Question

Question 2 Question 3 Question 4 Question 5 Question 6 Question 7 Question 8 Question 9 A project has estimated annual net cash flows of

Question 2

Question 2

Question 3

Question 4

Question 5

Question 6

Question 7

Question 8

Question 9

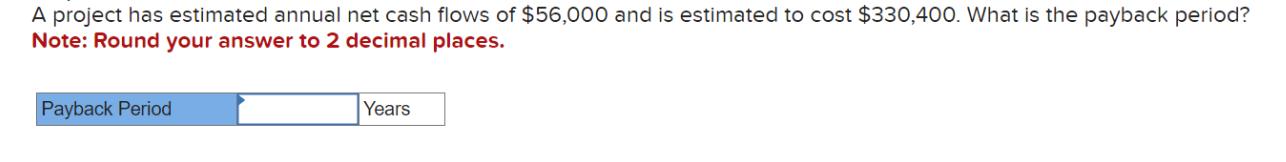

A project has estimated annual net cash flows of $56,000 and is estimated to cost $330,400. What is the payback period? Note: Round your answer to 2 decimal places. Payback Period Years

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

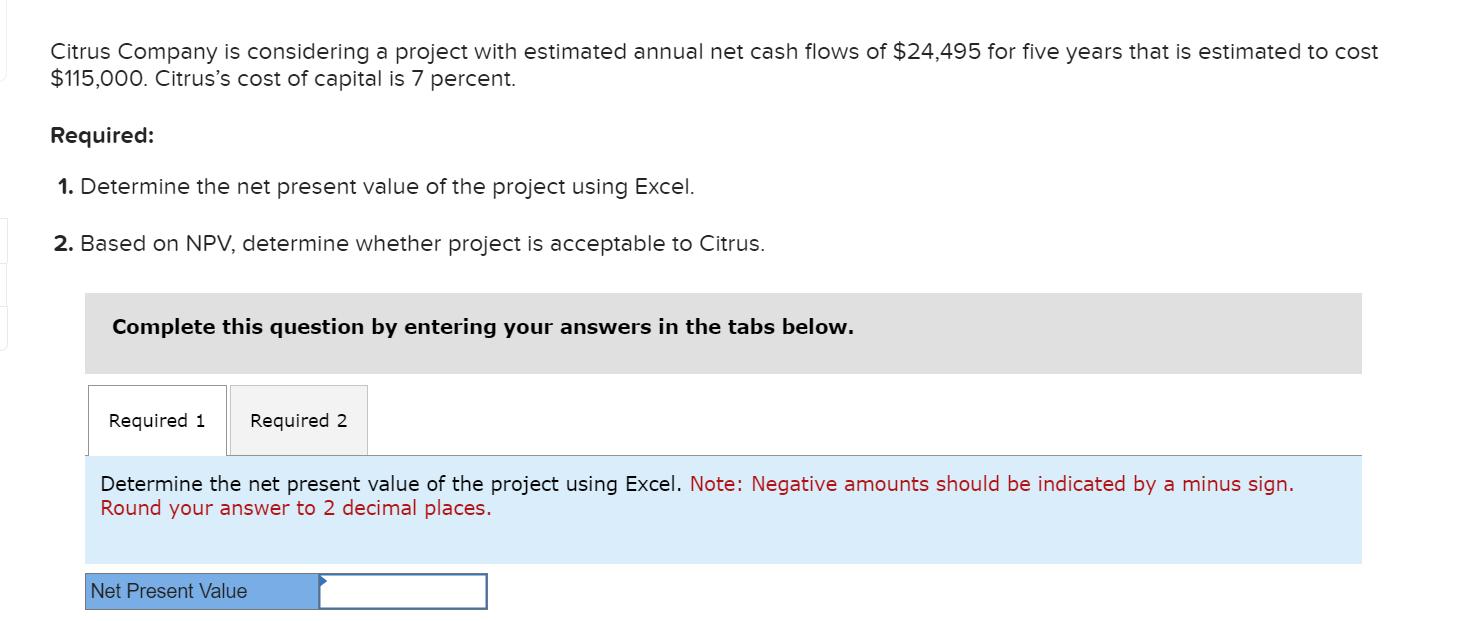

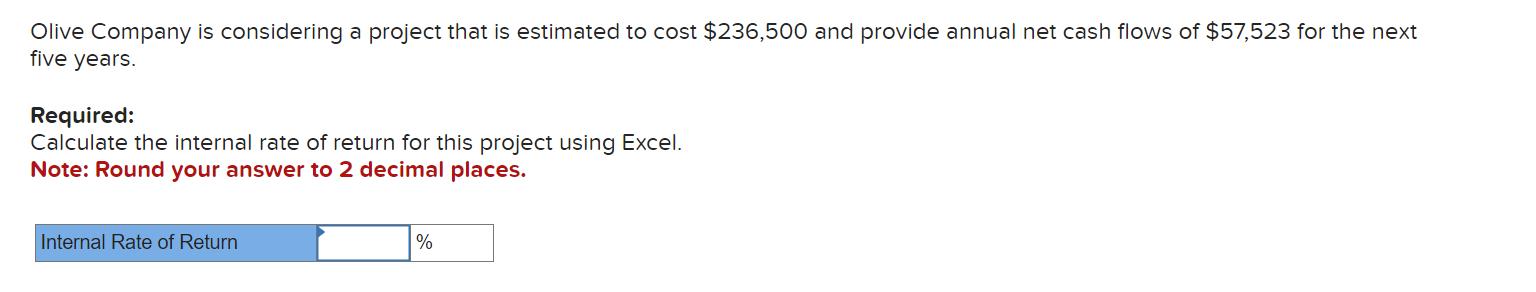

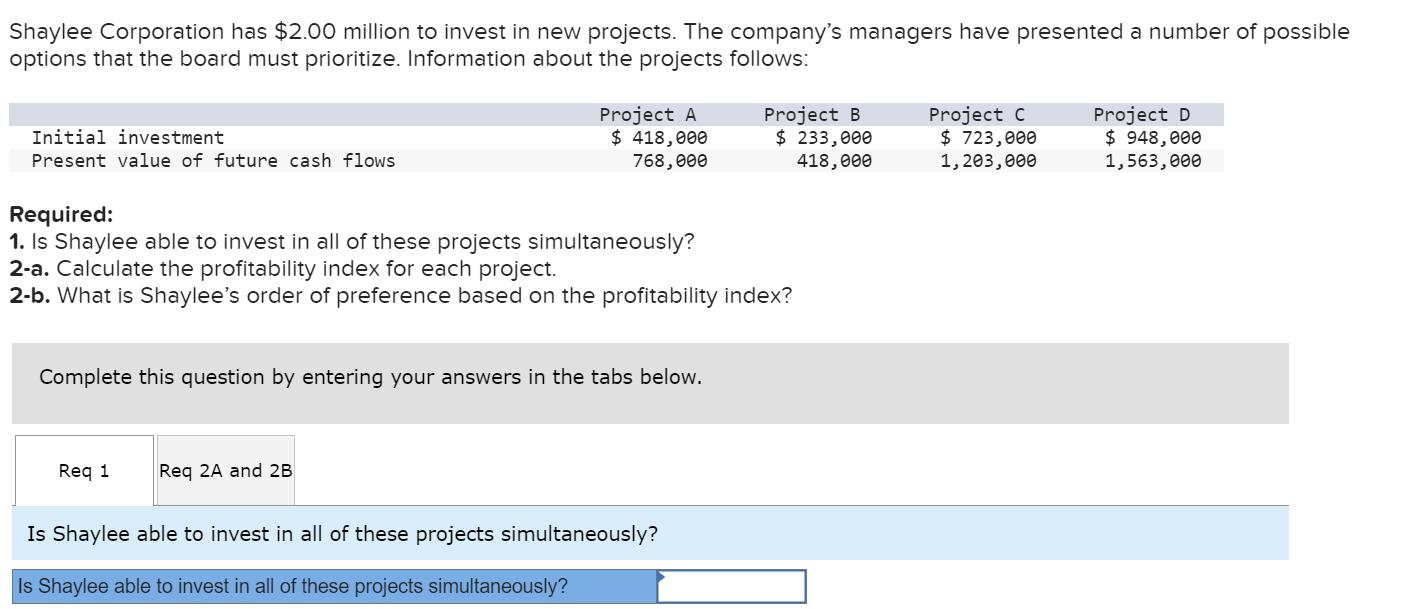

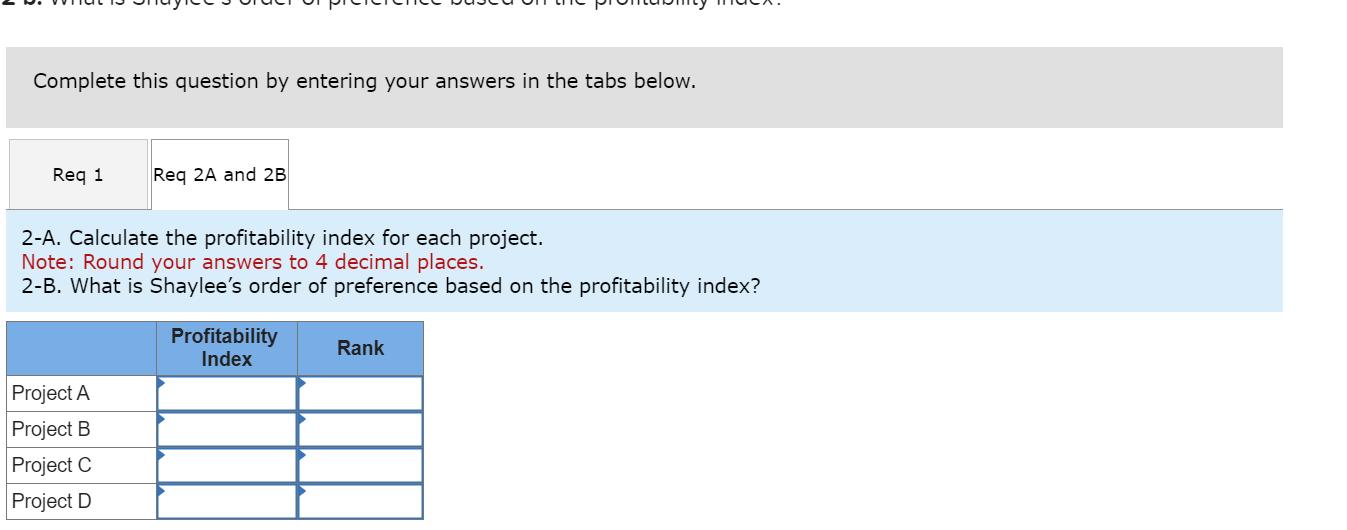

1 payback period 59 years payback period 33040056000 59 years 2 NPV 1456566 3 IRR 1296 4 Is Shaylee ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford, David A. Stangeland, Andras Marosi

