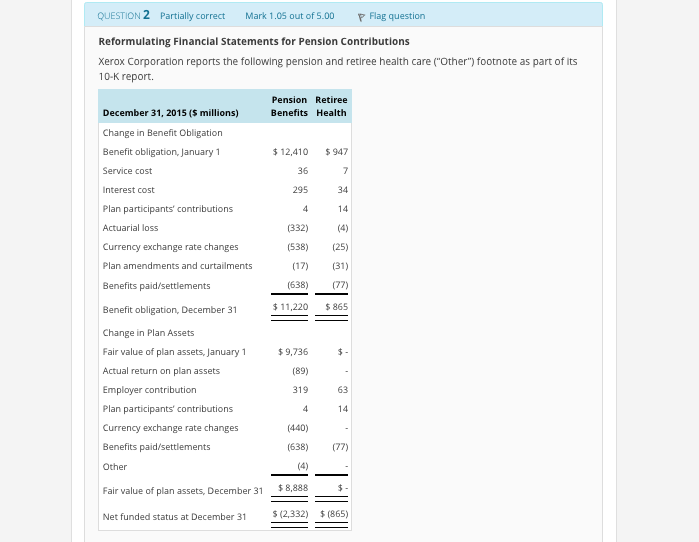

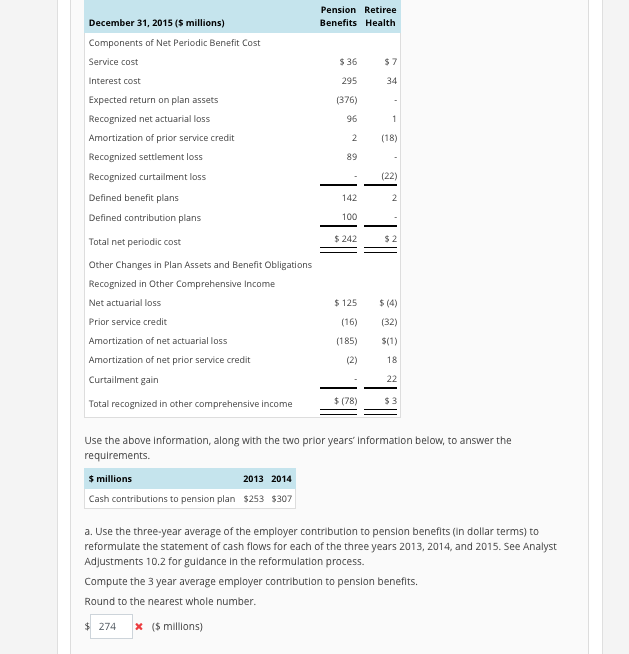

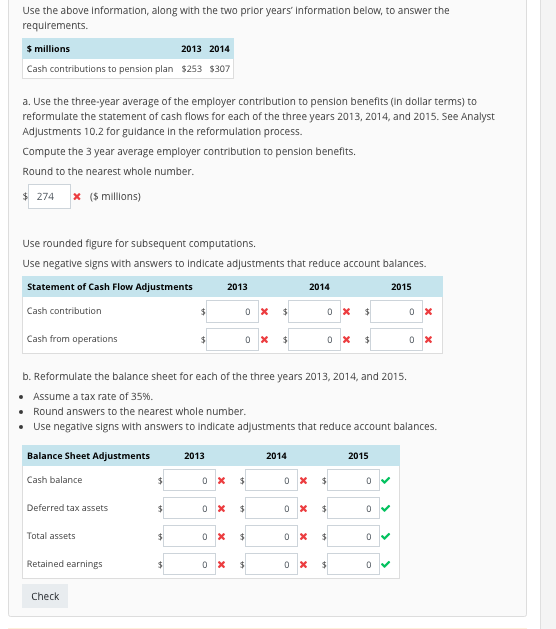

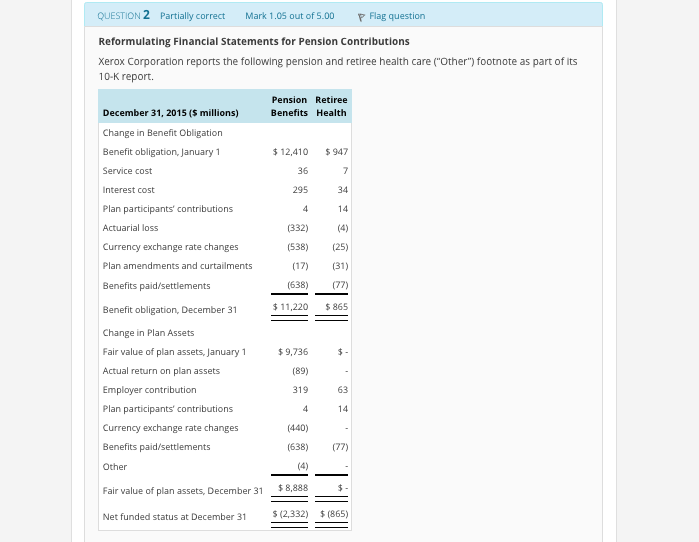

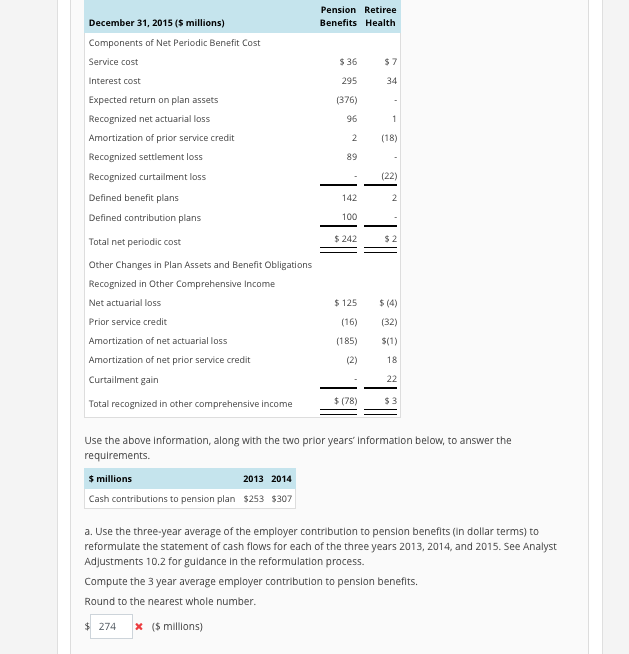

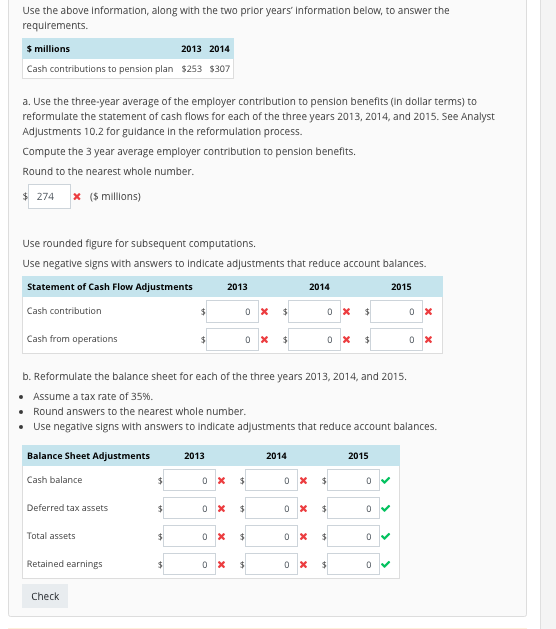

QUESTION 2 Partially correct Mark 1.05 out of5.00 Flag question Reformulating Financial Statements for Pension Contributions Xerox Corporation reports the following pension and retiree health care ("Other") footnote as part of its 10-K report. Pension Retiree Benefits Health December 31, 2015 ($ millions) Change in Benefit Obligation Benefit obligation, January 1 Service cost Interest cost Plan participants' contributions Actuarial loss Currency exchange rate changes Plan amendments and curtailments Benefits paid/settlements Benefit obligation, December 31 Change in Plan Assets Fair value of plan assets, January 1 Actual return on plan assets Employer contribution Plan participants' contributions Currency exchange rate changes $12,410 947 36 34 14 (332) (4) (538) (25) (17) (31) (638) (77) 11,220 865 295 $9,736 (89) 63 14 (440) (638) (77) Other value of plan assets, December 31$8,888 Net funded status at December 31 (2,332) (865) Pension Retiree Benefits Health December 31, 2015 ($ millions) Components of Net Periodic Benefit Cost Service cost Interest cost Expected return on plan assets Recognized net actuarial loss Amortization of prior service credit Recognized settlement loss $ 36 295 (376) 96 34 2(18) 89 (22) 142 Defined benefit plans 100 Defined contribution plans 242 $ 2 Total net periodic cost Other Changes in Plan Assets and Benefit Obligations Recognized in Other Comprehensive Income Net actuarial loss Prior service credit Amortization of net actuarial loss Amortization of net prior service credit Curtailment gain Total recognized in other comprehensive income $125 (4) (16) (32) (185) (1) 18 (78) $ 3 Use the above Information, along with the two prior years' Information below, to answer the requirements. $ millions 2013 2014 Cash contributions to pension plan $253 $307 a. Use the three-year average of the employer contribution to pension benefits (in dollar terms) to reformulate the statement of cash flows for each of the three years 2013, 2014, and 2015. See Analyst Adjustments 10.2 for guidance in