Question

The 10-year bond yield issued by the Singapore Government has been increasing consistently over the last three years, from 0.84% in 2020, to 1.67% in

The 10-year bond yield issued by the Singapore Government has been increasing consistently over the last three years, from 0.84% in 2020, to 1.67% in 2021 and 3.09% in 2022.

a) Examine the implications of the expected return on stocks using the capital asset pricing model in the current economic environment. Your answer should not exceed 200 words.

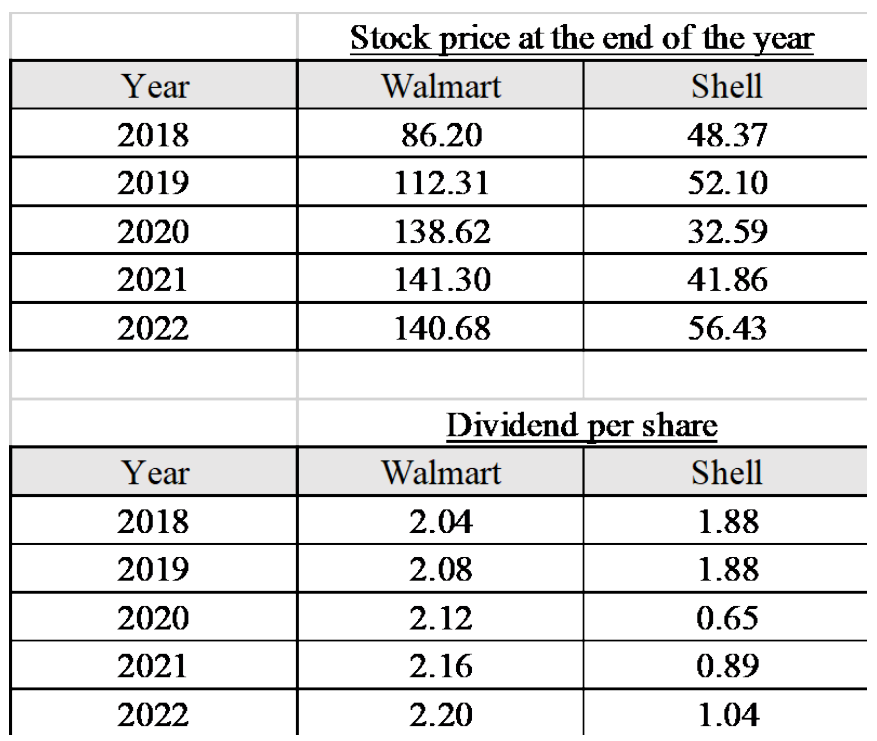

The price and dividend information over the last five years relating to Walmart (operating in the discount stores industry) and Shell (operating in the oil and gas industry) are shown below:

b) Appraise which stock is less risky if held on its own. Your answer should not exceed 200 words.

Stock price at the end of the year \begin{tabular}{|c|c|c|} \hline Year & Walmart & Shell \\ \hline 2018 & 86.20 & 48.37 \\ \hline 2019 & 112.31 & 52.10 \\ \hline 2020 & 138.62 & 32.59 \\ \hline 2021 & 141.30 & 41.86 \\ \hline 2022 & 140.68 & 56.43 \\ \hline \end{tabular} Dividend per share \begin{tabular}{|c|c|c|} \hline Year & Walmart & Shell \\ \hline 2018 & 2.04 & 1.88 \\ \hline 2019 & 2.08 & 1.88 \\ \hline 2020 & 2.12 & 0.65 \\ \hline 2021 & 2.16 & 0.89 \\ \hline 2022 & 2.20 & 1.04 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started