Question: Question 2 Please don't round up your answers at all. The best approach is to enter your formula straight into the answer cells. You buy

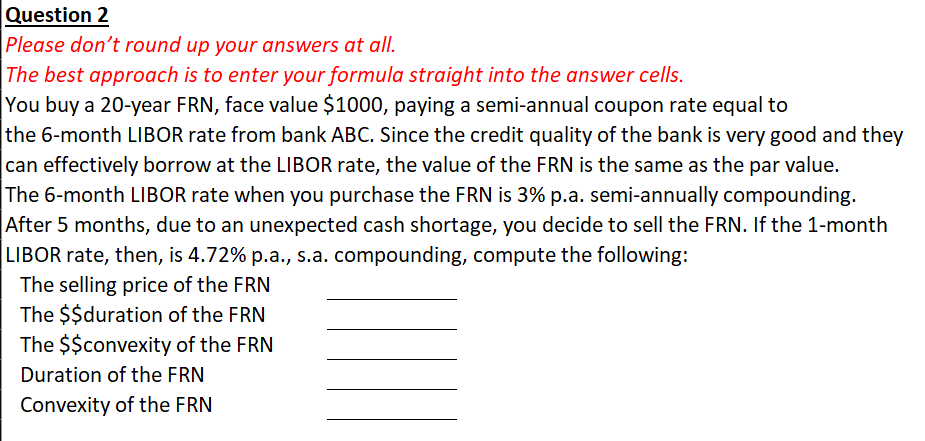

Question 2 Please don't round up your answers at all. The best approach is to enter your formula straight into the answer cells. You buy a 20-year FRN, face value $1000, paying a semi-annual coupon rate equal to the 6-month LIBOR rate from bank ABC. Since the credit quality of the bank is very good and they can effectively borrow at the LIBOR rate, the value of the FRN is the same as the par value. The 6-month LIBOR rate when you purchase the FRN is 3% p.a. semi-annually compounding. After 5 months, due to an unexpected cash shortage, you decide to sell the FRN. If the 1-month LIBOR rate, then, is 4.72% p.a., S.a. compounding, compute the following: The selling price of the FRN The $$ duration of the FRN The $$convexity of the FRN Duration of the FRN Convexity of the FRN Question 2 Please don't round up your answers at all. The best approach is to enter your formula straight into the answer cells. You buy a 20-year FRN, face value $1000, paying a semi-annual coupon rate equal to the 6-month LIBOR rate from bank ABC. Since the credit quality of the bank is very good and they can effectively borrow at the LIBOR rate, the value of the FRN is the same as the par value. The 6-month LIBOR rate when you purchase the FRN is 3% p.a. semi-annually compounding. After 5 months, due to an unexpected cash shortage, you decide to sell the FRN. If the 1-month LIBOR rate, then, is 4.72% p.a., S.a. compounding, compute the following: The selling price of the FRN The $$ duration of the FRN The $$convexity of the FRN Duration of the FRN Convexity of the FRN

Step by Step Solution

There are 3 Steps involved in it

To solve this problem follow the steps for each part of the question Step 1 Selling Price of the FRN The selling price of the FRN can be computed by d... View full answer

Get step-by-step solutions from verified subject matter experts