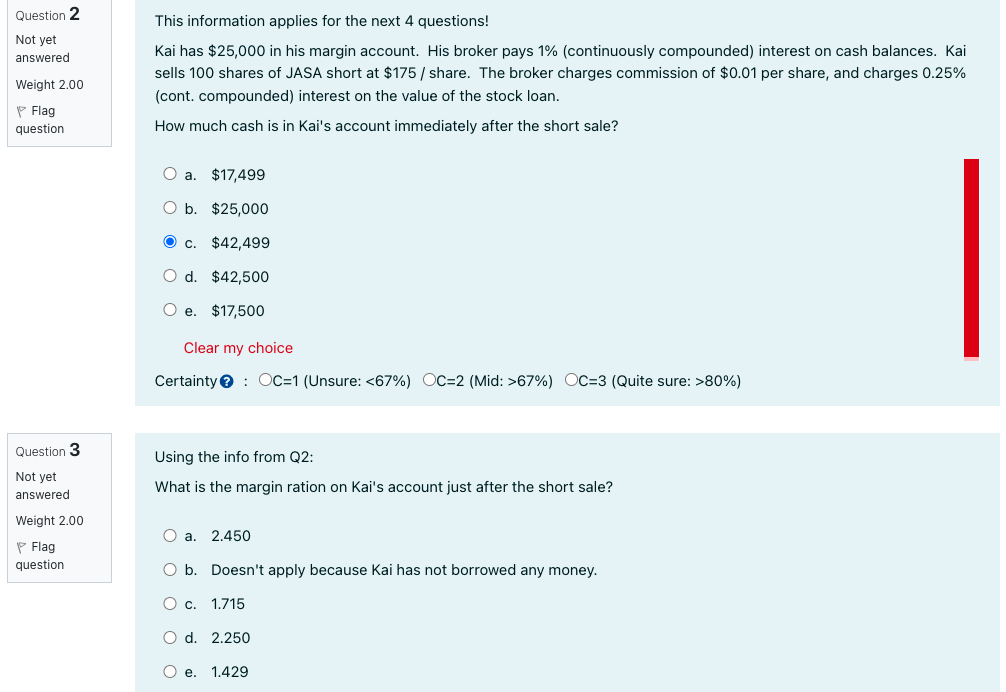

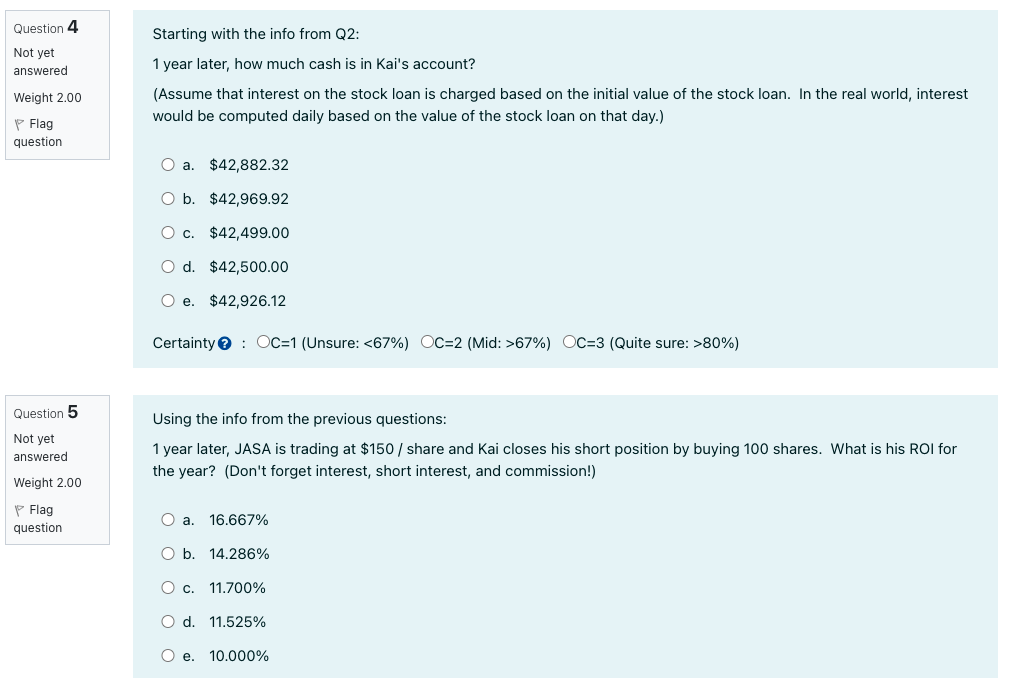

Question 2 Not yet answered This information applies for the next 4 questions! Kai has $25,000 in his margin account. His broker pays 1% (continuously compounded) interest on cash balances. Kai sells 100 shares of JASA short at $175 / share. The broker charges commission of $0.01 per share, and charges 0.25% (cont. compounded) interest on the value of the stock loan. How much cash is in Kai's account immediately after the short sale? Weight 2.00 P Flag question O a. $17,499 b. $25,000 C. $42,499 O d. $42,500 O e. $17,500 Clear my choice Certainty : OC=1 (Unsure: 67%) OC=3 (Quite sure: >80%) Question 3 Using the info from Q2: Not yet answered What is the margin ration on Kai's account just after the short sale? Weight 2.00 O a. 2.450 P Flag question O b. Doesn't apply because Kai has not borrowed any money. O c. 1.715 O d. 2.250 O e. 1.429 Question 4 Starting with the info from Q2: Not yet answered 1 year later, how much cash is in Kai's account? Weight 2.00 (Assume that interest on the stock loan is charged based on the initial value of the stock loan. In the real world, interest would be computed daily based on the value of the stock loan on that day.) P Flag question O a. $42,882.32 O b. $42,969.92 O c. $42,499.00 O d. $42,500.00 O e. $42,926.12 Certainty : OC=1 (Unsure: 67%) OC=3 (Quite sure: >80%) Question 5 Not yet answered Weight 2.00 Using the info from the previous questions: 1 year later, JASA is trading at $150 / share and Kai closes his short position by buying 100 shares. What is his ROI for the year? (Don't forget interest, short interest, and commission!) P Flag question O a. 16.667% O b. 