Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 please! The following information is used for the next TWO questions. You are the financial manager for the Golden Company and have received

Question 2 please!

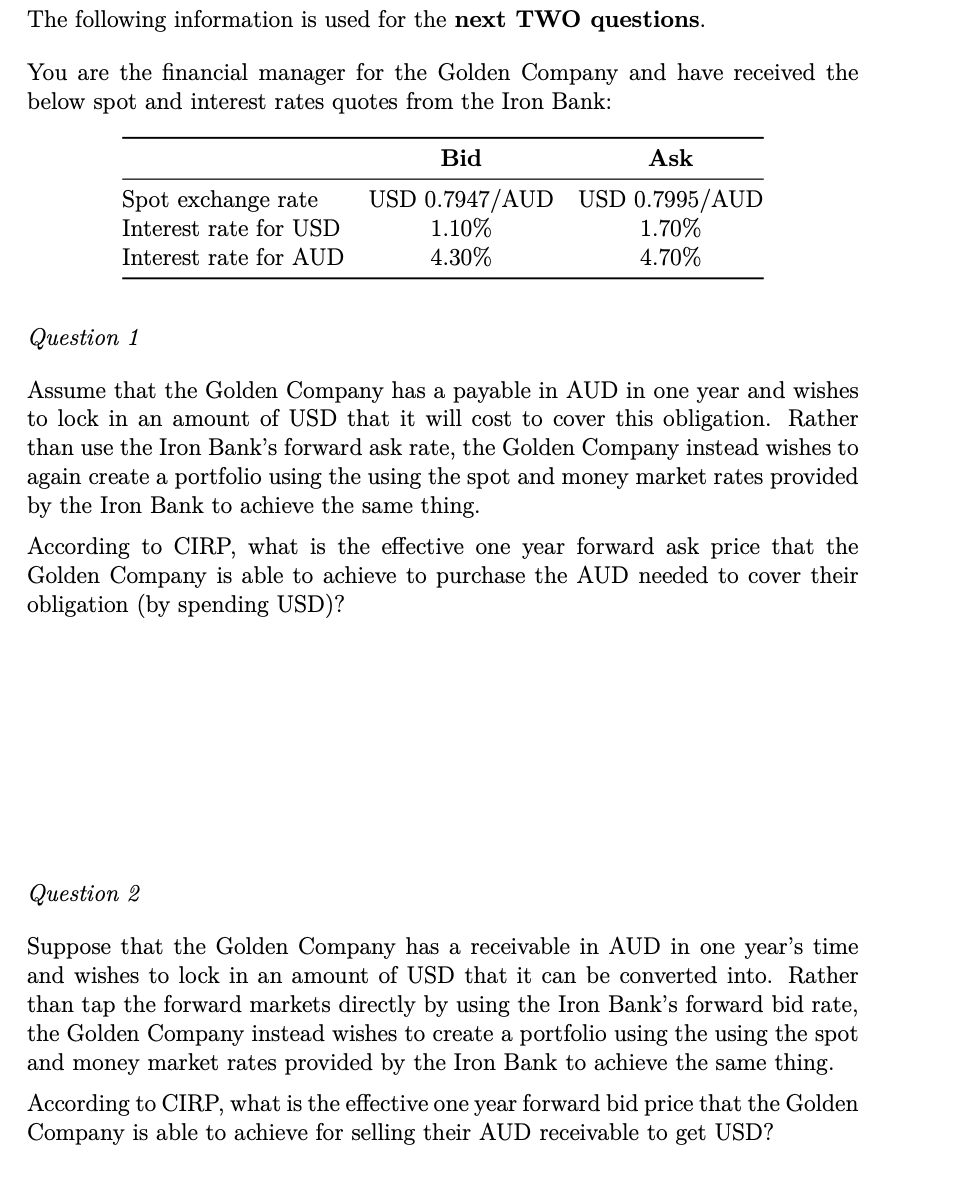

The following information is used for the next TWO questions. You are the financial manager for the Golden Company and have received the below spot and interest rates quotes from the Iron Bank: Bid Ask Spot exchange rate Interest rate for USD Interest rate for AUD USD 0.7947/AUD USD 0.7995/AUD 1.10% 1.70% 4.30% 4.70% Question 1 Assume that the Golden Company has a payable in AUD in one year and wishes to lock in an amount of USD that it will cost to cover this obligation. Rather than use the Iron Bank's forward ask rate, the Golden Company instead wishes to again create a portfolio using the using the spot and money market rates provided by the Iron Bank to achieve the same thing. According to CIRP, what is the effective one year forward ask price that the Golden Company is able to achieve to purchase the AUD needed to cover their obligation (by spending USD)? Question 2 Suppose that the Golden Company has a receivable in AUD in one year's time and wishes to lock in an amount of USD that it can be converted into. Rather than tap the forward markets directly by using the Iron Bank's forward bid rate, the Golden Company instead wishes to create a portfolio using the using the spot and money market rates provided by the Iron Bank to achieve the same thing. According to CIRP, what is the effective one year forward bid price that the Golden Company is able to achieve for selling their AUD receivable to get USDStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started