Answered step by step

Verified Expert Solution

Question

1 Approved Answer

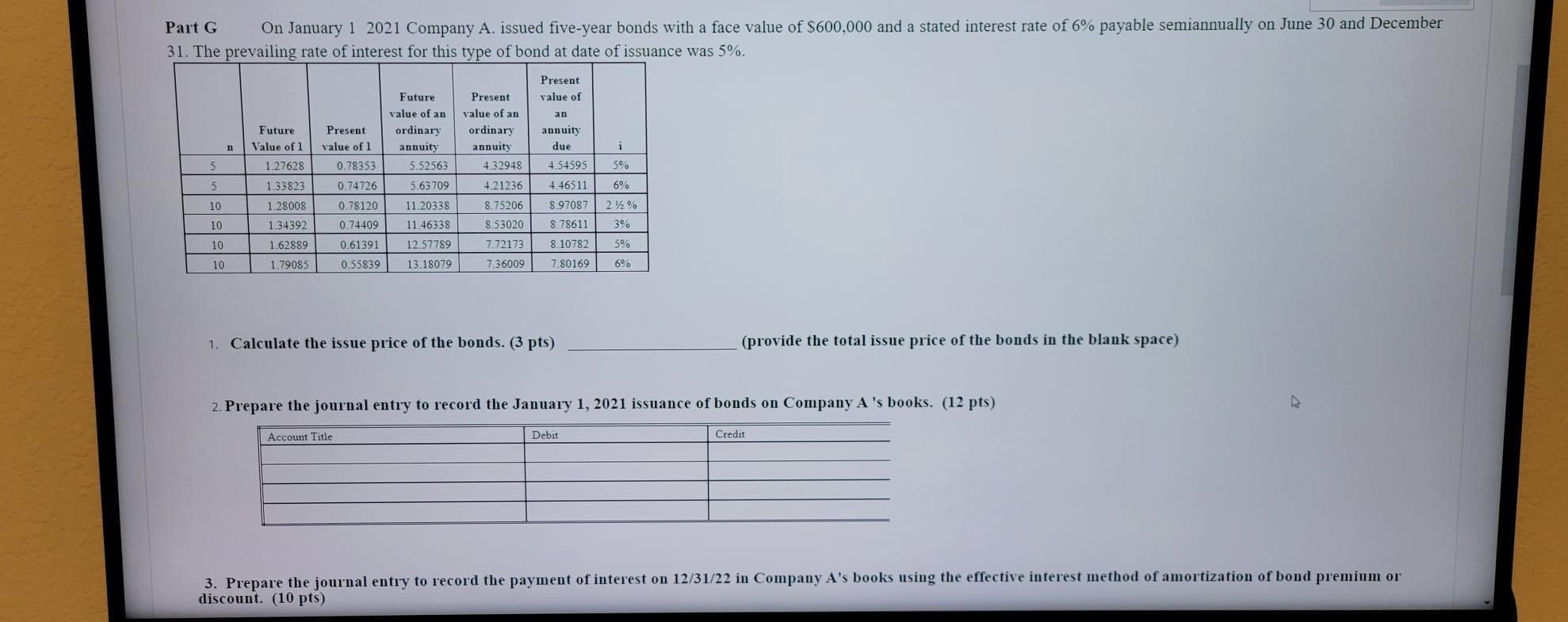

Part G On January 1 2021 Company A. issued five-year bonds with a face value of $600,000 and a stated interest rate of 6%

