Answered step by step

Verified Expert Solution

Question

1 Approved Answer

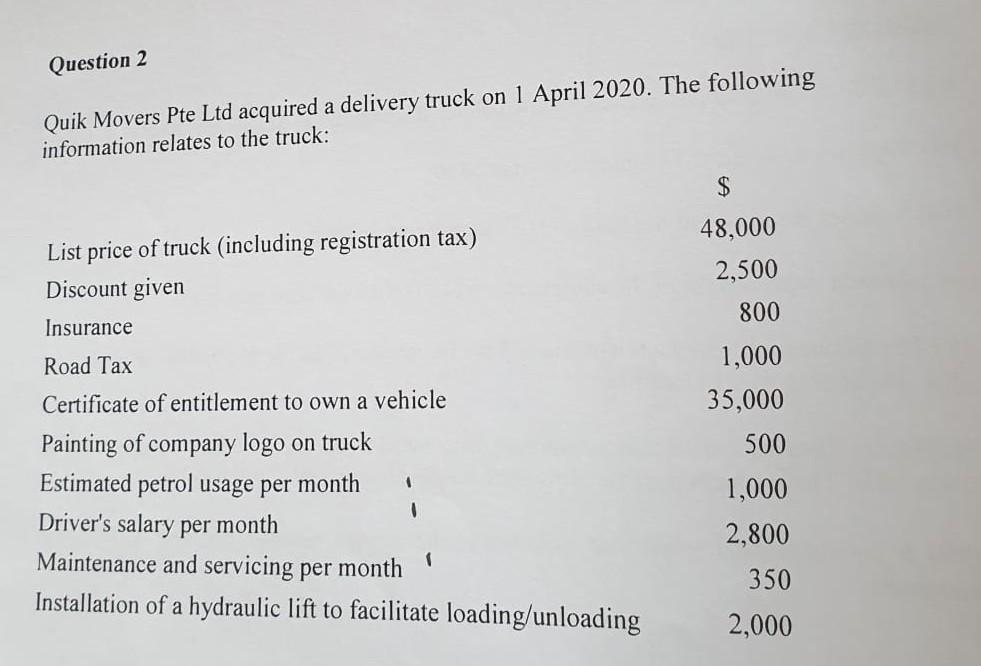

Question 2 Quik Movers Pte Ltd acquired a delivery truck on 1 April 2020. The following information relates to the truck: The estimated useful life

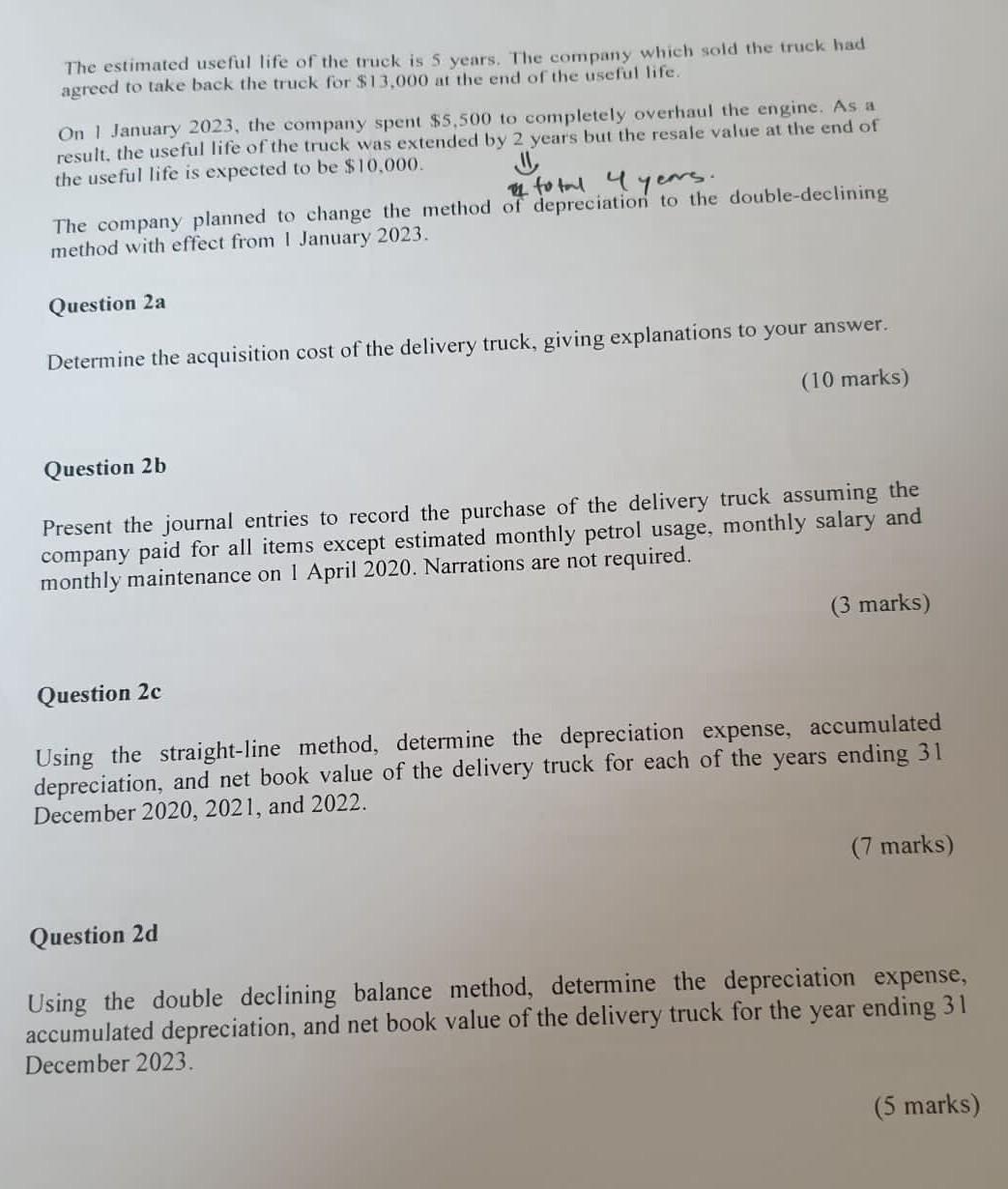

Question 2 Quik Movers Pte Ltd acquired a delivery truck on 1 April 2020. The following information relates to the truck: The estimated useful life of the truck is 5 years. The company which sold the truck had agreed to take back the truck for $13,000 at the end of the useful life. On 1 January 2023, the company spent $5,500 to completely overhaul the engine. As a result. the useful life of the truck was extended by 2 years but the resale value at the end of the useful life is expected to be $10,000. The company planned to change the method of depreciation to the double-declining method with effect from I January 2023. Question 2a Determine the acquisition cost of the delivery truck, giving explanations to your answer. (10 marks) Question 2b Present the journal entries to record the purchase of the delivery truck assuming the company paid for all items except estimated monthly petrol usage, monthly salary and monthly maintenance on 1 April 2020. Narrations are not required. (3 marks) Question 2c Using the straight-line method, determine the depreciation expense, accumulated depreciation, and net book value of the delivery truck for each of the years ending 31 December 2020, 2021, and 2022. (7 marks) Question 2d Using the double declining balance method, determine the depreciation expense, accumulated depreciation, and net book value of the delivery truck for the year ending 31 December 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started