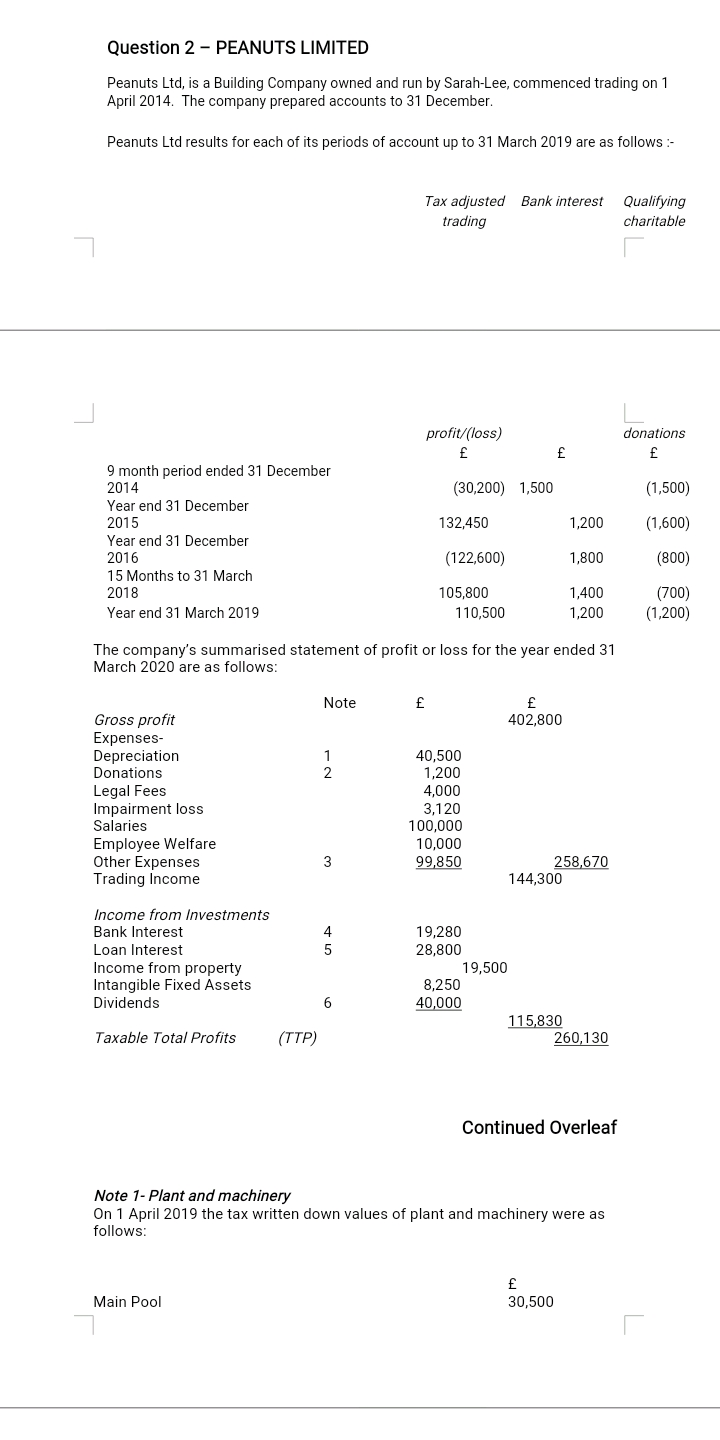

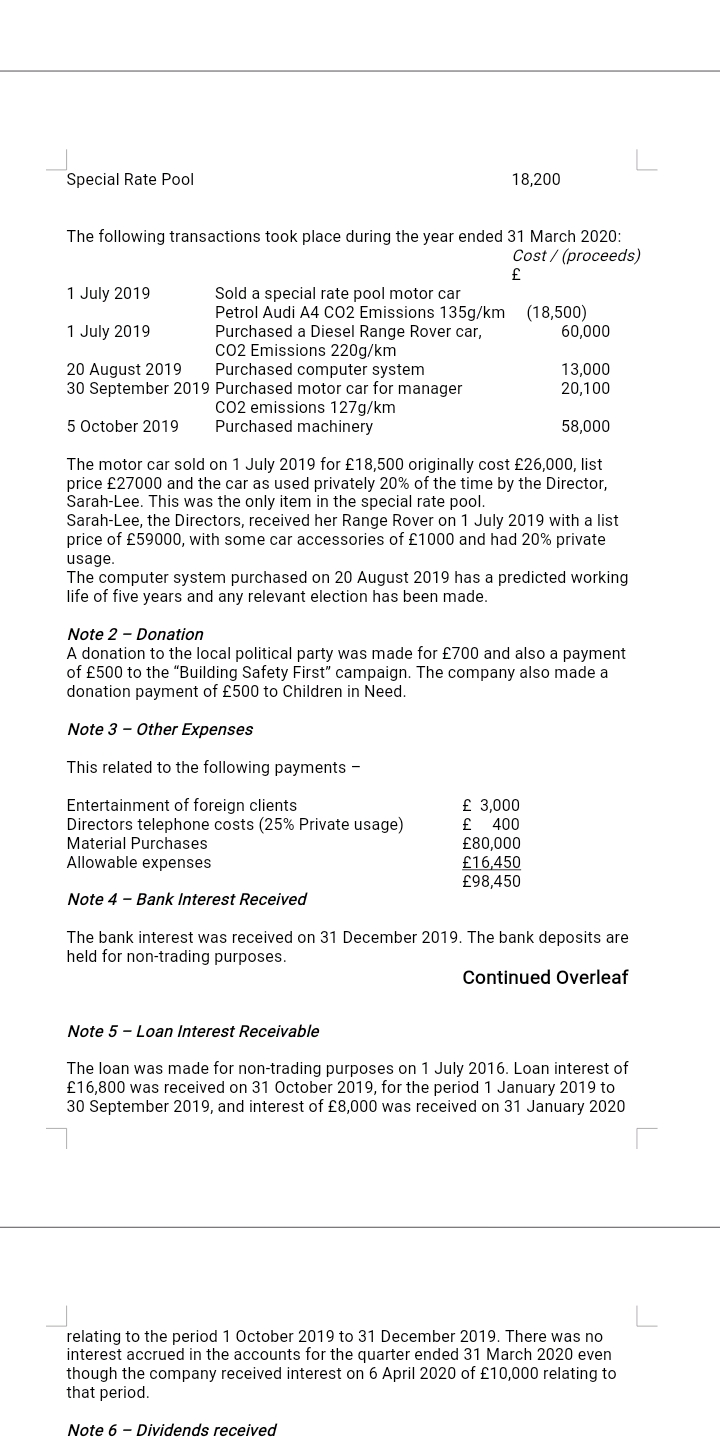

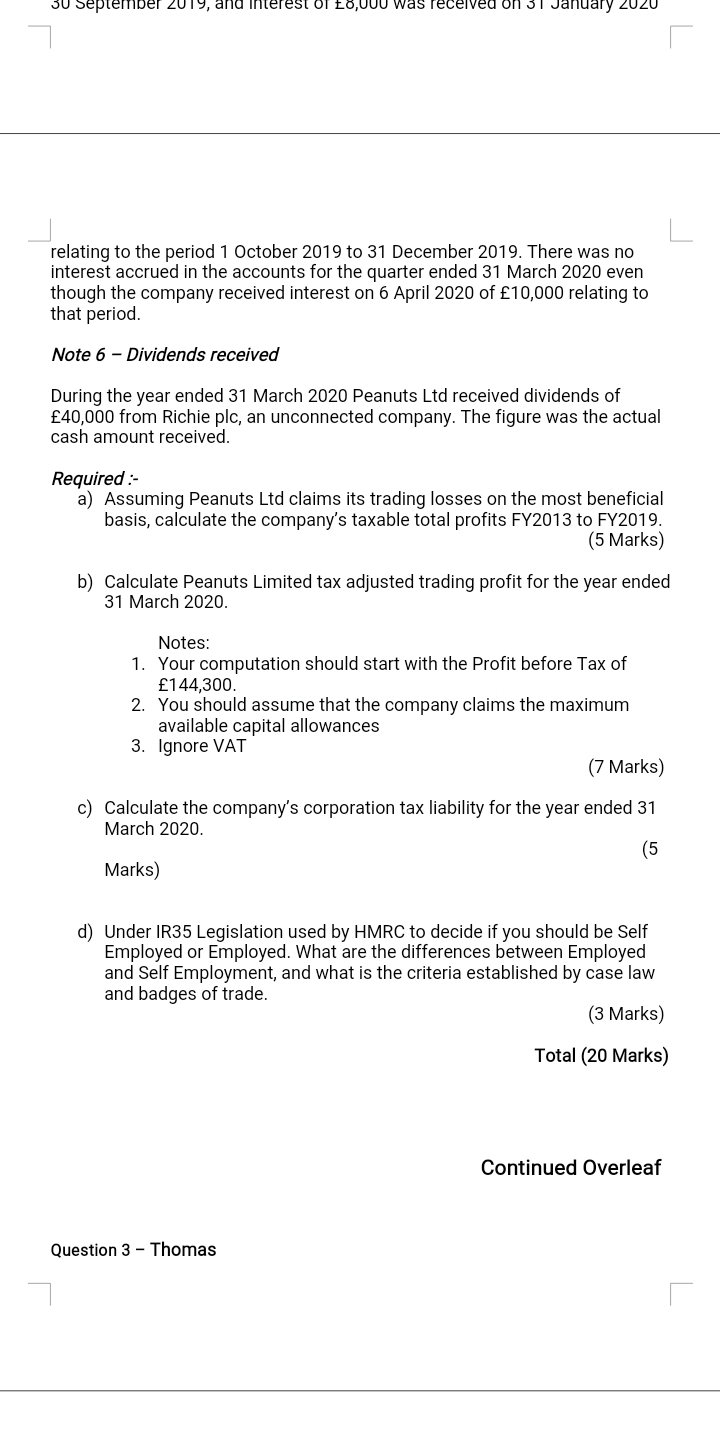

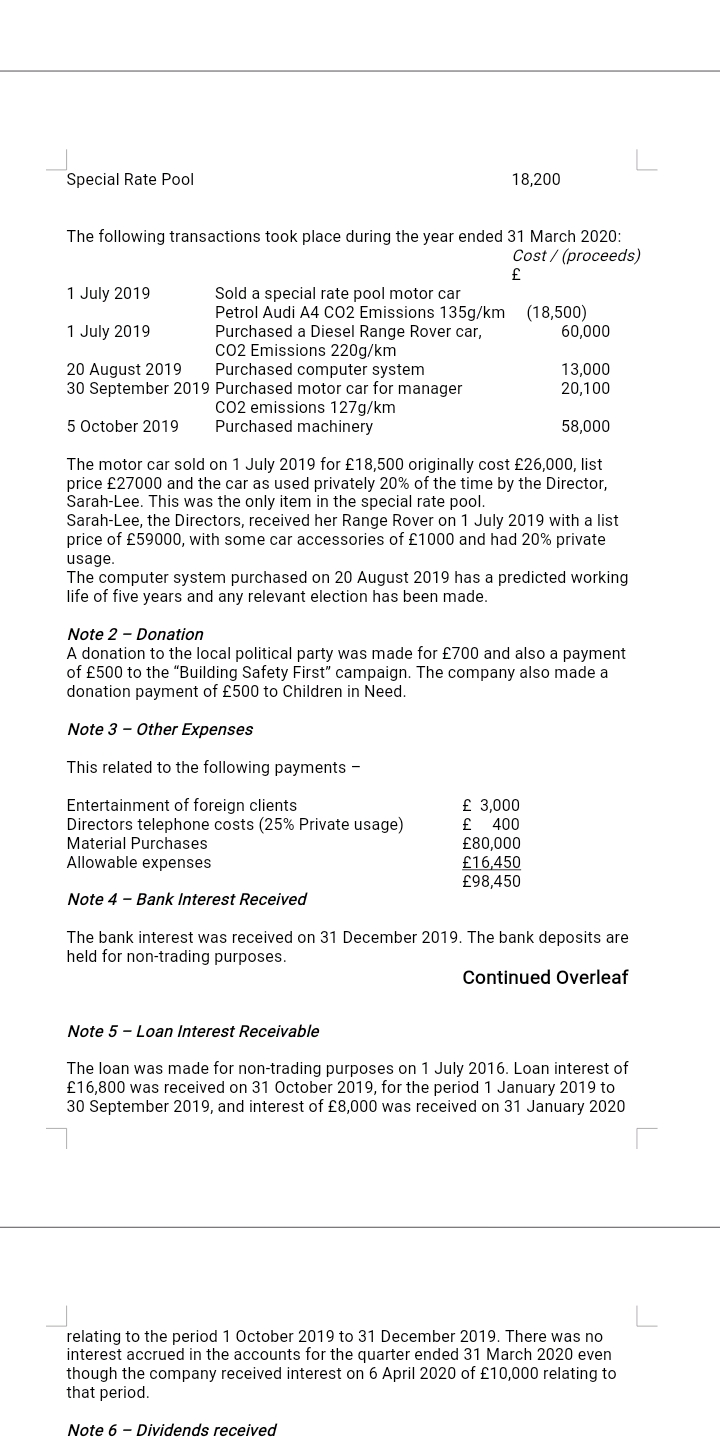

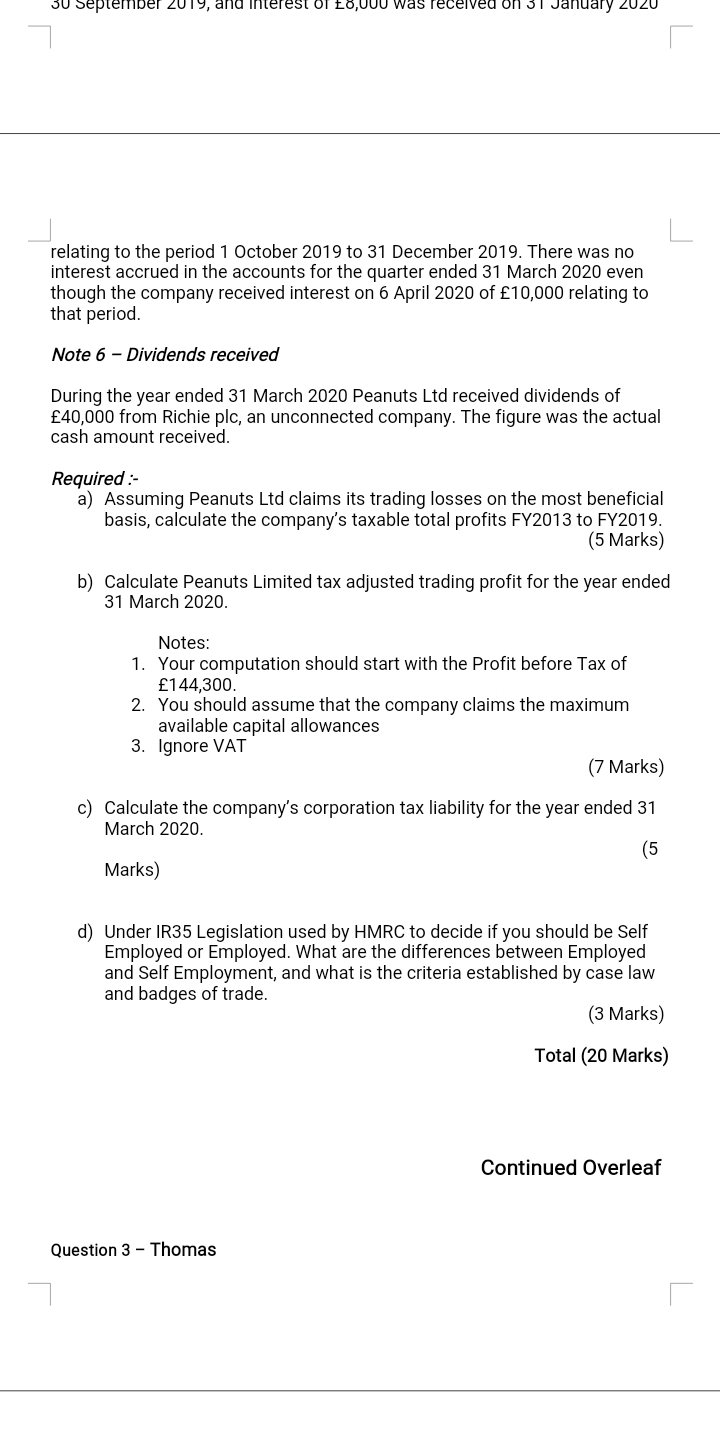

Question 2 - PEANUTS LIMITED Peanuts Ltd, is a Building Company owned and run by Sarah-Lee, commenced trading on 1 April 2014. The company prepared accounts to 31 December. Peanuts Ltd results for each of its periods of account up to 31 March 2019 are as follows:- Bank interest Tax adjusted trading Qualifying charitable profit/(loss) donations (30,200) 1,500 (1,500) 132,450 1,200 (1,600) 9 month period ended 31 December 2014 Year end 31 December 2015 Year end 31 December 2016 15 Months to 31 March 2018 Year end 31 March 2019 (122,600) 1,800 (800) 105,800 110,500 1,400 1,200 (700) (1,200) The company's summarised statement of profit or loss for the year ended 31 March 2020 are as follows: Note 402,800 Gross profit Expenses- Depreciation Donations Legal Fees Impairment loss Salaries Employee Welfare Other Expenses Trading Income 40,500 1,200 4,000 3,120 100,000 10,000 99,850 258,670 144,300 Income from Investments Bank Interest Loan Interest Income from property Intangible Fixed Assets Dividends 19,280 28,800 19,500 8,250 40,000 115,830 260,130 Taxable Total Profits (TTP) Continued Overleaf Note 1-Plant and machinery On 1 April 2019 the tax written down values of plant and machinery were as follows: 30,500 Main Pool 30.500 Special Rate Pool 18,200 The following transactions took place during the year ended 31 March 2020: Cost/ (proceeds) (18,500) 