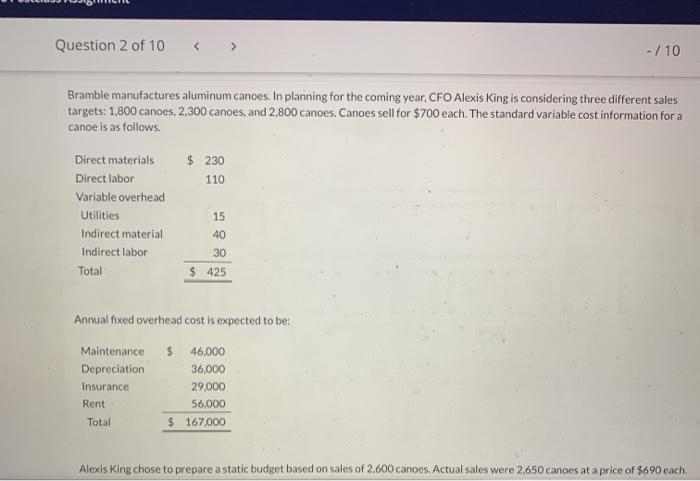

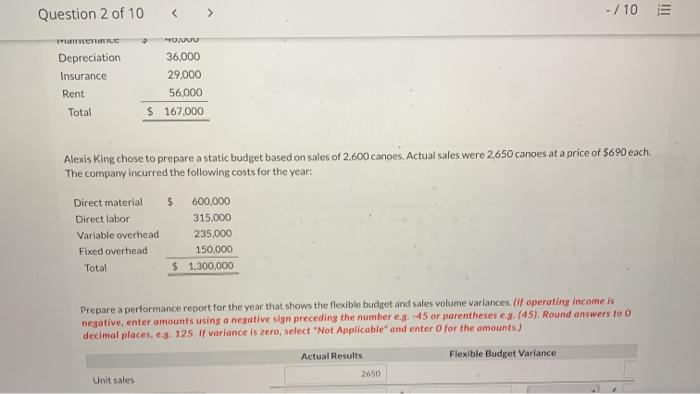

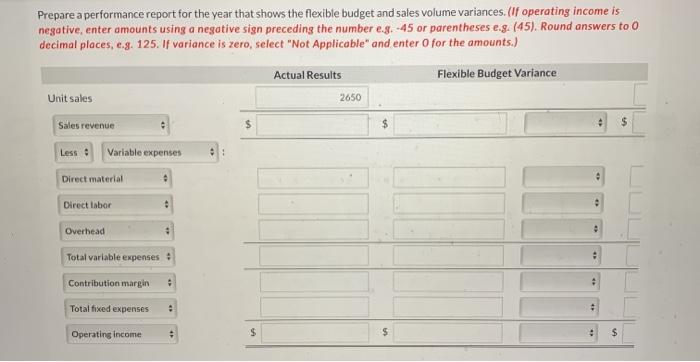

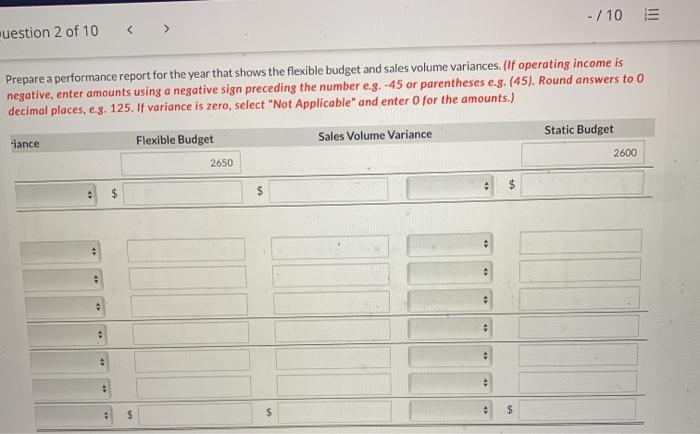

Question 2 of 10 - / 10 Bramble manufactures aluminum canoes. In planning for the coming year, CFO Alexis King is considering three different sales targets: 1,800 canoes, 2.300 canoes, and 2,800 canoes. Canoes sell for $700 each. The standard variable cost information for a canoe is as follows Direct materials $ 230 Direct labor Variable overhead Utilities Indirect material Indirect labor Total $ 425 110 15 40 30 Annual fixed overhead cost is expected to be Maintenance $ 46,000 Depreciation 36,000 Insurance 29,000 Rent 56.000 $167.000 Total Alexis King chose to prepare a static budget based on sales of 2,600 canoes. Actual sales were 2,650 canoes at a price of $690 each Question 2 of 10 - / 10 You 36,000 VIDEO Depreciation Insurance Rent Total 29,000 56,000 $ 167,000 Alexis King chose to prepare a static budget based on sales of 2,600 canoes. Actual sales were 2650 canoes at a price of $690 each. The company incurred the following costs for the year: Direct material Direct labor Variable overhead Fixed overhead Total $ 600.000 315.000 235,000 150.000 $ 1,300,000 Prepare a performance report for the year that shows the flexible budget and sales volume variances. (If operating Income is negative, enter amounts using a negative sign preceding the number eg. 45 or parentheses e... (45). Round answers to o decimal places, e.3. 125. If variance is zero, select "Not Applicable and enter for the amounts.) Actual Results Flexible Budget Variance 2030 Unit sales Prepare a performance report for the year that shows the flexible budget and sales volume variances. (If operating income is negative, enter amounts using a negative sign preceding the number e.g.-45 or parentheses e.g. (45). Round answers to o decimal places, e.g. 125. If variance is zero, select "Not Applicable" and enter for the amounts.) Actual Results Flexible Budget Variance Unit sales 2650 Sales revenue $ . Lesso Variable expenses Direct material Direct labor Overhead Total variable expenses Contribution margin Totalfixed expenses Operating income $ $ $ -/10 uestion 2 of 10 Prepare a performance report for the year that shows the flexible budget and sales volume variances. (If operating income is negative, enter amounts using a negative sign preceding the number e.g.-45 or parentheses e.g. (45). Round answers to 0 decimal places, c.8. 125. If variance is zero, select "Not Applicable" and enter for the amounts.) Sales Volume Variance fiance Flexible Budget Static Budget 2600 2650 $ $ $ $ $