the reformulation process. Compute the 3 year average employer contribution to pension benefits. Round to the nearest whole number 274 ($ millions) Use the above Information, along with the two prior years Information below, to answer the requirements. $ millions 2013 2014 Cash contributions to pension plan $253 $307 a. Use the three-year average of the employer contribution to pension benefits (in dollar terms) to reformulate the statement of cash flows for each of the three years 2013, 2014, and 2015. See Analyst Adjustments 10.2 for guidance in the reformulation process. Compute the 3 year average employer contribution to pension benefits. Round to the nearest whole number 274 ($ millions) Use rounded figure for subsequent computations. Use negative signs with answers to indicate adjustments that reduce account balances. Statement of Cash Flow Adjustments Cash contribution Cash from operations 2013 2015 2014 b. Reformulate the balance sheet for each of the three years 2013, 2014, and 2015. Assume a tax rate of 35%. Round answers to the nearest whole number Use negative signs with answers to indicate adjustments that reduce account balances. Balance Sheet Adjustments Cash balance . 2013 2014 2015 Deferred tax assets Total assets Retained earnings Check QUESTION 2 Partially correct Mark 1.05 out of5.00 Flag question Reformulating Financial Statements for Pension Contributions Xerox Corporation reports the following pension and retiree health care ("Other") footnote as part of its 10-K report. Pension Retiree Benefits Health December 31, 2015 ($ millions) Change in Benefit Obligation Benefit obligation, January 1 Service cost Interest cost Plan participants' contributions Actuarial loss Currency exchange rate changes Plan amendments and curtailments Benefits paid/settlements Benefit obligation, December 31 Change in Plan Assets Fair value of plan assets, January 1 Actual return on plan assets Employer contribution Plan participants' contributions Currency exchange rate changes $12,410 947 36 34 14 (332) (4) (538) (25) (17) (31) (638) (77) 11,220 865 295 $9,736 (89) 63 14 (440) (638) (77) Other value of plan assets, December 31$8,888 Net funded status at December 31 (2,332) (865) Pension Retiree Benefits Health December 31, 2015 ($ millions) Components of