60,000 1 July 2019 Sold a special rate pool motor car Petrol Audi A4 CO2 Emissions 135g/km 1 July 2019 Purchased a Diesel Range Rover car, CO2 Emissions 220g/km 20 August 2019 Purchased computer system 30 September 2019 Purchased motor car for manager CO2 emissions 127g/km 5 October 2019 Purchased machinery 13,000 20,100 58,000 The motor car sold on 1 July 2019 for 18,500 originally cost 26,000, list price 27000 and the car as used privately 20% of the time by the Director, Sarah-Lee. This was the only item in the special rate pool. Sarah-Lee, the Directors, received her Range Rover on 1 July 2019 with a list price of 59000, with some car accessories of 1000 and had 20% private usage. The computer system purchased on 20 August 2019 has a predicted working life of five years and any relevant election has been made. Note 2 - Donation A donation to the local political party was made for 700 and also a payment of 500 to the "Building Safety First" campaign. The company also made a donation payment of 500 to Children in Need. Note 3 - Other Expenses This related to the following payments - Entertainment of foreign clients Directors telephone costs (25% Private usage) Material Purchases Allowable expenses 3,000 400 80.000 16,450 98,450 Note 4 - Bank Interest Received The bank interest was received on 31 December 2019. The bank deposits are held for non-trading purposes. Continued Overleaf Note 5 - Loan Interest Receivable The loan was made for non-trading purposes on 1 July 2016. Loan interest of 16,800 was received on 31 October 2019, for the period 1 