Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 of 4 (25 marks) On April 1, 2018, Allen Company of Ontario purchased a new piece of equipment for the construction company, and

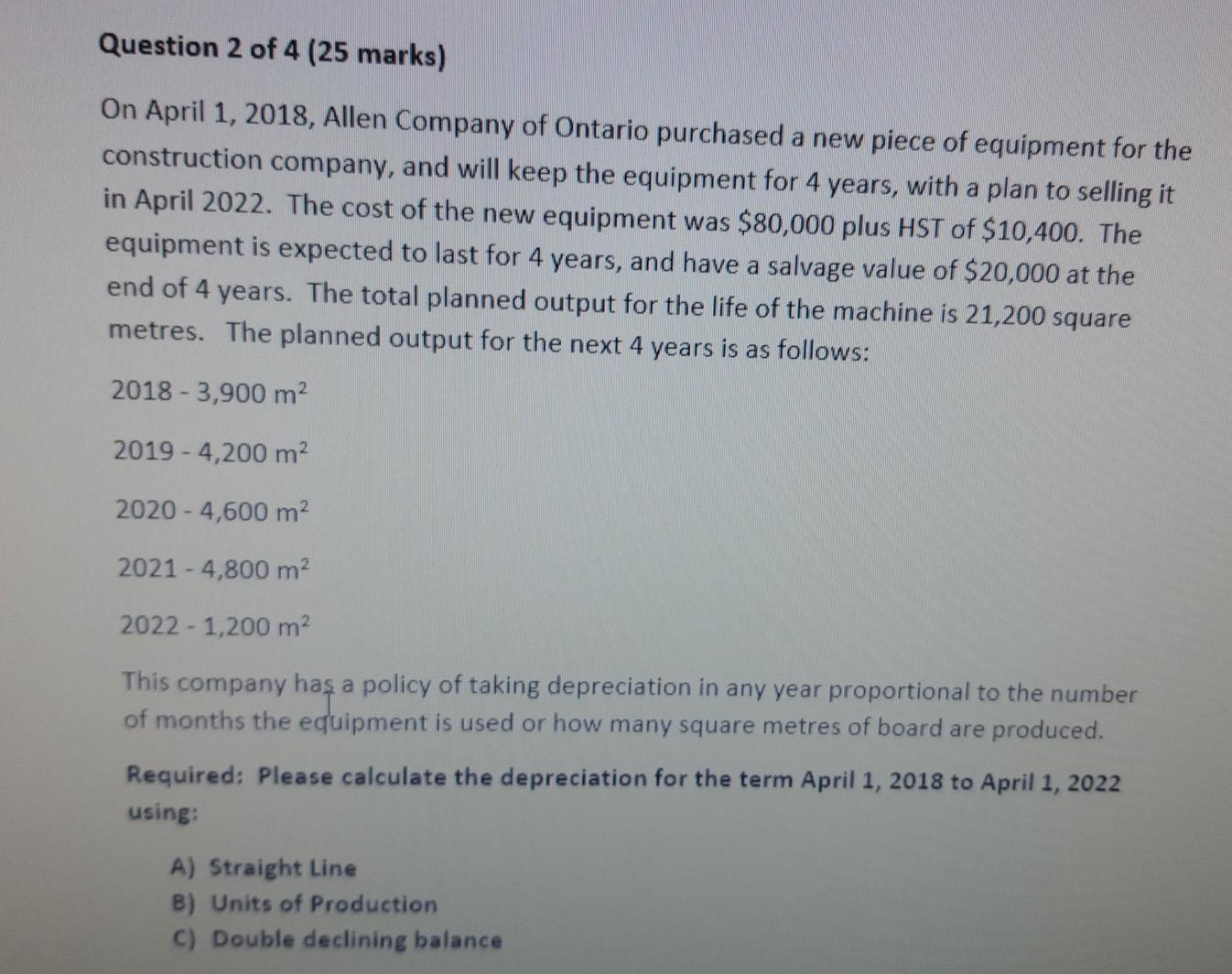

Question 2 of 4 (25 marks) On April 1, 2018, Allen Company of Ontario purchased a new piece of equipment for the construction company, and will keep the equipment for 4 years, with a plan to selling it in April 2022. The cost of the new equipment was $80,000 plus HST of $10,400. The equipment is expected to last for 4 years, and have a salvage value of $20,000 at the end of 4 years. The total planned output for the life of the machine is 21,200 square metres. The planned output for the next 4 years is as follows: 2018 - 3,900 m2 2019 - 4,200 m2 2020 - 4,600 m2 2021 - 4,800 m2 2022 - 1,200 m2 This company has a policy of taking depreciation in any year proportional to the number of months the equipment is used or how many square metres of board are produced. Required: Please calculate the depreciation for the term April 1, 2018 to April 1, 2022 using: A) Straight Line B) Units of Production C) Double declining balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started