Answered step by step

Verified Expert Solution

Question

1 Approved Answer

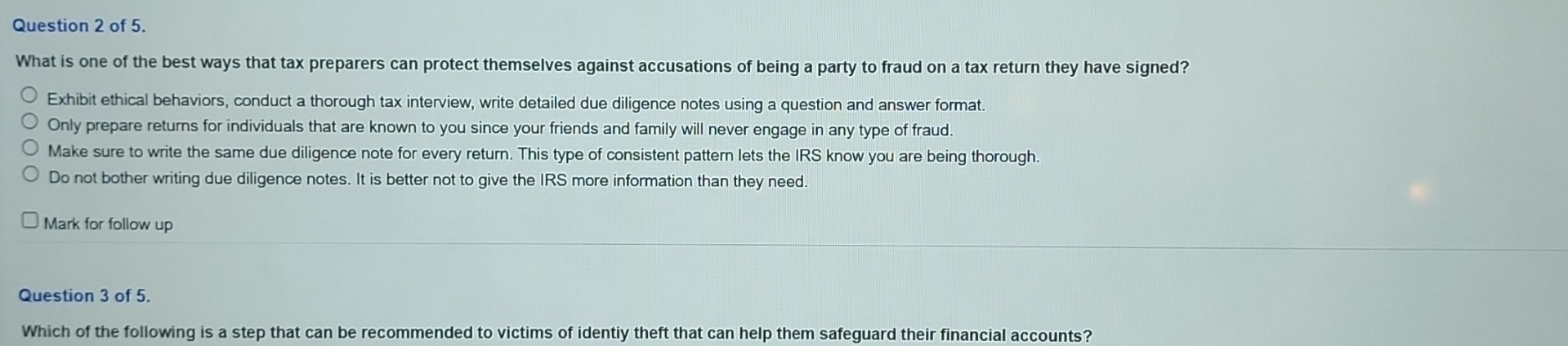

Question 2 of 5 . What is one of the best ways that tax preparers can protect themselves against accusations of being a party to

Question of

What is one of the best ways that tax preparers can protect themselves against accusations of being a party to fraud on a tax return they have signed?

Exhibit ethical behaviors, conduct a thorough tax interview, write detailed due diligence notes using a question and answer format.

Only prepare returns for individuals that are known to you since your friends and family will never engage in any type of fraud.

Make sure to write the same due diligence note for every return. This type of consistent pattern lets the IRS know you are being thorough.

Do not bother writing due diligence notes. It is better not to give the IRS more information than they need.

Mark for follow up

Question of

Which of the following is a step that can be recommended to victims of identiy theft that can help them safeguard their financial accounts?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started