January 2019 to 30 September 2019, and interest of 8,000 was received on 31 January 2020 relating to the period 1 October 2019 to 31 December 2019. There was no interest accrued in the accounts for the quarter ended 31 March 2020 even though the company received interest on 6 April 2020 of 10,000 relating to that period. Note 6 - Dividends received 30 September 2019, and interest of 8,000 was received on 31 January 2020 relating to the period 1 October 2019 to 31 December 2019. There was no interest accrued in the accounts for the quarter ended 31 March 2020 even though the company received interest on 6 April 2020 of 10,000 relating to that period. Note 6 - Dividends received During the year ended 31 March 2020 Peanuts Ltd received dividends of 40,000 from Richie plc, an unconnected company. The figure was the actual cash amount received. Required :- a) Assuming Peanuts Ltd claims its trading losses on the most beneficial basis, calculate the company's taxable total profits FY2013 to FY2019. (5 Marks) b) Calculate Peanuts Limited tax adjusted trading profit for the year ended 31 March 2020. Notes: 1. Your computation should start with the Profit before Tax of 144,300. 2. You should assume that the company claims the maximum available capital allowances 3. Ignore VAT (7 Marks) c) Calculate the company's corporation tax liability for the year ended 31 March 2020. Marks) d) Under IR35 Legislation used by HMRC to decide if you should be Self Employed or Employed. What are the differences between Employed and Self Employment, and what is the criteria