Answered step by step

Verified Expert Solution

Question

1 Approved Answer

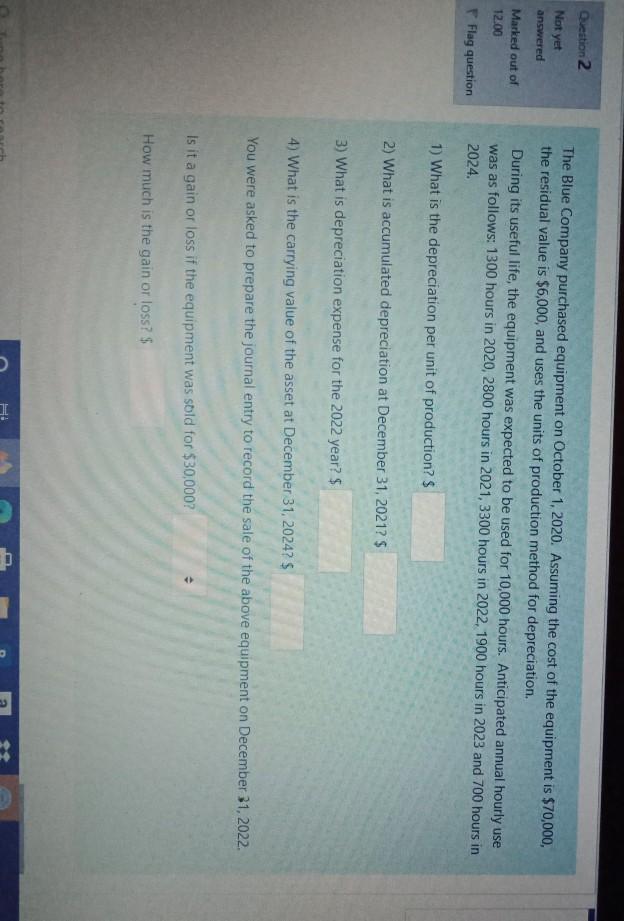

Question 2 Not yet answered Marked out of 12.00 The Blue Company purchased equipment on October 1, 2020. Assuming the cost of the equipment is

Question 2 Not yet answered Marked out of 12.00 The Blue Company purchased equipment on October 1, 2020. Assuming the cost of the equipment is $70,000, the residual value is $6,000, and uses the units of production method for depreciation. During its useful life, the equipment was expected to be used for 10,000 hours. Anticipated annual hourly use was as follows: 1300 hours in 2020, 2800 hours in 2021, 3300 hours in 2022, 1900 hours in 2023 and 700 hours in 2024. Flag question 1) What is the depreciation per unit of production? 2) What is accumulated depreciation at December 31, 2021?$ 3) What is depreciation expense for the 2022 year? $ 4) What is the carrying value of the asset at December 31, 20242 $ You were asked to prepare the journal entry to record the sale of the above equipment on December 31, 2022 Is it a gain or loss if the equipment was sold for $30,000? 4 How much is the gain or loss?$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started