Net Periodic Benefit Cost Service cost Interest cost Expected return on plan assets Recognized net actuarial loss Amortization of prior service credit Recognized settlement loss $ 36 295 (376) 96 34 2(18) 89 (22) 142 Defined benefit plans 100 Defined contribution plans 242 $ 2 Total net periodic cost Other Changes in Plan Assets and Benefit Obligations Recognized in Other Comprehensive Income Net actuarial loss Prior service credit Amortization of net actuarial loss Amortization of net prior service credit Curtailment gain Total recognized in other comprehensive income $125 (4) (16) (32) (185) (1) 18 (78) $ 3 Use the above Information, along with the two prior years' Information below, to answer the requirements. $ millions 2013 2014 Cash contributions to pension plan $253 $307 a. Use the three-year average of the employer contribution to pension benefits (in dollar terms) to reformulate the statement of cash flows for each of the three years 2013, 2014, and 2015. See Analyst Adjustments 10.2 for guidance in the reformulation process. Compute the 3 year average employer contribution to pension benefits. Round to the nearest whole number 274 ($ millions) Use the above Information, along with the two prior years Information below, to answer the requirements. $ millions 2013 2014 Cash contributions to pension plan $253 $307 a. Use the three-year average of the employer contribution to pension benefits (in dollar terms) to reformulate the statement of cash flows for each of the three years 2013, 2014, and 2015. See Analyst Adjustments 10.2 for guidance in the reformulation process. Compute the 3 year average employer contribution to pension benefits. Round to the nearest whole number 274 ($ millions) Use rounded figure for subsequent computations. Use negative signs with answers to indicate adjustments that reduce account balances. Statement of Cash Flow Adjustments Cash contribution Cash from operations 2013 2015 2014 b. Reformulate the balance sheet for each of the three years 2013, 2014, and 2015. Assume a tax rate of 35%. Round answers to the nearest whole number Use negative signs with answers to indicate adjustments that reduce account balances. Balance Sheet Adjustments Cash balance . 2013 2014 2015 Deferred tax assets Total assets Retained earnings Check