1st canadian edition

978-0133400694

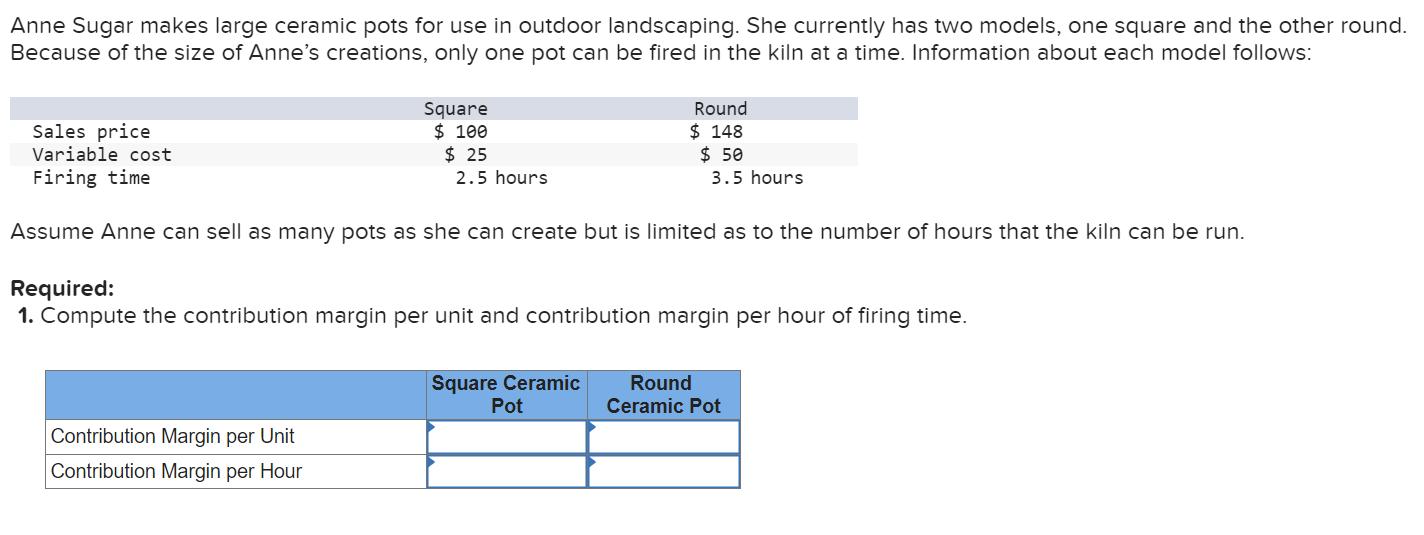

Students also viewed these Accounting questions

Question

Answered: 1 week ago

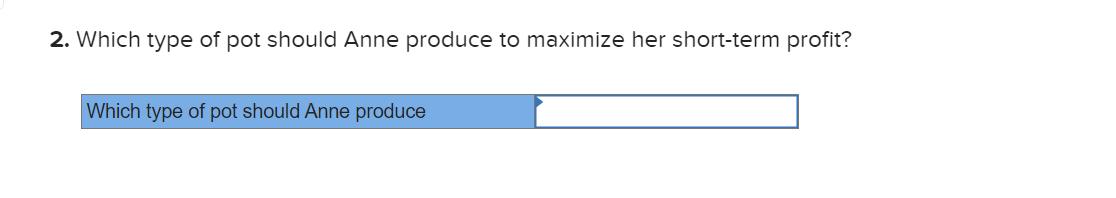

