Answered step by step

Verified Expert Solution

Question

1 Approved Answer

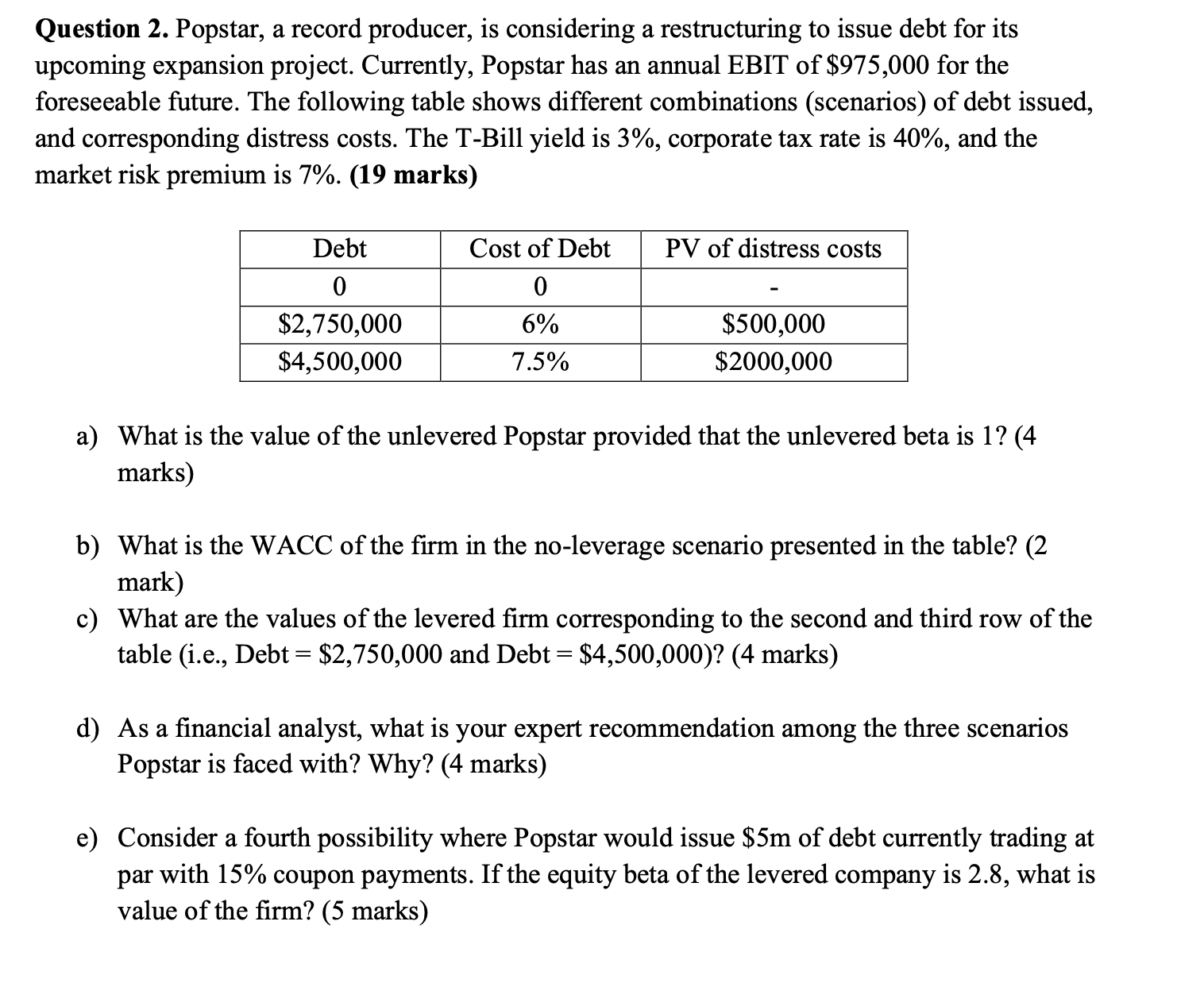

Question 2 . Popstar, a record producer, is considering a restructuring to issue debt for its upcoming expansion project. Currently, Popstar has an annual EBIT

Question Popstar, a record producer, is considering a restructuring to issue debt for its

upcoming expansion project. Currently, Popstar has an annual EBIT of $ for the

foreseeable future. The following table shows different combinations scenarios of debt issued,

and corresponding distress costs. The TBill yield is corporate tax rate is and the

market risk premium is marks

a What is the value of the unlevered Popstar provided that the unlevered beta is

marks

b What is the WACC of the firm in the noleverage scenario presented in the table?

mark

c What are the values of the levered firm corresponding to the second and third row of the

table ie Debt $ and Debt $ marks

d As a financial analyst, what is your expert recommendation among the three scenarios

Popstar is faced with? Why? marks

e Consider a fourth possibility where Popstar would issue $ of debt currently trading at

par with coupon payments. If the equity beta of the levered company is what is

value of the firm? marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started