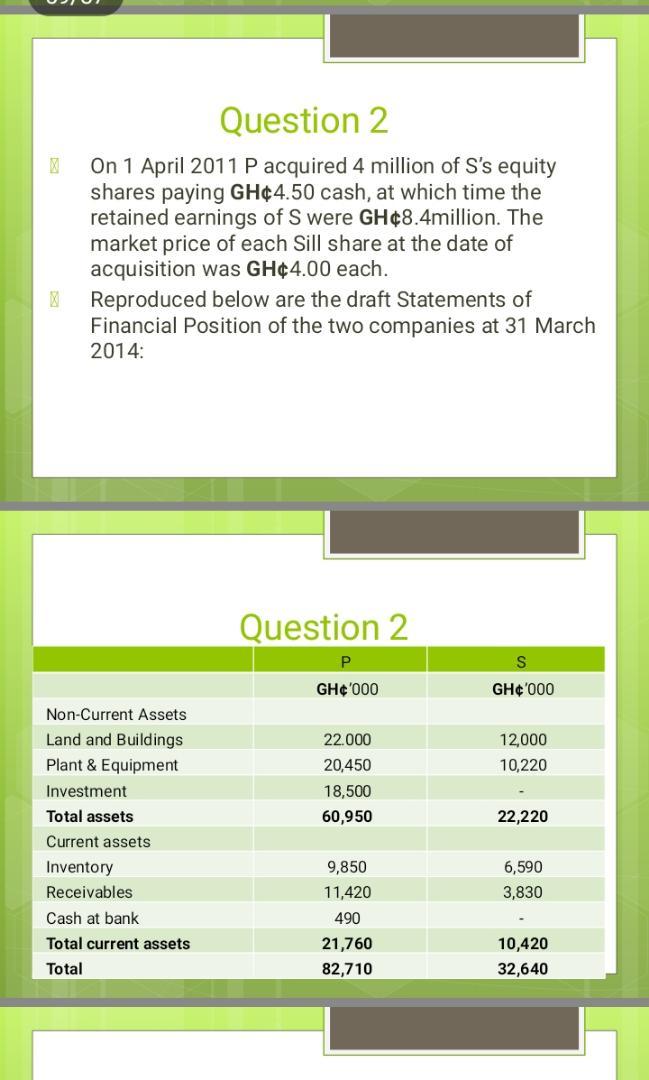

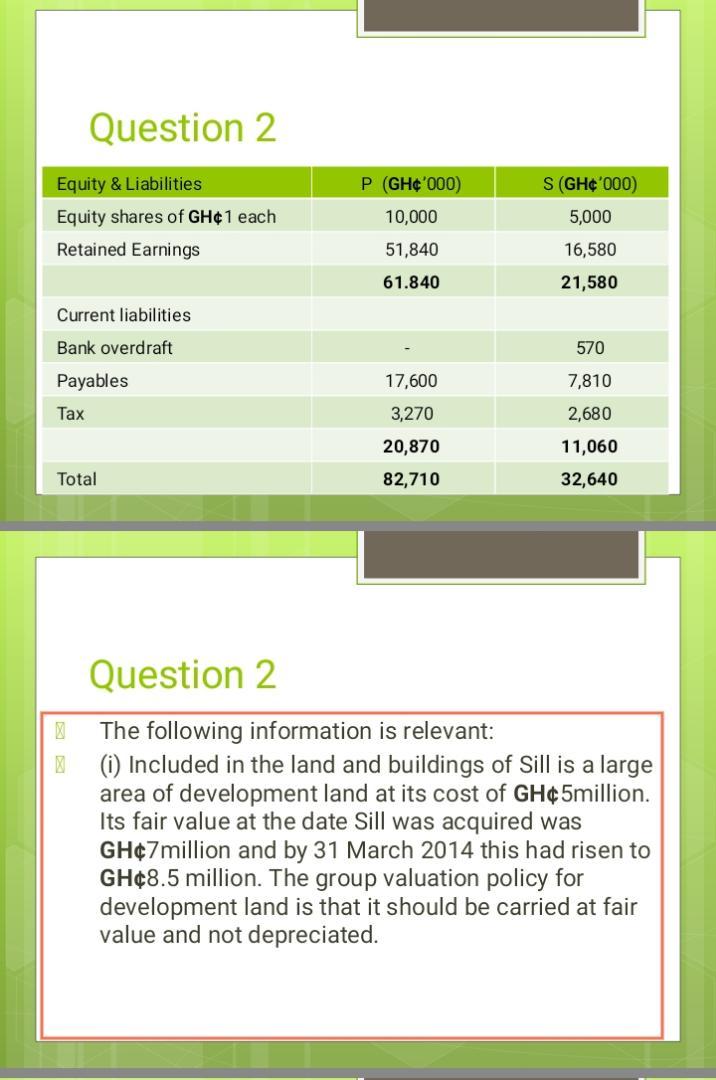

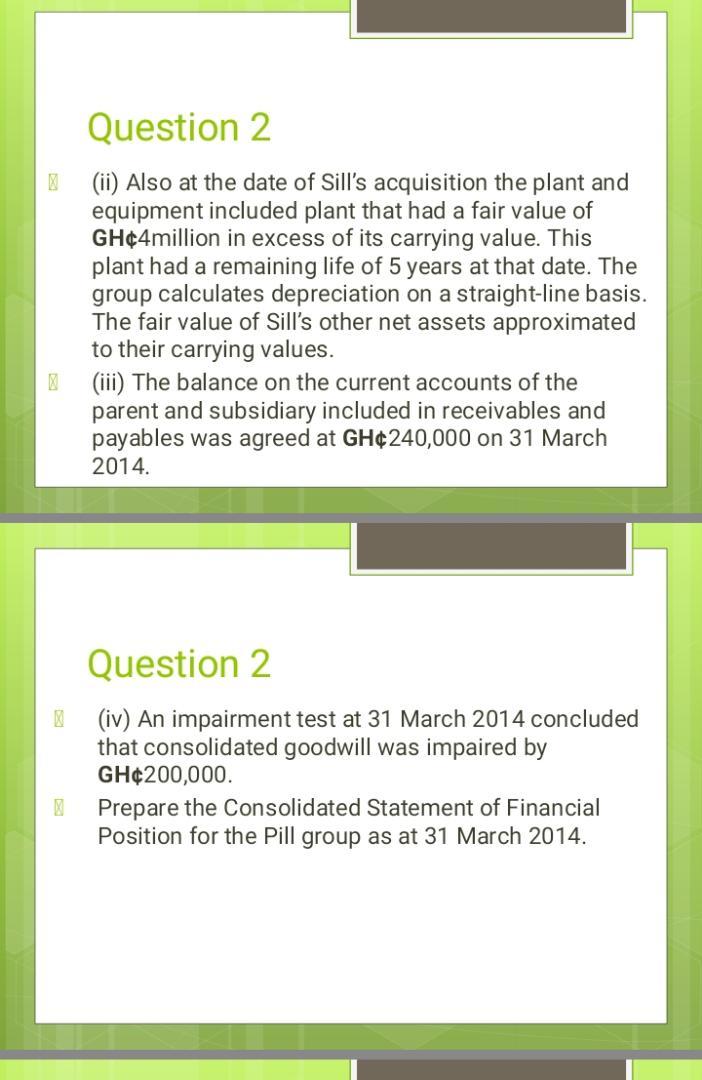

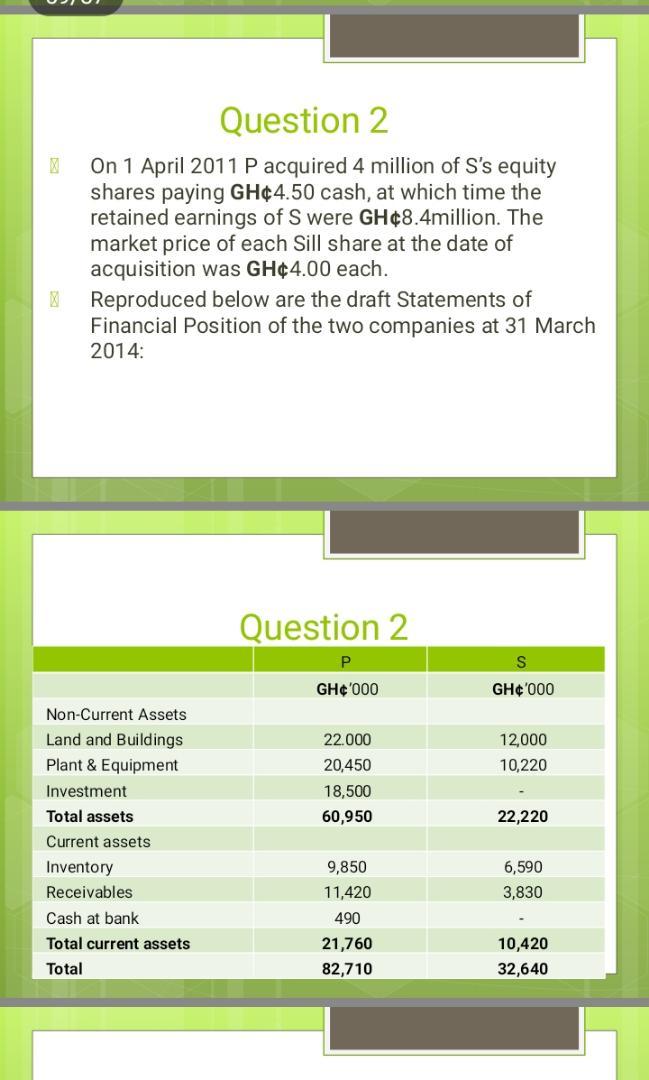

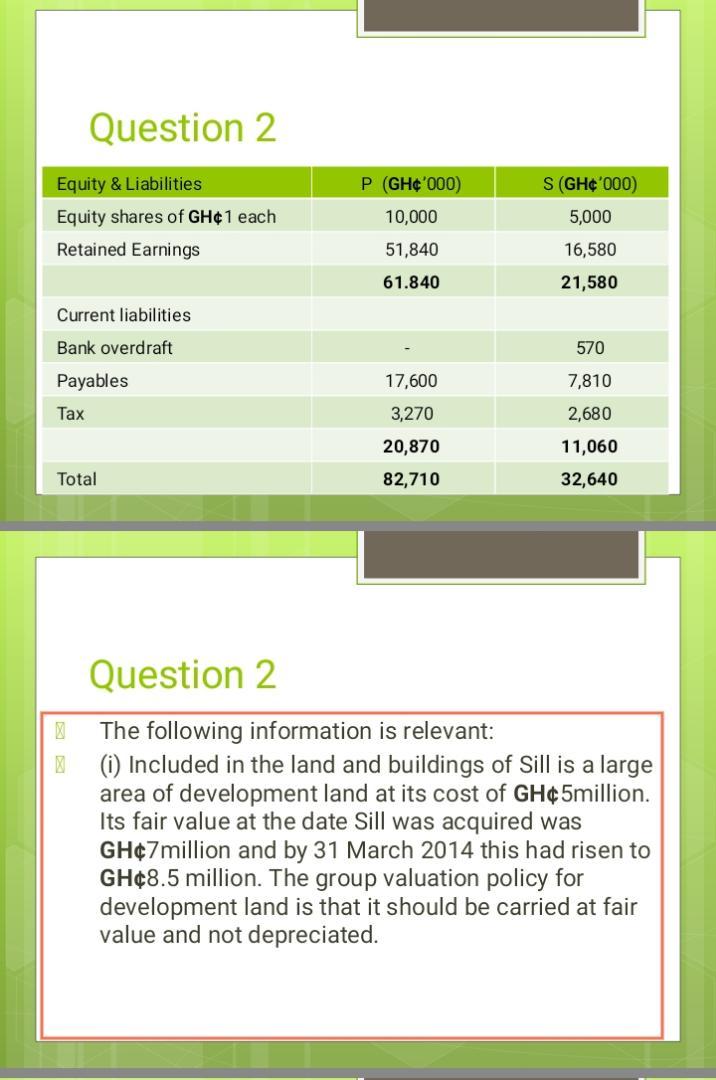

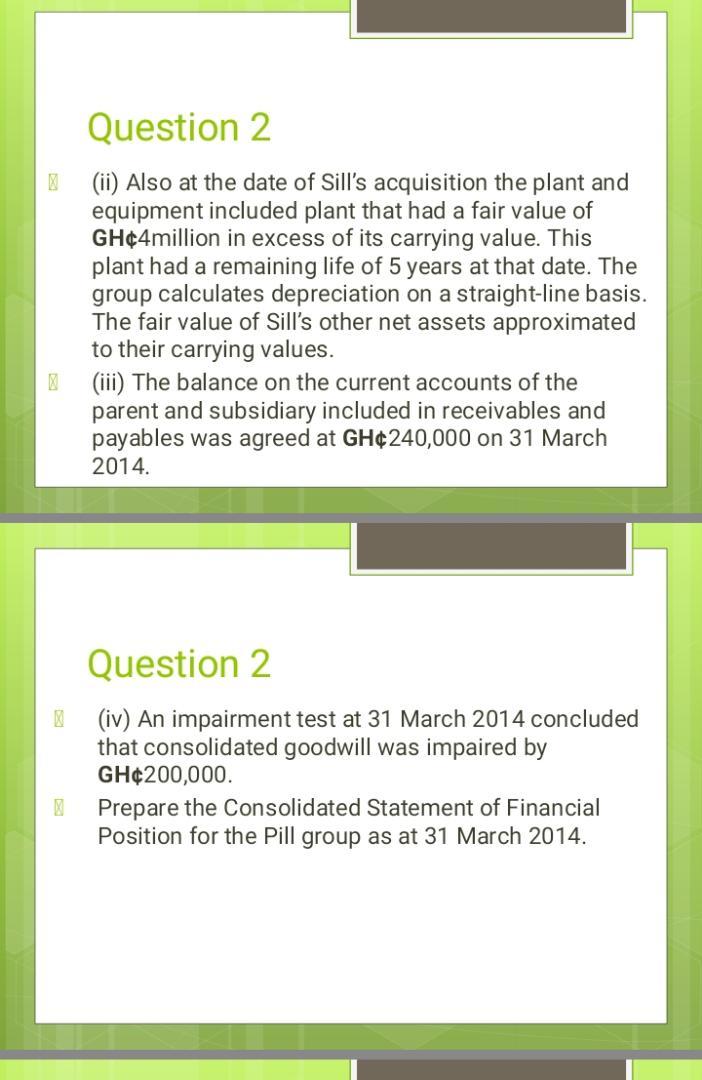

Question 2 On 1 April 2011 P acquired 4 million of S's equity shares paying GH4.50 cash, at which time the retained earnings of S were GH8.4million. The market price of each Sill share at the date of acquisition was GH4.00 each. Reproduced below are the draft Statements of Financial Position of the two companies at 31 March 2014: . Question 2 S GH'000 GH'000 12,000 10,220 22.000 20,450 18,500 60,950 22,220 Non-Current Assets Land and Buildings Plant & Equipment Investment Total assets Current assets Inventory Receivables Cash at bank Total current assets Total 6,590 3,830 9,850 11,420 490 21,760 82,710 10,420 32,640 Question 2 Equity & Liabilities Equity shares of GH1 each Retained Earnings P (GH'000) 10,000 51,840 S (GH'000) 5,000 16,580 21,580 61.840 Current liabilities Bank overdraft 570 