Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Prepare a schedule of monthly cash receipts, monthly cash payments and a complete monthly budget for March through June for Watson Company. (30

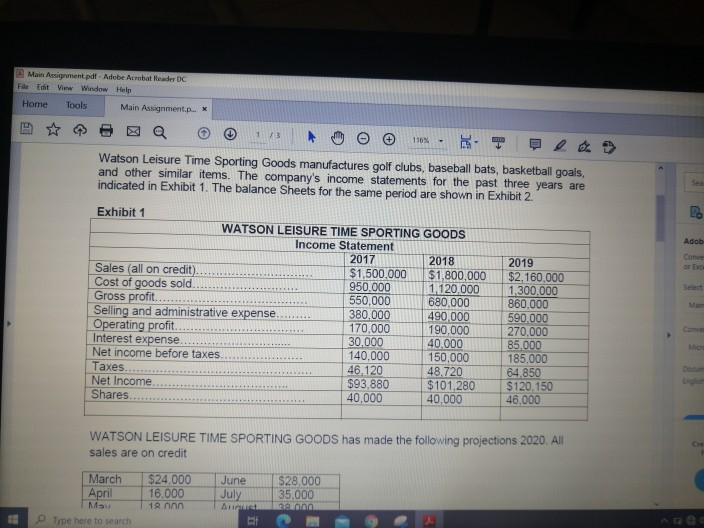

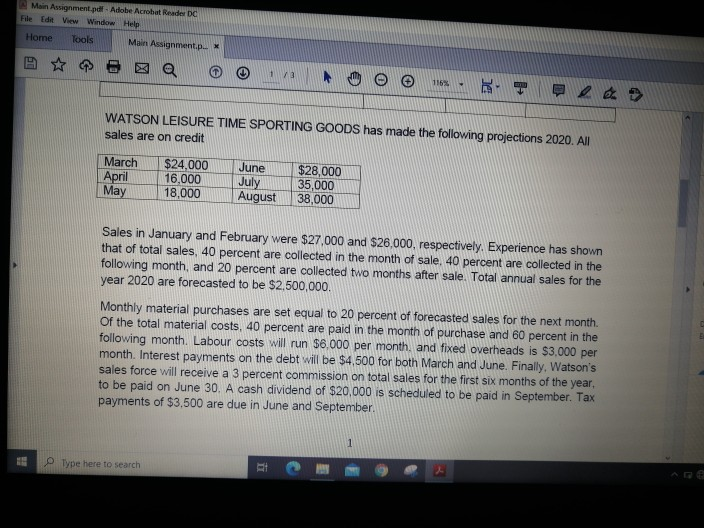

Question 2 Prepare a schedule of monthly cash receipts, monthly cash payments and a complete monthly budget for March through June for Watson Company. (30 marks) Main Assignment.pdf Adobe Acrobat Reader DC File Edit View Window Help Home Tools Main Assignment.p... * 1/3 116% Watson Leisure Time Sporting Goods manufactures golf clubs, baseball bats, basketball goals, and other similar items. The company's income statements for the past three years are indicated in Exhibit 1. The balance Sheets for the same period are shown in Exhibit 2. 09 Adob Conve or FC Select Exhibit 1 WATSON LEISURE TIME SPORTING GOODS Income Statement 2017 2018 Sales (all on credit) $1,500,000 $1,800,000 Cost of goods sold 950.000 1,120,000 Gross profit... 550,000 680,000 Selling and administrative expense. 380,000 490,000 Operating profit 170.000 190.000 Interest expense 30.000 40.000 Net income before taxes 140.000 150,000 Taxes. 46.120 48.720 Net Income $93.880 $101,280 Shares 40,000 40.000 2019 $2.160,000 1,300,000 860,000 590.000 270.000 85,000 185,000 64.850 $120.150 46,000 Conve Miche WATSON LEISURE TIME SPORTING GOODS has made the following projections 2020. All sales are on credit March April $24,000 16.000 18 nnn June July Au $28.000 35,000 2000 Type here to search Acec Mein Assignment.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools Main Assignment. * 1 3 115% WATSON LEISURE TIME SPORTING GOODS has made the following projections 2020. All sales are on credit March April May $24,000 16.000 18,000 June July August $28,000 35,000 38,000 Sales in January and February were $27,000 and $26,000, respectively. Experience has shown that of total sales, 40 percent are collected in the month of sale, 40 percent are collected in the following month, and 20 percent are collected two months after sale. Total annual sales for the year 2020 are forecasted to be $2,500,000. Monthly material purchases are set equal to 20 percent of forecasted sales for the next month. of the total material costs, 40 percent are paid in the month of purchase and 60 percent in the following month. Labour costs will run $6.000 per month and fixed overheads is $3,000 per month. Interest payments on the debt will be $4.500 for both March and June. Finally, Watson's sales force will receive a 3 percent commission on total sales for the first six months of the year, to be paid on June 30. A cash dividend of $20,000 is scheduled to be paid in September. Tax payments of $3.500 are due in June and September. 15 Type here to search +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started