Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 2 please asap INTERNATIONAL FINANCE AV 63% 00:57 2020BE630-6-AU-RESIT - Saved ... BE630-6-SP-RESIT 4 (b) What is the difference between bilateral exchange rate and

question 2 please asap

INTERNATIONAL FINANCE

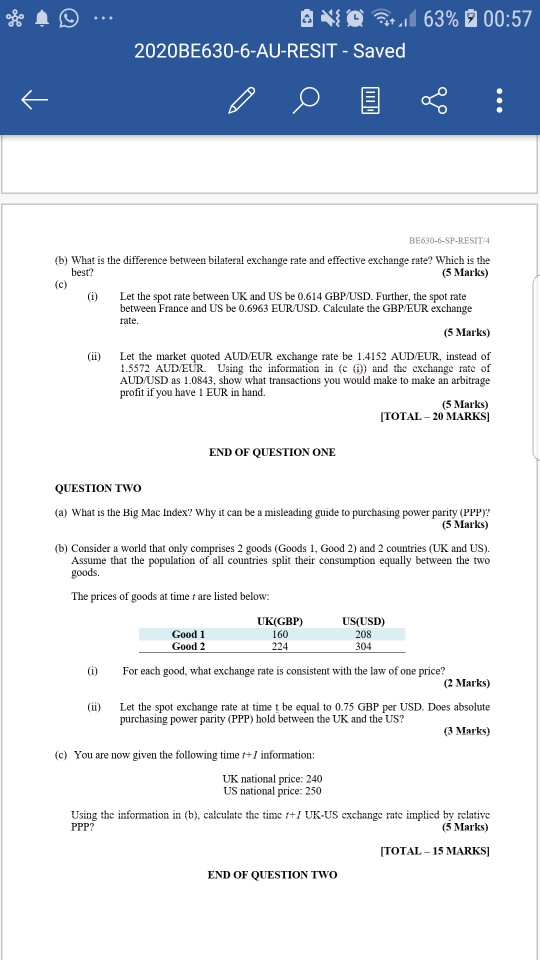

AV 63% 00:57 2020BE630-6-AU-RESIT - Saved ... BE630-6-SP-RESIT 4 (b) What is the difference between bilateral exchange rate and effective exchange rate? Which is the best? (5 Marks) (c) (1) Let the spot rate between UK and US be 0.614 GBP/USD. Further, the spot rate between France and US be 0.6963 EUR/USD. Calculate the GBP EUR exchange rate. (5 Marks) Let the market quoted AUD/EUR exchange rate be 1.4152 AUD EUR, instead of 1.5572 AUD/EUR. Using the information in (c () and the exchange rate of AUD/USD as 1.0843, show what transactions you would make to make an arbitrage profit if you have 1 EUR in hand. (5 Marks) [TOTAL - 20 MARKS END OF QUESTION ONE QUESTION TWO (a) What is the Big Mac Index? Why it can be a misleading guide to purchasing power parity (PPP)? (5 Marks) (b) Consider a world that only comprises 2 goods (Goods 1, Good 2) and 2 countries (UK and US). Assume that the population of all countries split their consumption equally between the two goods. The prices of goods at time t are listed below: UK(GBP) US(USD) Good 1 Good 2 160 224 208 304 (i) For each good, what exchange rate is consistent with the law of one price? (2 Marks) (ii) Let the spot exchange rate at time t be equal to 0.75 GBP per USD. Does absolute purchasing power parity (PPP) hold between the UK and the US? (3 Marks) (C) You are now given the following time t+/ information: UK national price: 240 US national price: 250 Using the information in (b), calculate the time 1+1 UK-US exchange rate implicd by relative PPP? (5 Marks) [TOTAL - 15 MARKS END OF QUESTION TWOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started