Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION #2 PLEASE. Question 1 (5 points) In 2019, Leo construction traded in a light duty pickup truck that had a book value of $15,000.

QUESTION #2 PLEASE.

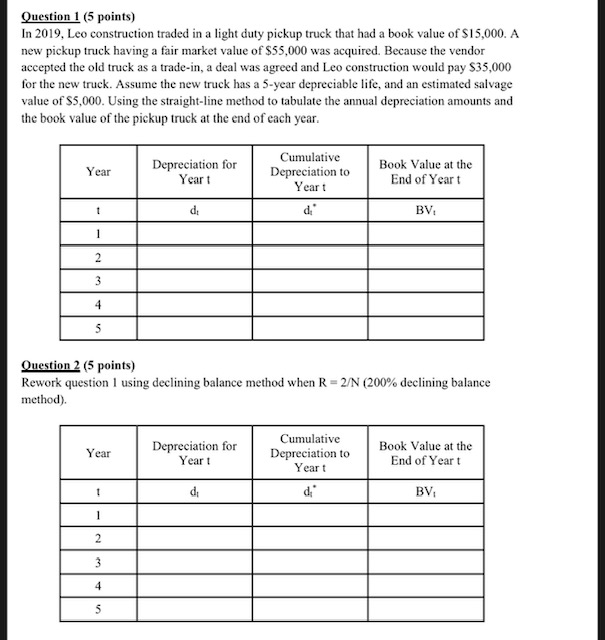

Question 1 (5 points) In 2019, Leo construction traded in a light duty pickup truck that had a book value of $15,000. A new pickup truck having a fair market value of $55,000 was acquired. Because the vendor accepted the old truck as a trade-in, a deal was agreed and Leo construction would pay $35,000 for the new truck. Assume the new truck has a 5-year depreciable life, and an estimated salvage value of $5,000. Using the straight-line method to tabulate the annual depreciation amounts and the book value of the pickup truck at the end of each year. Year Depreciation for Yeart Cumulative Depreciation to Yeart Book Value at the End of Yeart BV -WN-- Question 2 (5 points) Rework question I using declining balance method when R-2/N (200% declining balance method). Year Depreciation for Year Cumulative Depreciation to Yeart Book Value at the End of Yeart BVStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started