Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 of 6 . Jane is a partner in a CPA firm that prepares tax returns and provides tax planning to Clark and Ellen

Question of

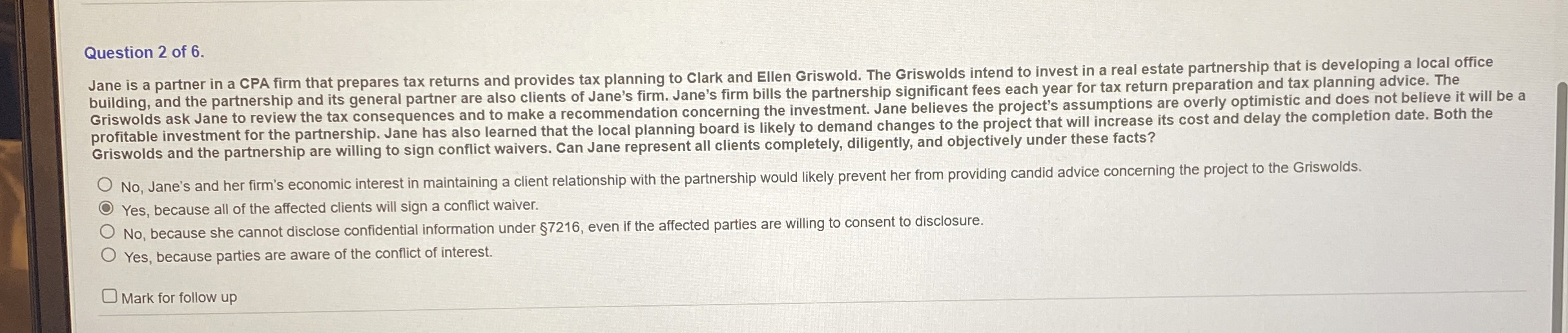

Jane is a partner in a CPA firm that prepares tax returns and provides tax planning to Clark and Ellen Griswold. The Griswolds intend to invest in a real estate partnership that is developing a local office building, and the partnership and its general partner are also clients of Jane's firm. Jane's firm bills the partnership significant fees each year for tax return preparation and tax planning advice. The Griswolds ask Jane to review the tax consequences and to make a recommendation concerning the investment. Jane believes the project's assumptions are overly optimistic and does not believe it will be a profitable investment for the partnership. Jane has also learned that the local planning board is likely to demand changes to the project that will increase its cost and delay the completion date. Both the Griswolds and the partnership are willing to sign conflict waivers. Can Jane represent all clients completely, diligently, and objectively under these facts?

No Jane's and her firm's economic interest in maintaining a client relationship with the partnership would likely prevent her from providing candid advice concerning the project to the Griswolds.

Yes, because all of the affected clients will sign a conflict waiver.

No because she cannot disclose confidential information under even if the affected parties are willing to consent to disclosure.

Yes, because parties are aware of the conflict of interest.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started