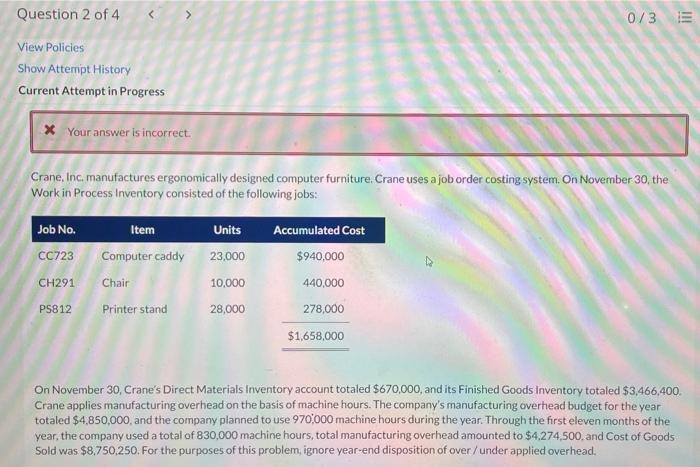

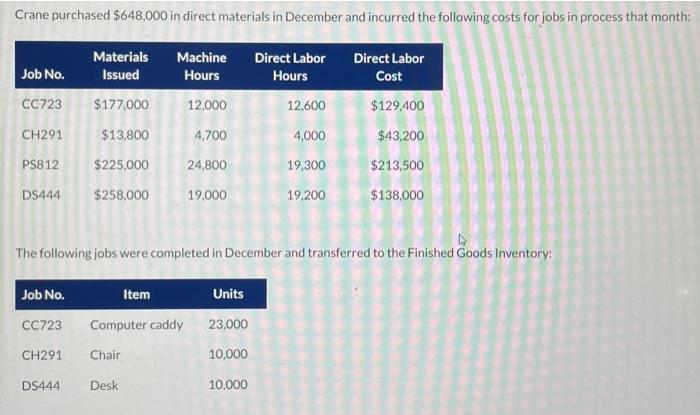

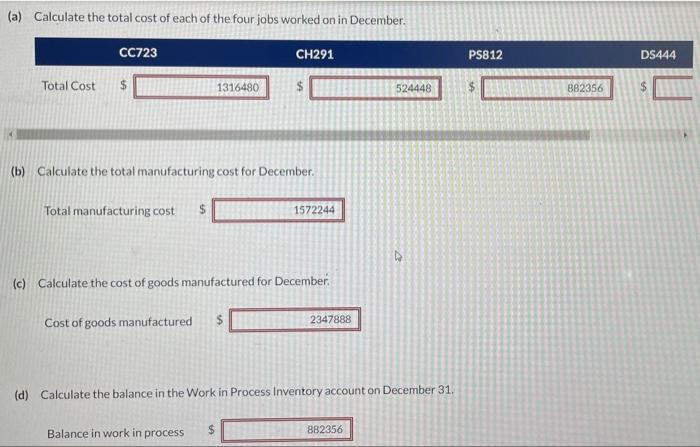

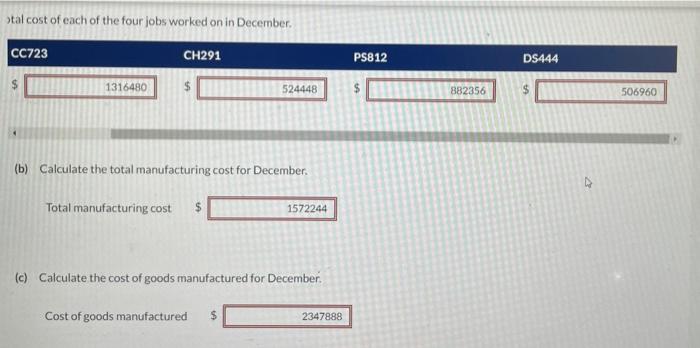

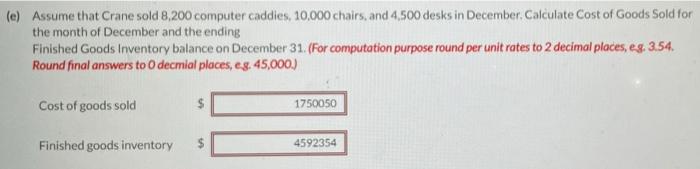

Question 2 of 4 0/3 E View Policies Show Attempt History Current Attempt in Progress * Your answer is incorrect. Crane, Inc., manufactures ergonomically designed computer furniture. Crane uses a job order costing system. On November 30, the Work in Process Inventory consisted of the following jobs: Job No. CC723 Item Computer caddy Units 23,000 10,000 28,000 Accumulated Cost $940,000 440,000 278,000 CH291 Chair PS812 Printer stand $1,658,000 On November 30, Crane's Direct Materials inventory account totaled $670,000, and its Finished Goods Inventory totaled $3,466,400 Crane applies manufacturing overhead on the basis of machine hours. The company's manufacturing overhead budget for the year totaled $4,850,000, and the company planned to use 970.000 machine hours during the year. Through the first eleven months of the year, the company used a total of 830,000 machine hours, total manufacturing overhead amounted to $4.274,500 and Cost of Goods Sold was $8,750,250. For the purposes of this problem, ignore year-end disposition of over / under applied overhead. Crane purchased $648,000 in direct materials in December and incurred the following costs for jobs in process that month: Job No. Materials Issued $177,000 CC723 CH291 $13,800 Machine Direct Labor Direct Labor Hours Hours Cost 12,000 12,600 $129,400 4.700 4,000 $43,200 24,800 19,300 $213,500 19,000 19,200 $138,000 PS812 $225,000 DS444 $258,000 The following jobs were completed in December and transferred to the Finished Goods Inventory: Job No. Item Units 23,000 CC723 Computer caddy CH291 Chair 10,000 DS444 Desk 10,000 (a) Calculate the total cost of each of the four jobs worked on in December. CC723 CH291 PS812 DS444 Total Cost $ 1316480 $ 524448 882356 $ (b) Calculate the total manufacturing cost for December. Total manufacturing cost $ 1572244 (c) Calculate the cost of goods manufactured for December Cost of goods manufactured $ 2347888 (d) Calculate the balance in the Work in Process Inventory account on December 31 Balance in work in process $ 882356 otal cost of each of the four jobs worked on in December. CC723 CH291 PS812 DS444 1316480 524448 882356 506960 (b) Calculate the total manufacturing cost for December, Total manufacturing cost 1572244 (c) Calculate the cost of goods manufactured for December Cost of goods manufactured $ $ 2347888 (e) Assume that Crane sold 8 200 computer caddies. 10,000 chairs and 4.500 desks in December, Calculate Cost of Goods Sold for the month of December and the ending Finished Goods Inventory balance on December 31. (For computation purpose round per unit rates to 2 decimal places, eg: 3.54. Round final answers to decmial places, eg. 45,000.) Cost of goods sold $ 1750050 Finished goods inventory $ 4592354