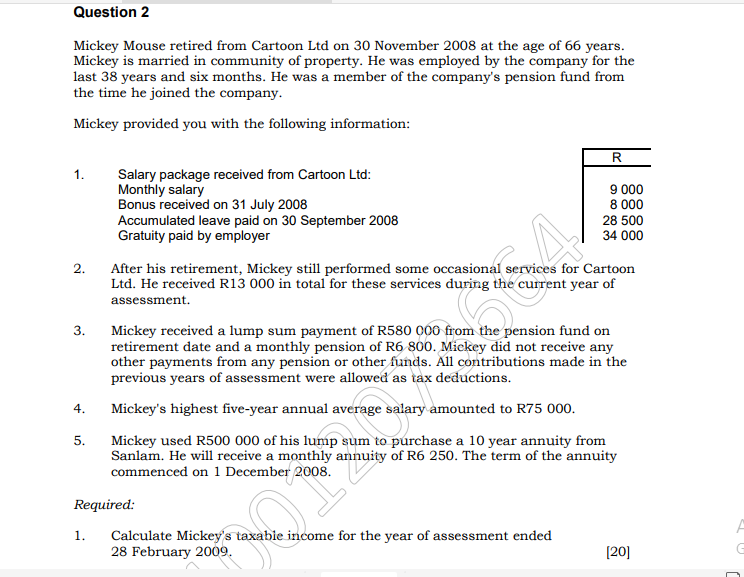

Question 2 Mickey Mouse retired from Cartoon Ltd on 30 November 2008 at the age of 66 years. Mickey is married in community of property. He was employed by the company for the last 38 years and six months. He was a member of the company's pension fund from the time he joined the company. Mickey provided you with the following information: 1. 2. R Salary package received from Cartoon Ltd: Monthly salary 9 000 Bonus received on 31 July 2008 8 000 Accumulated leave paid on 30 September 2008 28 500 Gratuity paid by employer 34 000 After his retirement, Mickey still performed some occasional services for Cartoon Ltd. He received R13 000 in total for these services during the current year of assessment Mickey received a lump sum payment of R580 000 from the pension fund on retirement date and a monthly pension of R6 800. Mickey did not receive any other payments from any pension or other funds. All contributions made in the previous years of assessment were allowed as tax deductions. Mickey's highest five-year annual average salary amounted to R75 000. Mickey used R500 000 of his lump sum to purchase a 10 year annuity from Sanlam. He will receive a monthly annuity of R6 250. The term of the annuity commenced on 1 December 2008. 3. 4. 5. Required: 1. Calculate Mickey's taxabie income for the year of assessment ended 28 February 2009 [20] G Question 2 Mickey Mouse retired from Cartoon Ltd on 30 November 2008 at the age of 66 years. Mickey is married in community of property. He was employed by the company for the last 38 years and six months. He was a member of the company's pension fund from the time he joined the company. Mickey provided you with the following information: 1. 2. R Salary package received from Cartoon Ltd: Monthly salary 9 000 Bonus received on 31 July 2008 8 000 Accumulated leave paid on 30 September 2008 28 500 Gratuity paid by employer 34 000 After his retirement, Mickey still performed some occasional services for Cartoon Ltd. He received R13 000 in total for these services during the current year of assessment Mickey received a lump sum payment of R580 000 from the pension fund on retirement date and a monthly pension of R6 800. Mickey did not receive any other payments from any pension or other funds. All contributions made in the previous years of assessment were allowed as tax deductions. Mickey's highest five-year annual average salary amounted to R75 000. Mickey used R500 000 of his lump sum to purchase a 10 year annuity from Sanlam. He will receive a monthly annuity of R6 250. The term of the annuity commenced on 1 December 2008. 3. 4. 5. Required: 1. Calculate Mickey's taxabie income for the year of assessment ended 28 February 2009 [20] G