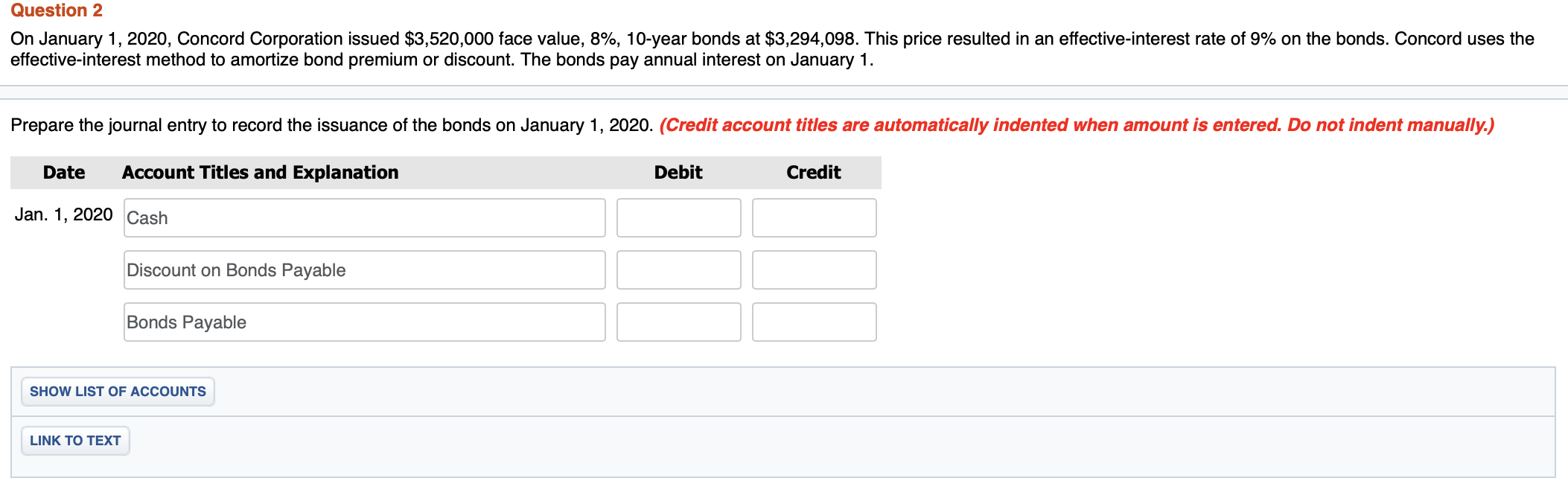

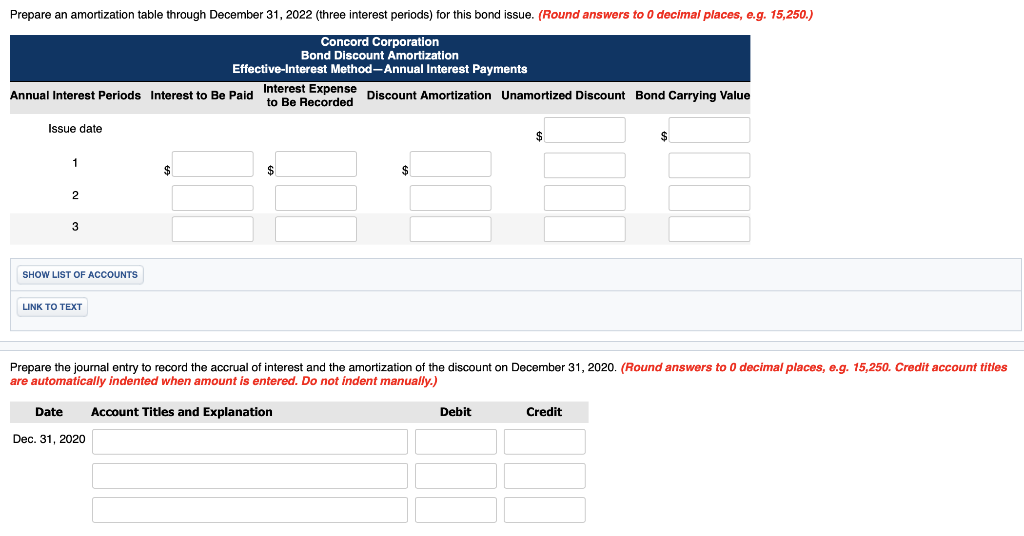

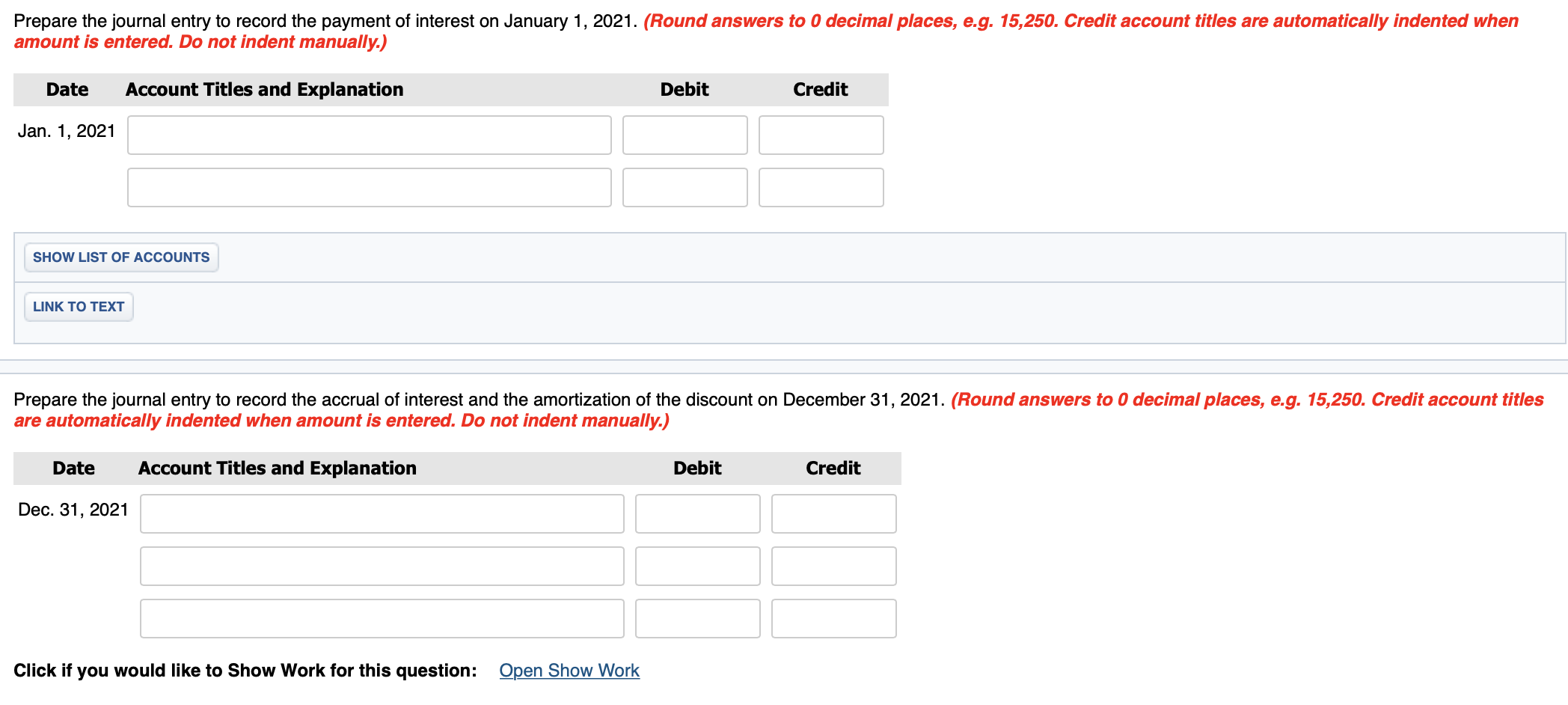

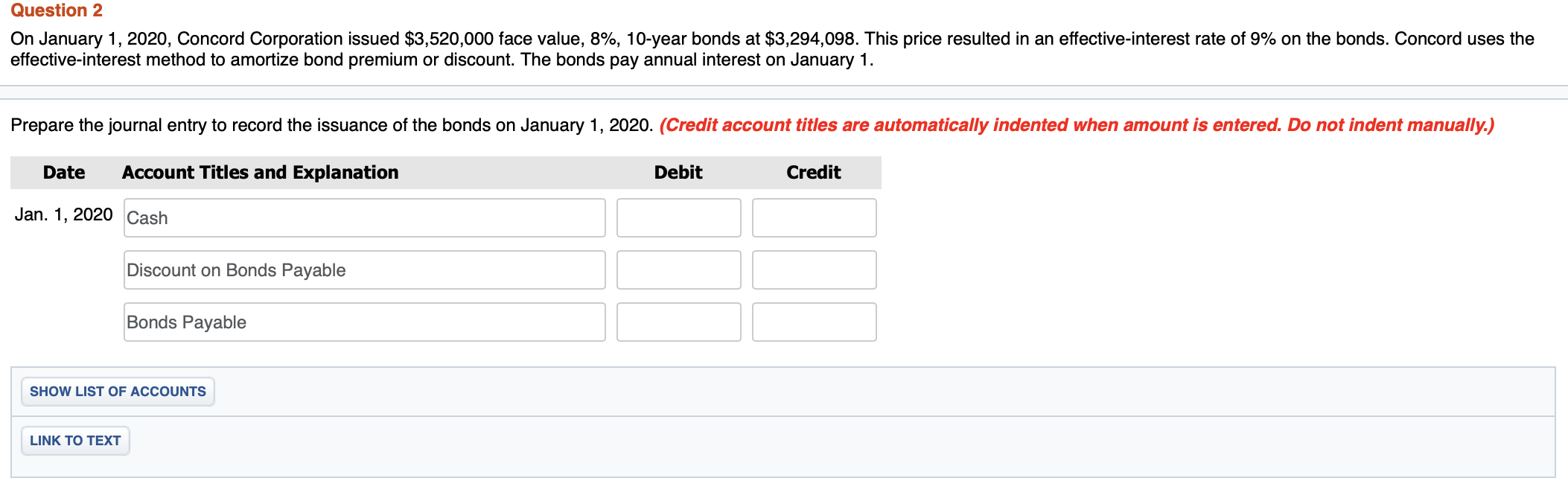

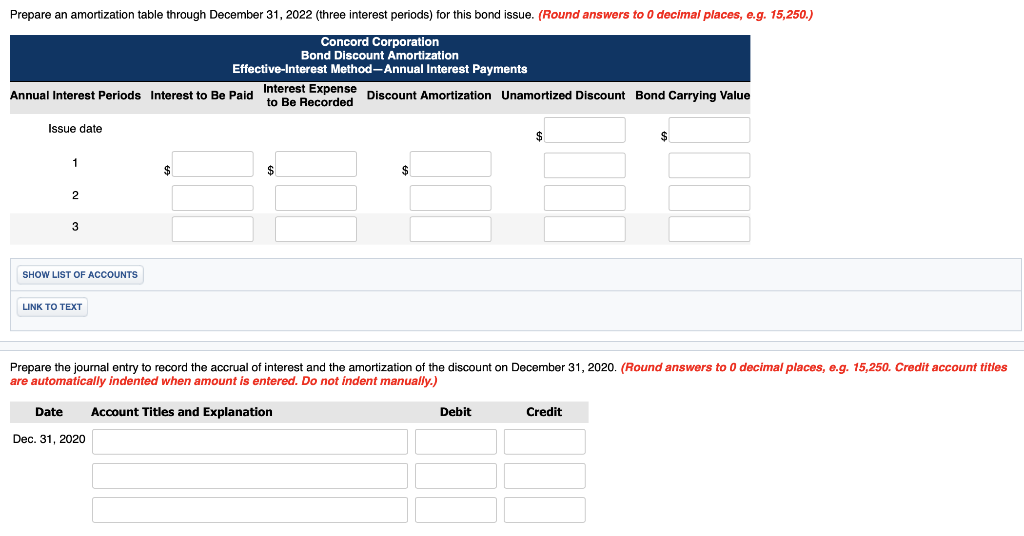

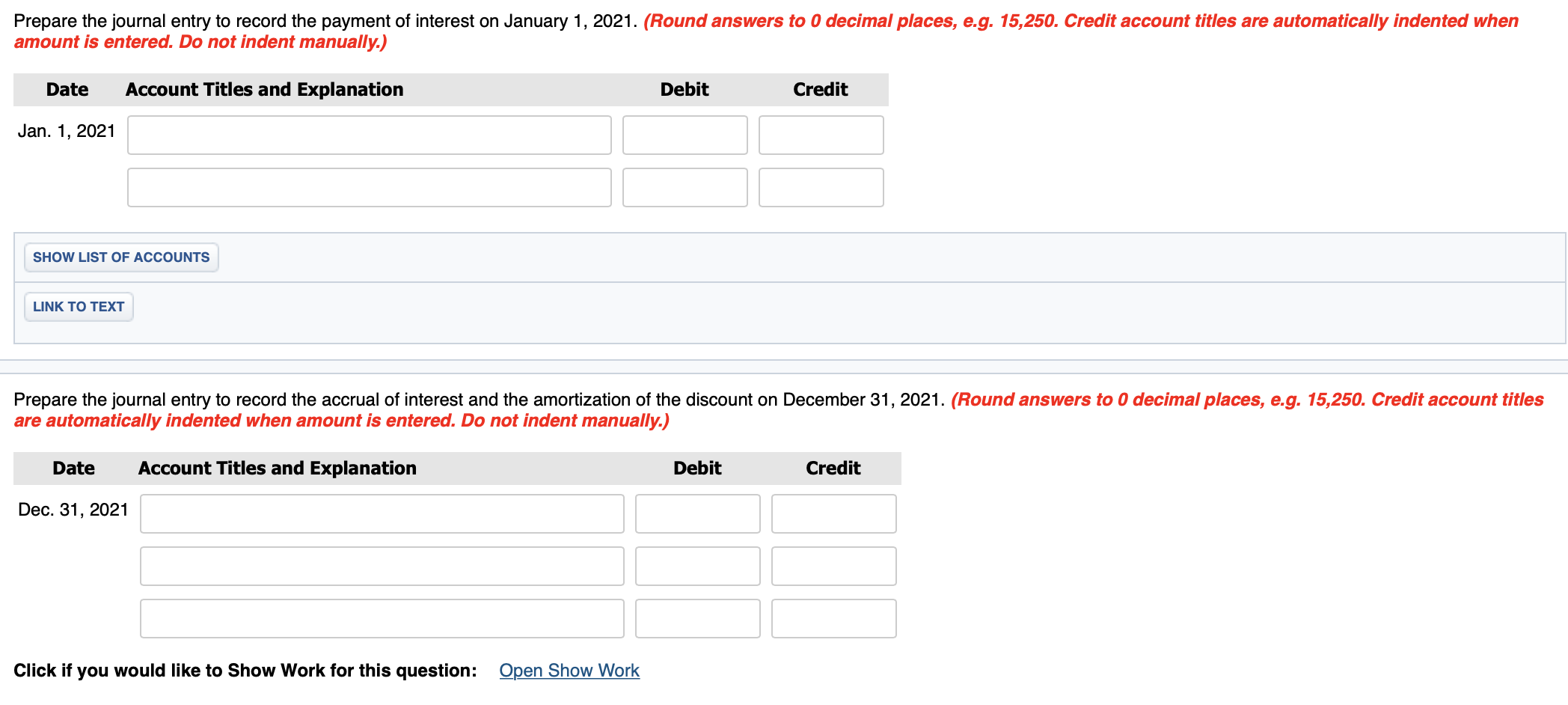

Question 2 On January 1, 2020, Concord Corporation issued $3,520,000 face value, 8%, 10-year bonds at $3,294,098. This price resulted in an effective-interest rate of 9% on the bonds. Concord uses the effective-interest method to amortize bond premium or discount. The bonds pay annual interest on January 1. Prepare the journal entry to record the issuance of the bonds on January 1, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 1, 2020 Cash Discount on Bonds Payable Bonds Payable SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare an amortization table through December 31, 2022 (three interest periods) for bond issue. (Round answers to 0 decimal places, e.g. 15,250.) Concord Corporation Bond Discount Amortization Effective-Interest Method-Annual Interest Payments Annual Interest Periods Interest to Be Paid Interest Expense Discount Amortization Unamortized Discount Bond Carrying Value to Be Recorded Issue date $ $ 1 $ $ 2 3 SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare the journal entry to record the accrual of interest and the amortization of the discount on December 31, 2020. (Round answers to 0 decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31, 2020 Prepare the journal entry to record the payment of interest on January 1, 2021. (Round answers to 0 decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 1, 2021 SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare the journal entry to record the accrual of interest and the amortization of the discount on December 31, 2021. (Round answers to 0 decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31, 2021 Click if you would like to Show Work for this question: Open Show Work