Question 2

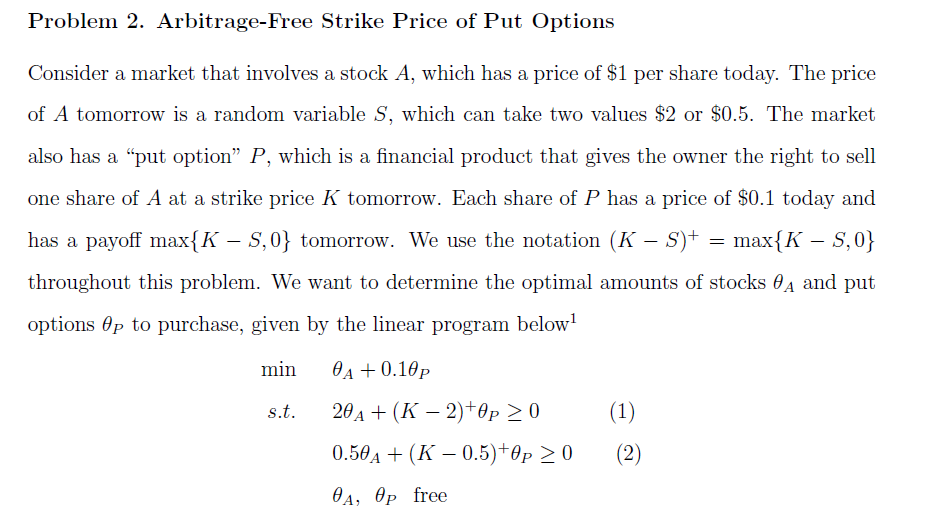

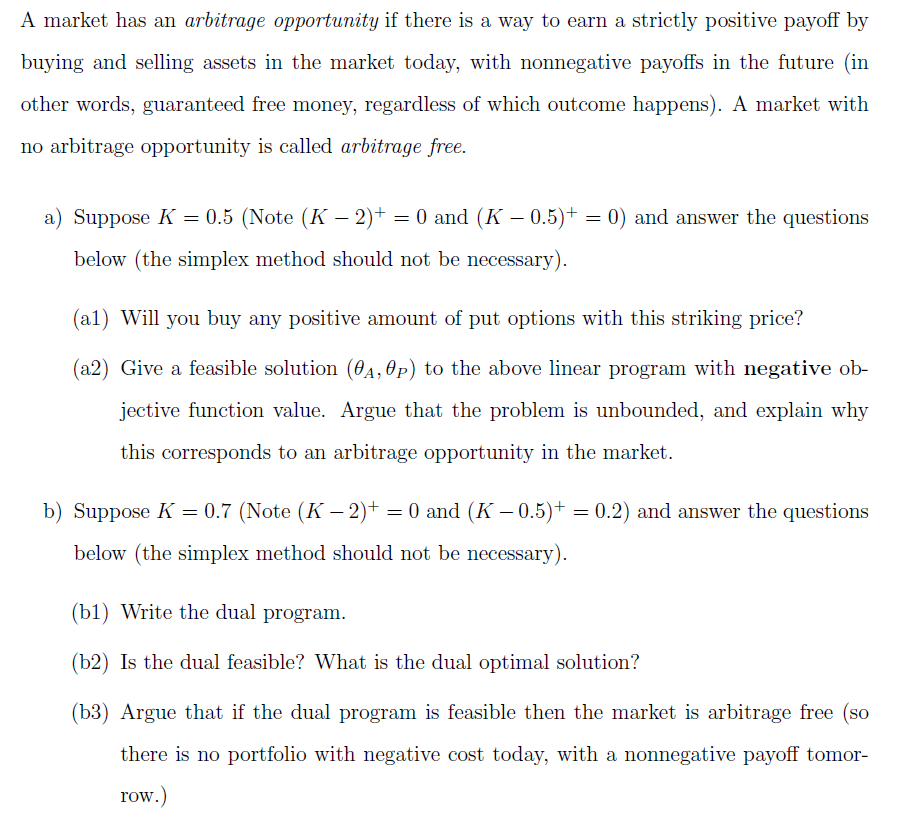

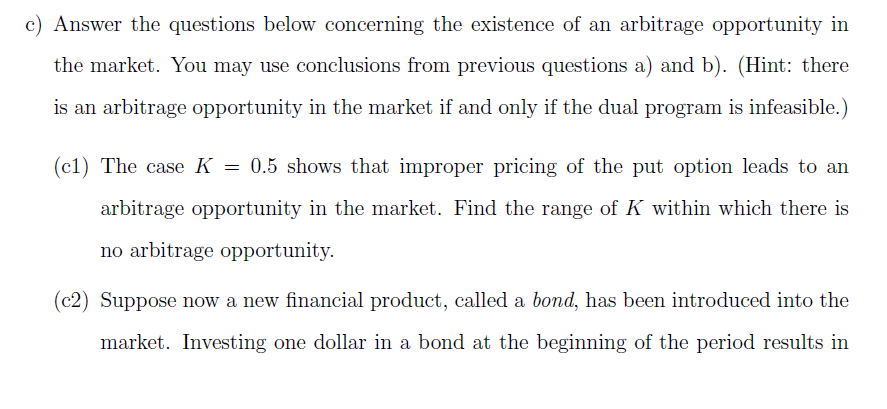

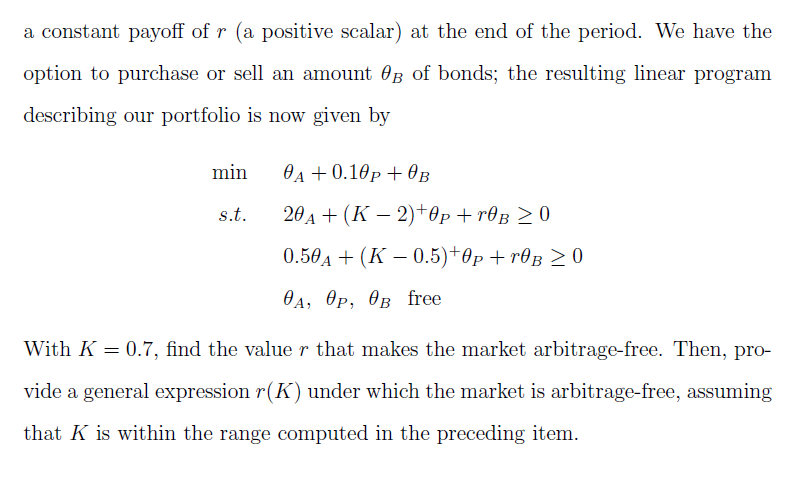

Problem 2. Arbitrage-Free Strike Price of Put Options Consider a market that involves a stock A, which has a price of $1 per share today. The price of A tomorrow is a random variable 3, which can take two values $2 or $0.5. The market also has a \"put option\" P, which is a nancial product that gives the owner the right to sell one share of A at a strike price K tomorrow. Each share of P has a price of $0.1 today and has a payor maJC{K 8,0} tomorrow. We use the notation (K S)+ = max{K 8,0} throughout this problem. We want to determine the optimal amounts of stocks 9A and put options Sp to purchase, given by the linear program below1 min 6A + 0.19;; st. 29A + (K 2)+6p 2 O (1) 0.56141 + (K 0.5)+6p Z O (2) 6,4, 9,0 free A market has an arbitrage opportunity if there is a way to earn a strictly positive payoiir by buying and selling assets in the market today, with nonnegative payoffs in the future (in other words, guaranteed free money, regardless of which outcome happens). A market with no arbitrage opportunity is called arbitrage free. a) Suppose K = 0.5 (Note (K 2)+ = U and (K 0.5)+ = U) and answer the questions below (the simplex method should not be necessary). (a1) Will you buy any positive amount of put options with this striking price? (a2) Give a feasible solution (9,4, 6,0) to the above linear program with negative ob jective function value. Argue that the problem is unbounded, and