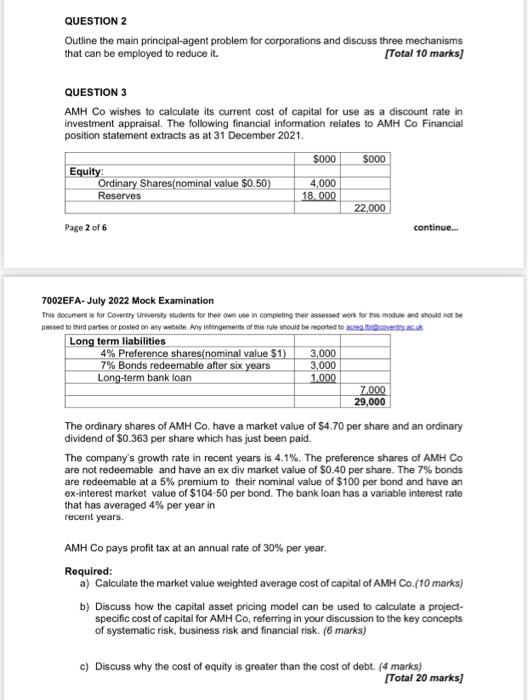

QUESTION 2 Outline the main principal-agent problem for corporations and discuss three mechanisms that can be employed to reduce it. [Total 10 marks] QUESTION 3 AMH Co wishes to calculate its current cost of capital for use as a discount rate in investment appraisal. The following financial information relates to AMH Co Financial position statement extracts as at 31 December 2021. Page 2 of 6 continue... 7002EFA- July 2022 Mock Examination The ordinary shares of AMH Co. have a market value of $4.70 per share and an ordinary dividend of $0.363 per share which has just been paid. The compary's growth rate in recent years is 4.1%. The preference shares of AMH Co are not redeemable and have an ex div market value of $0.40 per share. The 7% bonds are redeemable at a 5% premium to their nominal value of $100 per bond and have an ex-interest market value of $104.50 per bond. The bank loan has a variable interest rate that has averaged 4% per year in recent years. AMH Co pays profit tax at an annual rate of 30% per year. Required: a) Calculate the market value weighted average cost of capital of AMH Co. (10 marks) b) Discuss how the capital asset pricing model can be used to calculate a projectspecific cost of capital for AMH Co, referring in your discussion to the key concepts of systematic risk, business risk and financial risk. (6 marks) c) Discuss why the cost of equity is greater than the cost of debt. (4 marks) [Total 20 marks] QUESTION 2 Outline the main principal-agent problem for corporations and discuss three mechanisms that can be employed to reduce it. [Total 10 marks] QUESTION 3 AMH Co wishes to calculate its current cost of capital for use as a discount rate in investment appraisal. The following financial information relates to AMH Co Financial position statement extracts as at 31 December 2021. Page 2 of 6 continue... 7002EFA- July 2022 Mock Examination The ordinary shares of AMH Co. have a market value of $4.70 per share and an ordinary dividend of $0.363 per share which has just been paid. The compary's growth rate in recent years is 4.1%. The preference shares of AMH Co are not redeemable and have an ex div market value of $0.40 per share. The 7% bonds are redeemable at a 5% premium to their nominal value of $100 per bond and have an ex-interest market value of $104.50 per bond. The bank loan has a variable interest rate that has averaged 4% per year in recent years. AMH Co pays profit tax at an annual rate of 30% per year. Required: a) Calculate the market value weighted average cost of capital of AMH Co. (10 marks) b) Discuss how the capital asset pricing model can be used to calculate a projectspecific cost of capital for AMH Co, referring in your discussion to the key concepts of systematic risk, business risk and financial risk. (6 marks) c) Discuss why the cost of equity is greater than the cost of debt. (4 marks) [Total 20 marks]