established by case law and badges of trade. (3 Marks) Total (20 Marks) Continued Overleaf Question 3 - Thomas Question 2 - PEANUTS LIMITED Peanuts Ltd, is a Building Company owned and run by Sarah-Lee, commenced trading on 1 April 2014. The company prepared accounts to 31 December. Peanuts Ltd results for each of its periods of account up to 31 March 2019 are as follows:- Bank interest Tax adjusted trading Qualifying charitable profit/(loss) donations (30,200) 1,500 (1,500) 132,450 1,200 (1,600) 9 month period ended 31 December 2014 Year end 31 December 2015 Year end 31 December 2016 15 Months to 31 March 2018 Year end 31 March 2019 (122,600) 1,800 (800) 105,800 110,500 1,400 1,200 (700) (1,200) The company's summarised statement of profit or loss for the year ended 31 March 2020 are as follows: Note 402,800 Gross profit Expenses- Depreciation Donations Legal Fees Impairment loss Salaries Employee Welfare Other Expenses Trading Income 40,500 1,200 4,000 3,120 100,000 10,000 99,850 258,670 144,300 Income from Investments Bank Interest Loan Interest Income from property Intangible Fixed Assets Dividends 19,280 28,800 19,500 8,250 40,000 115,830 260,130 Taxable Total Profits (TTP) Continued Overleaf Note 1-Plant and machinery On 1 April 2019 the tax written down values of plant and machinery were as follows: 30,500 Main Pool 30.500 Special Rate Pool 18,200 The following transactions took place during the year ended 31 March 2020: Cost/ (proceeds) (18,500) 60,000 1 July 2019 Sold a special rate pool motor car Petrol Audi A4 CO2 Emissions 135g/km 1 July 2019 