Payables 17,600 7,810 Tax 3,270 2,680 11,060 20,870 82,710 Total 32,640 Question 2 The following information is relevant: (i) Included in the land and buildings of Sill is a large area of development land at its cost of GH 5million. Its fair value at the date Sill was acquired was GH7million and by 31 March 2014 this had risen to GH8.5 million. The group valuation policy for development land is that it should be carried at fair value and not depreciated. Question 2 (ii) Also at the date of Sill's acquisition the plant and equipment included plant that had a fair value of GH4million in excess of its carrying value. This plant had a remaining life of 5 years at that date. The group calculates depreciation on a straight-line basis. The fair value of Sill's other net assets approximated to their carrying values. (iii) The balance on the current accounts of the parent and subsidiary included in receivables and payables was agreed at GH240,000 on 31 March 2014. Question 2 (iv) An impairment test at 31 March 2014 concluded that consolidated goodwill was impaired by GH200,000. Prepare the Consolidated Statement of Financial Position for the Pill group as at 31 March 2014. Question 2 On 1 April 2011 P acquired 4 million of S's equity shares paying GH4.50 cash, at which time the retained earnings of S were GH8.4million. The market price of each Sill share at the date of acquisition was GH4.00 each. Reproduced below are the draft Statements of Financial Position of the two companies at 31 March 2014: . Question 2 S GH'000 GH'000 12,000 10,220 22.000 20,450 18,500 60,950 22,220 Non-Current Assets Land and Buildings Plant & Equipment Investment Total assets Current assets Inventory Receivables Cash at bank Total current assets Total 6,590 3,830 9,850 11,420 490 21,760 82,710 10,420 32,640 Question 2 Equity & Liabilities Equity shares of GH1 each Retained Earnings P (GH'000) 10,000 51,840 S (GH'000) 5,000 16,580 21,580 61.840 Current liabilities Bank overdraft 570 Payables 17,600 7,810 Tax 3,270 2,680 11,060 20,870 82,710 Total 32,640 Question 2 The following information is relevant: (i) Included in the land and buildings of Sill is a large area of development land at its cost of GH 5million. Its fair value at the date Sill was acquired was GH7million and by 31 March 2014 this had risen to GH8.5 million. The group valuation policy for development land is that it should be carried at fair value and not depreciated. Question 2 (ii) Also at the date of Sill's acquisition the plant and equipment included plant that had a fair value of GH4million in excess of its carrying value. This plant had a remaining life of 5 years at that date. The group calculates depreciation on a straight-line basis. The fair value of Sill's other net assets approximated to their carrying values. (iii) The balance on the current accounts of the parent and subsidiary included in receivables and payables was agreed at GH240,000 on 31 March 2014. Question 2 (iv) An impairment test at 31 March 2014 concluded that consolidated goodwill was impaired by GH200,000. Prepare the Consolidated Statement of Financial Position for the Pill group as at 31 March 2014