Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 of 1 5 . Monica is a first - year tax preparer who works hard to ask probing questions when information seems unclear.

Question of

Monica is a firstyear tax preparer who works hard to ask probing questions when information seems unclear. Doing this protects:

Only the taxpayer.

The tax preparation firm and the tax preparer.

The taxpayer, the tax preparer, and the tax preparation firm.

Only the tax preparer.

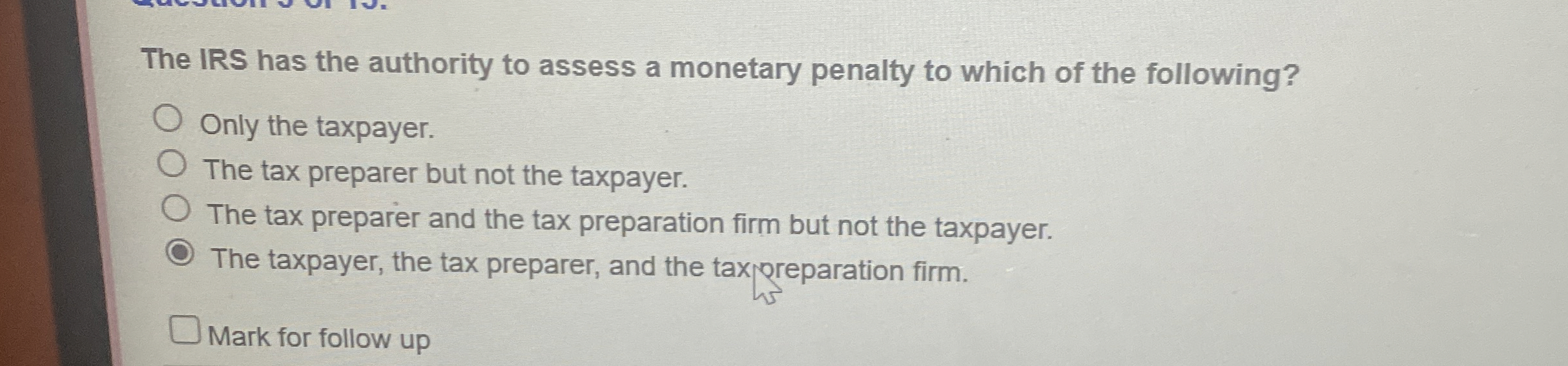

The IRS has the authority to assess a monetary penalty to which of the following?

Only the taxpayer.

The tax preparer but not the taxpayer.

The tax preparer and the tax preparation firm but not the taxpayer.

The taxpayer, the tax preparer, and the tax preparation firm.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started