Purchased a Diesel Range Rover car, CO2 Emissions 220g/km 20 August 2019 Purchased computer system 30 September 2019 Purchased motor car for manager CO2 emissions 127g/km 5 October 2019 Purchased machinery 13,000 20,100 58,000 The motor car sold on 1 July 2019 for 18,500 originally cost 26,000, list price 27000 and the car as used privately 20% of the time by the Director, Sarah-Lee. This was the only item in the special rate pool. Sarah-Lee, the Directors, received her Range Rover on 1 July 2019 with a list price of 59000, with some car accessories of 1000 and had 20% private usage. The computer system purchased on 20 August 2019 has a predicted working life of five years and any relevant election has been made. Note 2 - Donation A donation to the local political party was made for 700 and also a payment of 500 to the "Building Safety First" campaign. The company also made a donation payment of 500 to Children in Need. Note 3 - Other Expenses This related to the following payments - Entertainment of foreign clients Directors telephone costs (25% Private usage) Material Purchases Allowable expenses 3,000 400 80.000 16,450 98,450 Note 4 - Bank Interest Received The bank interest was received on 31 December 2019. The bank deposits are held for non-trading purposes. Continued Overleaf Note 5 - Loan Interest Receivable The loan was made for non-trading purposes on 1 July 2016. Loan interest of 16,800 was received on 31 October 2019, for the period 1 January 2019 to 30 September 2019, and interest of 8,000 was received on 31 January 2020 relating to the