14.286% O c. 11.700% d. 11.525% e. 10.000% Question 2 Not yet answered This information applies for the next 4 questions! Kai has $25,000 in his margin account. His broker pays 1% (continuously compounded) interest on cash balances. Kai sells 100 shares of JASA short at $175 / share. The broker charges commission of $0.01 per share, and charges 0.25% (cont. compounded) interest on the value of the stock loan. How much cash is in Kai's account immediately after the short sale? Weight 2.00 P Flag question O a. $17,499 b. $25,000 C. $42,499 O d. $42,500 O e. $17,500 Clear my choice Certainty : OC=1 (Unsure: 67%) OC=3 (Quite sure: >80%) Question 3 Using the info from Q2: Not yet answered What is the margin ration on Kai's account just after the short sale? Weight 2.00 O a. 2.450 P Flag question O b. Doesn't apply because Kai has not borrowed any money. O c. 1.715 O d. 2.250 O e. 1.429 Question 4 Starting with the info from Q2: Not yet answered 1 year later, how much cash is in Kai's account? Weight 2.00 (Assume that interest on the stock loan is charged based on the initial value of the stock loan. In the real world, interest would be computed daily based on the value of the stock loan on that day.) P Flag question O a. $42,882.32 O b. $42,969.92 O c. $42,499.00 O d. $42,500.00 O e. $42,926.12 Certainty : OC=1 (Unsure: 67%) OC=3 (Quite sure: >80%) Question 5 Not yet answered Weight 2.00 Using the info from the previous questions: 1 year later, JASA is trading at $150 / share and Kai closes his short position by buying 100 shares. What is his ROI for the year? (Don't forget interest, short interest, and commission!) P Flag question O a. 16.667% O b. 14.286% O c. 11.700% d. 11.525% e. 10.000%