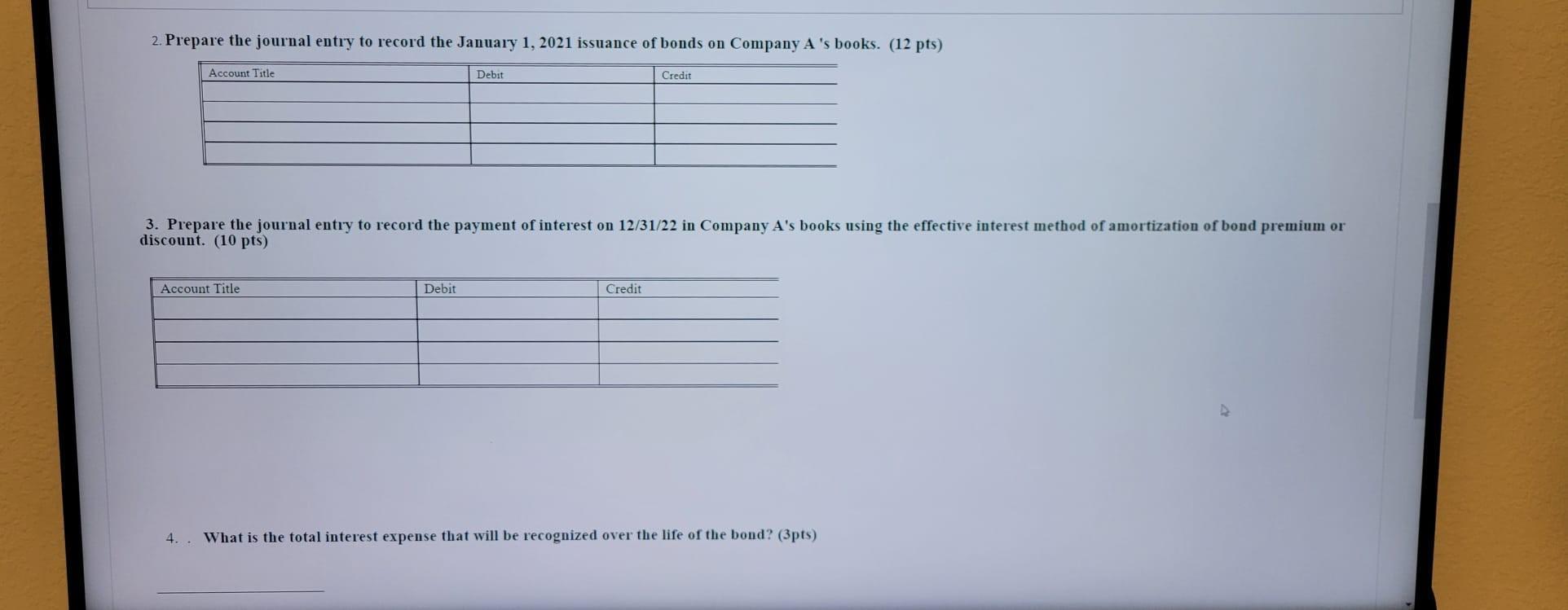

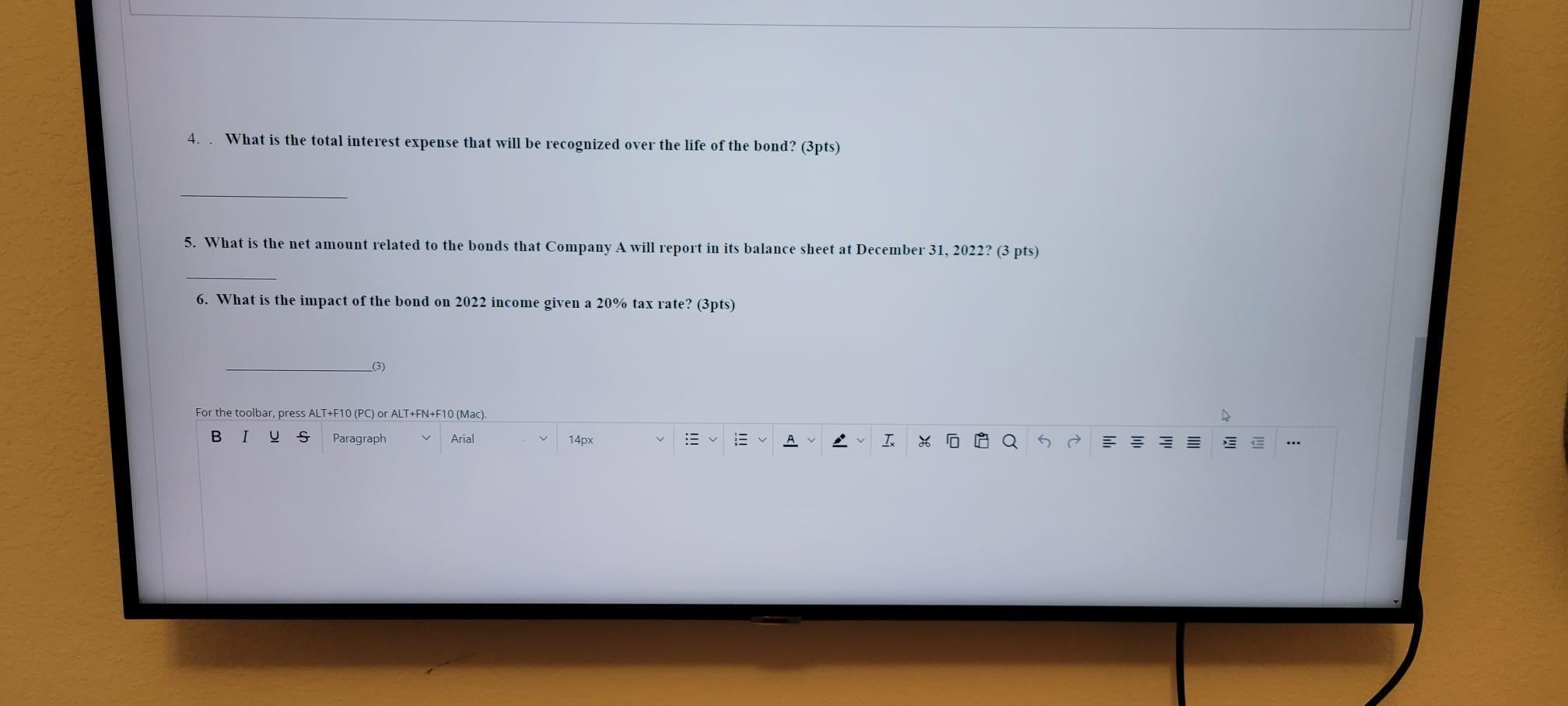

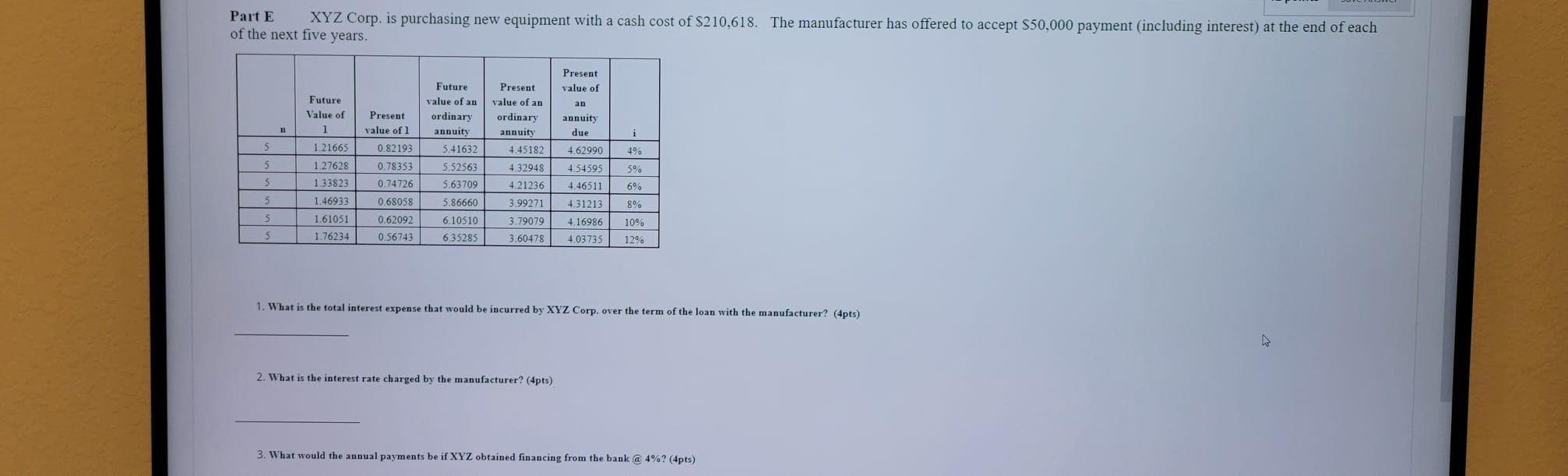

Part G On January 1 2021 Company A. issued five-year bonds with a face value of $600,000 and a stated interest rate of 6% payable semiannually on June 30 and December 31. The prevailing rate of interest for this type of bond at date of issuance was 5%. 5 5 10 10 10 10 n Future Value of 1 1.27628 1.33823 1.28008 1.34392 1.62889 1.79085 Future value of an ordinary annuity 5.52563 0.78353 0.74726 5.63709 11.20338 0.78120 0.74409 0.61391 0.55839 13.18079 11.46338 12.57789 Present value of 1 Present value of Account Title an Present value of an ordinary annuity annuity due 4.54595 4.32948 4.21236 i 5% 4.46511 6% 8.75206 8.97087 2% 8.53020 8.78611 3% 7.72173 8.10782 5% 7.36009 7.80169 6% 1. Calculate the issue price of the bonds. (3 pts) 2. Prepare the journal entry to record the January 1, 2021 issuance of bonds on Company A's books. (12 pts) (provide the total issue price of the bonds in the blank space) Debit Credit A 3. Prepare the journal entry to record the payment of interest on 12/31/22 in Company A's books using the effective interest method of amortization of bond