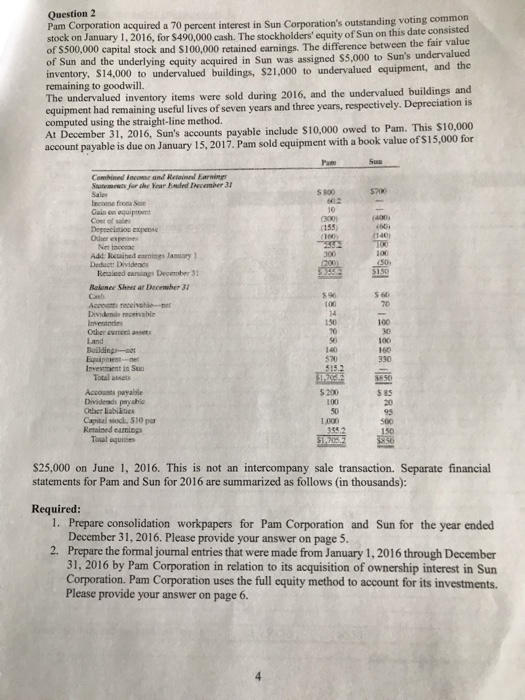

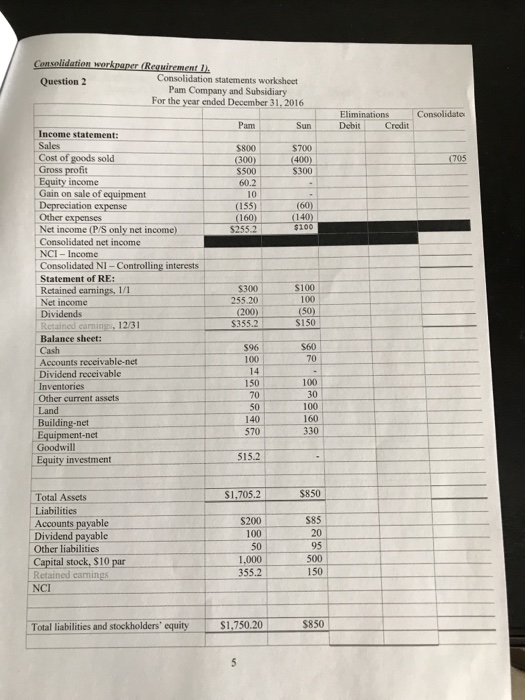

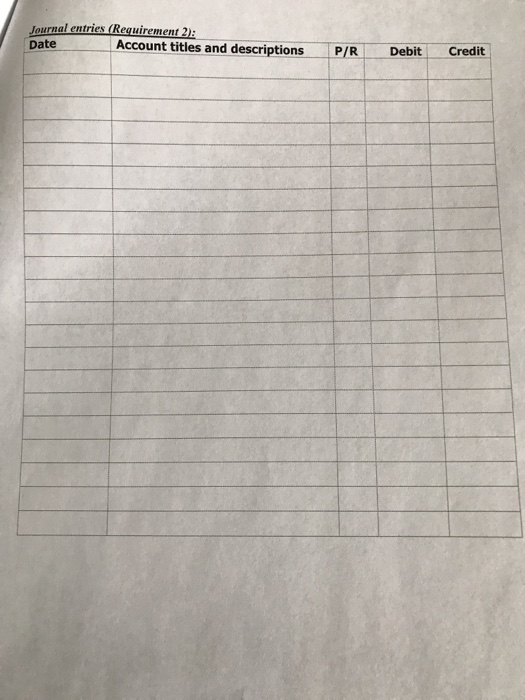

Question 2 Pam Corporation acquired a 70 percent interest in Sun Corporation stock on January 1, 2016, for $490,000 cash. The stockholders' equity of Sun on of $500,000 capital stock and $100,000 retained earnings. The difference of Sun and the underlying equity acquired in Sun was assigned $5,000 to Sun's u inventory, S14,000 to undervalued buildings, $21,000 to remaining to goodwill The undervalued inventory items were sold during 2016, and the undervalued buildings and equipment had remaining useful lives of seven years and three years, respectively. Deprecia computed using the straight-line method. s outstanding voting common this date consisted between the fair value ndervalued undervalued equipment, and the December 31, 2016, Sun's accounts payable include $10,000 owed to Pam. This $10,000 account payable is due on January 15, 2017. Pam sold equipment with a book value of S15,000 for Pam Combined laconse and Retainndl Earnings Sastemets fur ahe Year bndrd Inecember 3 Gain on equipment Cont of sales Degeeciatios expense Odher espenes S 800 10 133) (400 Net ince Add keuined carnings January 1 Deduct: Dividencs Reuieed eanings December 31 Rakonee Shees ar Decewher 3 5 96 Dividends recervcable 100 30 100 160 330 150 Other cument assets 50 140 570 Investmment in Su Total awets Accounts payaible Dividends payahle Otber labilies Capital slock, 510 par Retained eamings S 200 100 5 85 20 Toal aquicies S25,000 on June 1, 2016. This is not an intercompany sale transaction. Separate financial statements for Pam and Sun for 2016 are summarized as follows (in thousands): Required 1. Prepare consolidation workpapers for Pam Corporation and Sun for the year ended 2. Prepare the formal journal entries that were made from January 1, 2016 through December December 31, 2016. Please provide your answer on page 5. 31, 2016 by Pam Corporation in relation to its acquisition of ownership interest in Sun Corporation. Pam Corporation uses the full equity method to account for its investments. Please provide your answer on page 6. Consolidation statements worksheet Pam Company and Subsidiary For the year ended December 31, 2016 Question 2 Eliminations Debit " -Credit Consolidato Pam Income statement: Sales $800 $700 Cost of goods sold (400 Gross profit S500 60.2 10 (155 $300 Equity income Gain on sale of equipment (60) (140 $100 Depreciation expense Other expenses Net income (P/S only net income)- Consolidated net income NCI- Income Consolidated NI- Controlling interests Statement of RE: Retained earnings, 1/1 Net income Dividends Retained ca Balance sheet: Cash Accounts receivable-net Dividend receivable Inventories Other current assets Land Building-net $300 255.20 S100 100 $355.2 si 50 l mings, 12/31 S60 70 S96 100 14 150 70 50 140 570 100 30 100 160 330 Equipment-net Goodwill Equity investment 515.2 $850 Total Assets Liabilities Accounts payable Dividend payable Other liabilities Capital stock, $10 par S200 100 50 1,000 355.2 S85 20 95 500 150 NCI 850 Total liabilities and stockholders' equity Journal entries (Requirement 2: Date Account titles and descriptions PR Debit Credit Question 2 Pam Corporation acquired a 70 percent interest in Sun Corporation stock on January 1, 2016, for $490,000 cash. The stockholders' equity of Sun on of $500,000 capital stock and $100,000 retained earnings. The difference of Sun and the underlying equity acquired in Sun was assigned $5,000 to Sun's u inventory, S14,000 to undervalued buildings, $21,000 to remaining to goodwill The undervalued inventory items were sold during 2016, and the undervalued buildings and equipment had remaining useful lives of seven years and three years, respectively. Deprecia computed using the straight-line method. s outstanding voting common this date consisted between the fair value ndervalued undervalued equipment, and the December 31, 2016, Sun's accounts payable include $10,000 owed to Pam. This $10,000 account payable is due on January 15, 2017. Pam sold equipment with a book value of S15,000 for Pam Combined laconse and Retainndl Earnings Sastemets fur ahe Year bndrd Inecember 3 Gain on equipment Cont of sales Degeeciatios expense Odher espenes S 800 10 133) (400 Net ince Add keuined carnings January 1 Deduct: Dividencs Reuieed eanings December 31 Rakonee Shees ar Decewher 3 5 96 Dividends recervcable 100 30 100 160 330 150 Other cument assets 50 140 570 Investmment in Su Total awets Accounts payaible Dividends payahle Otber labilies Capital slock, 510 par Retained eamings S 200 100 5 85 20 Toal aquicies S25,000 on June 1, 2016. This is not an intercompany sale transaction. Separate financial statements for Pam and Sun for 2016 are summarized as follows (in thousands): Required 1. Prepare consolidation workpapers for Pam Corporation and Sun for the year ended 2. Prepare the formal journal entries that were made from January 1, 2016 through December December 31, 2016. Please provide your answer on page 5. 31, 2016 by Pam Corporation in relation to its acquisition of ownership interest in Sun Corporation. Pam Corporation uses the full equity method to account for its investments. Please provide your answer on page 6. Consolidation statements worksheet Pam Company and Subsidiary For the year ended December 31, 2016 Question 2 Eliminations Debit " -Credit Consolidato Pam Income statement: Sales $800 $700 Cost of goods sold (400 Gross profit S500 60.2 10 (155 $300 Equity income Gain on sale of equipment (60) (140 $100 Depreciation expense Other expenses Net income (P/S only net income)- Consolidated net income NCI- Income Consolidated NI- Controlling interests Statement of RE: Retained earnings, 1/1 Net income Dividends Retained ca Balance sheet: Cash Accounts receivable-net Dividend receivable Inventories Other current assets Land Building-net $300 255.20 S100 100 $355.2 si 50 l mings, 12/31 S60 70 S96 100 14 150 70 50 140 570 100 30 100 160 330 Equipment-net Goodwill Equity investment 515.2 $850 Total Assets Liabilities Accounts payable Dividend payable Other liabilities Capital stock, $10 par S200 100 50 1,000 355.2 S85 20 95 500 150 NCI 850 Total liabilities and stockholders' equity Journal entries (Requirement 2: Date Account titles and descriptions PR Debit Credit