Answered step by step

Verified Expert Solution

Question

1 Approved Answer

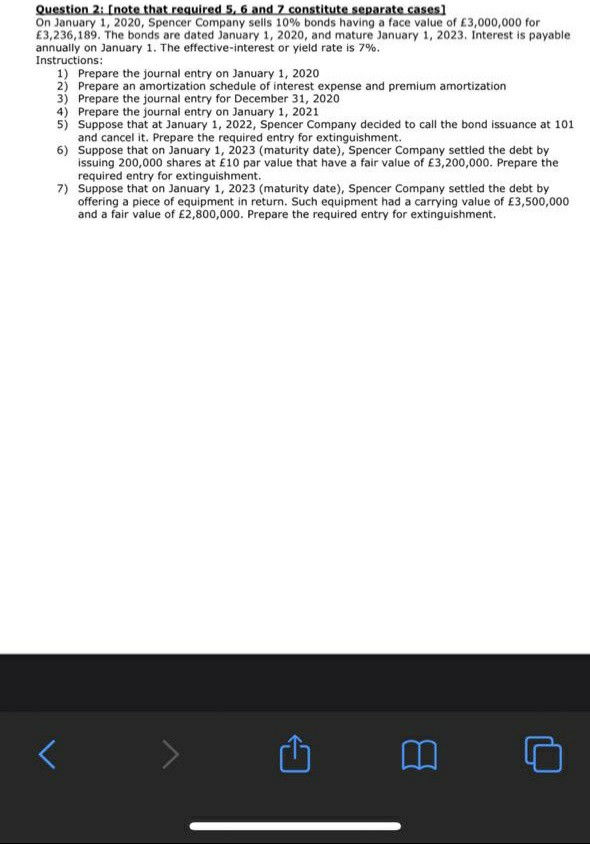

Question 2: [note that required 5, 6 and 7 constitute separate cases On January 1, 2020, Spencer Company sells 10% bonds having a face value

Question 2: [note that required 5, 6 and 7 constitute separate cases On January 1, 2020, Spencer Company sells 10% bonds having a face value of 3,000,000 for 3,236,189. The bonds are dated January 1, 2020, and mature January 1, 2023. Interest is payable annually on January 1. The effective-interest or yield rate is 7%. Instructions: 1) Prepare the journal entry on January 1, 2020 2) Prepare an amortization schedule of interest expense and premium amortization 3) Prepare the journal entry for December 31, 2020 4) Prepare the journal entry on January 1, 2021 5) Suppose that at January 1, 2022, Spencer Company decided to call the bond issuance at 101 and cancel it. Prepare the required entry for extinguishment. 6) Suppose that on January 1, 2023 (maturity date), Spencer Company settled the debt by issuing 200,000 shares at 10 par value that have a fair value of 3,200,000. Prepare the required entry for extinguishment. 7) Suppose that on January 1, 2023 (maturity date), Spencer Company settled the debt by offering a piece of equipment in return. Such equipment had a carrying value of 3,500,000 and a fair value of 2,800,000. Prepare the required entry for extinguishment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started