explain why this corresponds to an arbitrage opportunity in the market. b) Suppose K = 0.7 (Note (K 2)+ = 0 and (K 0.5)+ = 0.2) and answer the questions below (the simplex method should not be necessary). (b1) Write the dual program. (b2) Is the dual feasible? What is the dual optimal solution? (b3) Argue that if the dual program is feasible then the market is arbitrage free (so there is no portfolio with negative cost today, with a nonnegative payoff tomor row.) c) Answer the questions below concerning the existence of an arbitrage opportunity in the market. You may use conclusions from previous questions a) and b). (Hint: there is an arbitrage opportunity in the market if and only if the dual program is infeasible.) (c1) The case K = 0.5 shows that improper pricing of the put option leads to an arbitrage opportunity in the market. Find the range of K within which there is no arbitrage opportunity. (c2) Suppose now a new nancial product, called a bond, has been introduced into the market. Investing one dollar in a bond at the beginning of the period results in a constant payoff of \"r (a positive scalar) at the end of the period. We have the option to purchase or sell an amount I93 of bonds; the resulting linear program describing our portfolio is now given by min 9A + 0.19? + 63 at. 29A + (K 2)+6p + THE 2 0 0.56A + (K U.5)+6p + r93 2 0 :14, HP, 63 free With K = 0.7, nd the value a" that makes the market arbitragefree. Then, pro vide a general expression 1"(K ) under which the market is arbitragefree, assuming that K is within the range computed in the preceding item