Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Part A Wood World manufactures many wooden products. One of its popular product lines is the wooden crate line. It currently produces 100,000

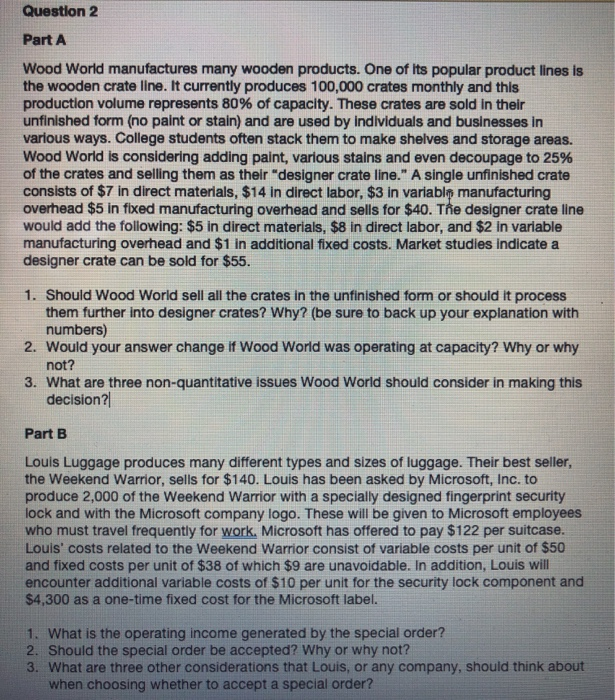

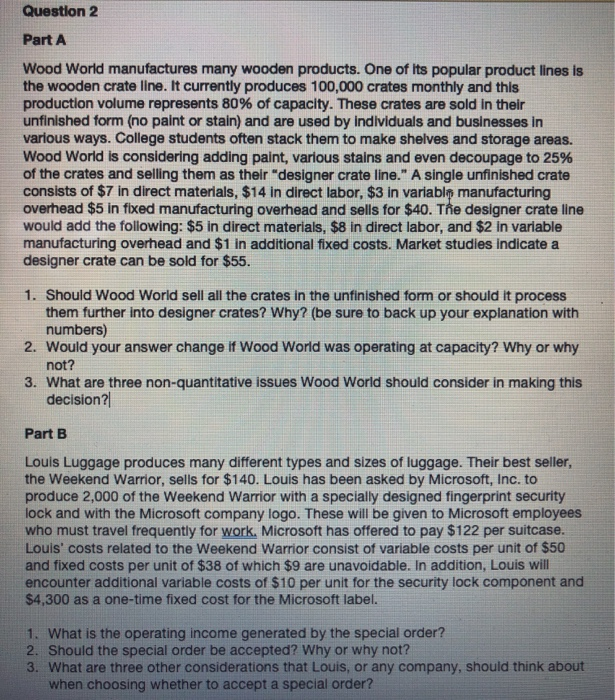

Question 2 Part A Wood World manufactures many wooden products. One of its popular product lines is the wooden crate line. It currently produces 100,000 crates monthly and this production volume represents 80% of capacity. These crates are sold in their unfinished form (no paint or stain) and are used by individuals and businesses in various ways. College students often stack them to make shelves and storage areas. Wood World is considering adding paint, various stains and even decoupage to 25% of the crates and selling them as their designer crate line." A single unfinished crate consists of $7 in direct materials, $14 in direct labor, $3 in variablp manufacturing overhead $5 in fixed manufacturing overhead and sells for $40. The designer crate line would add the following: $5 in direct materials, $8 in direct labor, and $2 in variable manufacturing overhead and $1 in additional fixed costs. Market studies indicate a designer crate can be sold for $55. 1. Should Wood World sell all the crates in the unfinished form or should it process them further into designer crates? Why? (be sure to back up your explanation with numbers) 2. Would your answer change if Wood World was operating at capacity? Why or why not? 3. What are three non-quantitative issues Wood World should consider in making this decision? Part B Louis Luggage produces many different types and sizes of luggage. Their best seller, the Weekend Warrior, sells for $140. Louis has been asked by Microsoft, Inc. to produce 2,000 of the Weekend Warrior with a specially designed fingerprint security lock and with the Microsoft company logo. These will be given to Microsoft employees who must travel frequently for work. Microsoft has offered to pay $122 per suitcase. Louis' costs related to the Weekend Warrior consist of variable costs per unit of $50 and fixed costs per unit of $38 of which $9 are unavoidable. In addition, Louis will encounter additional variable costs of $10 per unit for the security lock component and $4,300 as a one-time fixed cost for the Microsoft label. 1. What is the operating income generated by the special order? 2. Should the special order be accepted? Why or why not? 3. What are three other considerations that Louis, or any company, should think about when choosing whether to accept a special order

Question 2 Part A Wood World manufactures many wooden products. One of its popular product lines is the wooden crate line. It currently produces 100,000 crates monthly and this production volume represents 80% of capacity. These crates are sold in their unfinished form (no paint or stain) and are used by individuals and businesses in various ways. College students often stack them to make shelves and storage areas. Wood World is considering adding paint, various stains and even decoupage to 25% of the crates and selling them as their designer crate line." A single unfinished crate consists of $7 in direct materials, $14 in direct labor, $3 in variablp manufacturing overhead $5 in fixed manufacturing overhead and sells for $40. The designer crate line would add the following: $5 in direct materials, $8 in direct labor, and $2 in variable manufacturing overhead and $1 in additional fixed costs. Market studies indicate a designer crate can be sold for $55. 1. Should Wood World sell all the crates in the unfinished form or should it process them further into designer crates? Why? (be sure to back up your explanation with numbers) 2. Would your answer change if Wood World was operating at capacity? Why or why not? 3. What are three non-quantitative issues Wood World should consider in making this decision? Part B Louis Luggage produces many different types and sizes of luggage. Their best seller, the Weekend Warrior, sells for $140. Louis has been asked by Microsoft, Inc. to produce 2,000 of the Weekend Warrior with a specially designed fingerprint security lock and with the Microsoft company logo. These will be given to Microsoft employees who must travel frequently for work. Microsoft has offered to pay $122 per suitcase. Louis' costs related to the Weekend Warrior consist of variable costs per unit of $50 and fixed costs per unit of $38 of which $9 are unavoidable. In addition, Louis will encounter additional variable costs of $10 per unit for the security lock component and $4,300 as a one-time fixed cost for the Microsoft label. 1. What is the operating income generated by the special order? 2. Should the special order be accepted? Why or why not? 3. What are three other considerations that Louis, or any company, should think about when choosing whether to accept a special order

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started