premium or discount. (10 pts) 2. Prepare the journal entry to record the January 1, 2021 issuance of bonds on Company A 's books. (12 pts) Account Title Account Title Debit 3. Prepare the journal entry to record the payment of interest on 12/31/22 in Company A's books using the effective interest method of amortization of bond premium or discount. (10 pts) Debit Credit Credit 4. What is the total interest expense that will be recognized over the life of the bond? (3pts) D 4.. What is the total interest expense that will be recognized over the life of the bond? (3pts) 5. What is the net amount related to the bonds that Company A will report in its balance sheet at December 31, 2022? (3 pts) 6. What is the impact of the bond on 2022 income given a 20% tax rate? (3pts) (3) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial V 14px AV T % 0 $1 52 A Part E XYZ Corp. is purchasing new equipment with a cash cost of $210,618. The manufacturer has offered to accept $50,000 payment (including interest) at the end of each of the next five years. 5 5 5 5 5 5 11 Future Value of 1 1.21665 1.27628 1.33823 1.46933 1,61051 1.76234 Present value of 1 0.82193 0.78353 0.74726 0.68058 0.62092 0.56743 Future value of an ordinary annuity 5.41632 5.52563 5.63709 5.86660 6.10510 6.35285 Present value of an Present value of an ordinary annuity 4.45182 4.32948 annuity due i 4.62990 4% 4.54595 5% 4.46511 6% 3.99271 4.31213 8% 3.79079 4.16986 10% 3.60478 4.03735 12% 4.21236 1. What is the total interest expense that would be incurred by XYZ Corp. over the term of the loan with the manufacturer? (4pts) 2. What is the interest rate charged by the manufacturer? (4pts) 3. What would the annual payments be if XYZ obtained financing from the bank @ 4% ? ( 4pts). 2. What is the interest rate charged by the manufacturer? (4pts) 3. What would the annual payments be if XYZ obtained financing from the bank @ 4%? (4pts) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial P V 4 Moving to another question will save this response. 14px > !!! !!! A V y I. X0 40 o t 44 00 *** O WORDS POWERED BY TINY Question 6 of 8 Close Window

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the issue price of the bonds 3 pts Given information Face value of the bonds 600000 Stated interest rate 6 Market interest rate 5 Number of periods 5 years 10 semiannual periods Using the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started