period 1 October 2019 to 31 December 2019. There was no interest accrued in the accounts for the quarter ended 31 March 2020 even though the company received interest on 6 April 2020 of 10,000 relating to that period. Note 6 - Dividends received 30 September 2019, and interest of 8,000 was received on 31 January 2020 relating to the period 1 October 2019 to 31 December 2019. There was no interest accrued in the accounts for the quarter ended 31 March 2020 even though the company received interest on 6 April 2020 of 10,000 relating to that period. Note 6 - Dividends received During the year ended 31 March 2020 Peanuts Ltd received dividends of 40,000 from Richie plc, an unconnected company. The figure was the actual cash amount received. Required :- a) Assuming Peanuts Ltd claims its trading losses on the most beneficial basis, calculate the company's taxable total profits FY2013 to FY2019. (5 Marks) b) Calculate Peanuts Limited tax adjusted trading profit for the year ended 31 March 2020. Notes: 1. Your computation should start with the Profit before Tax of 144,300. 2. You should assume that the company claims the maximum available capital allowances 3. Ignore VAT (7 Marks) c) Calculate the company's corporation tax liability for the year ended 31 March 2020. Marks) d) Under IR35 Legislation used by HMRC to decide if you should be Self Employed or Employed. What are the differences between Employed and Self Employment, and what is the criteria established by case law and badges of trade. (3 Marks) Total (20 Marks) Continued Overleaf Question 3 - Thomas