Question

Answered: 1 week ago

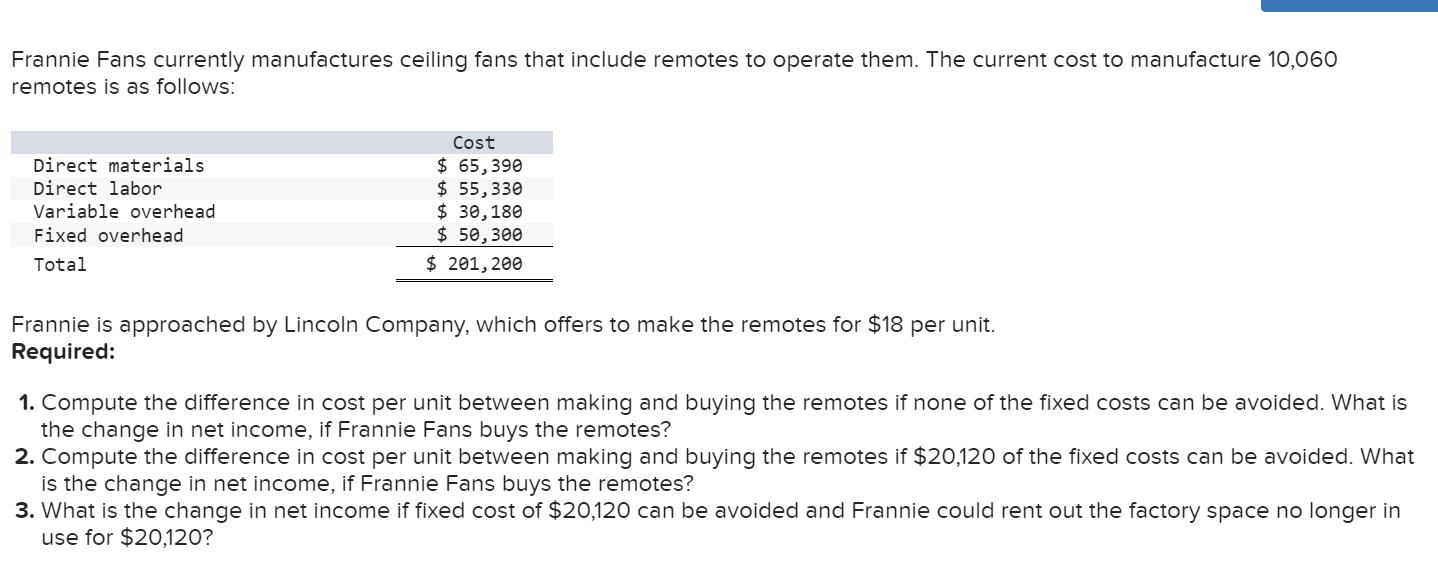

Question

Answered: 1 week ago

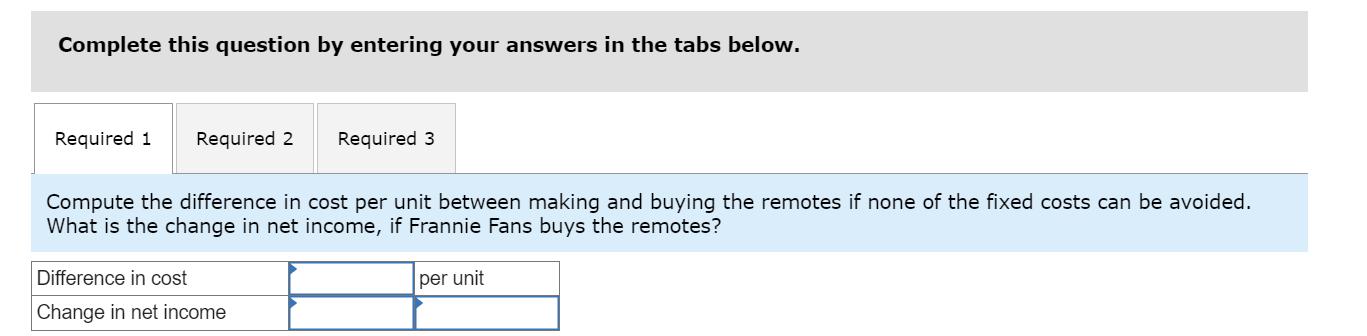

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App