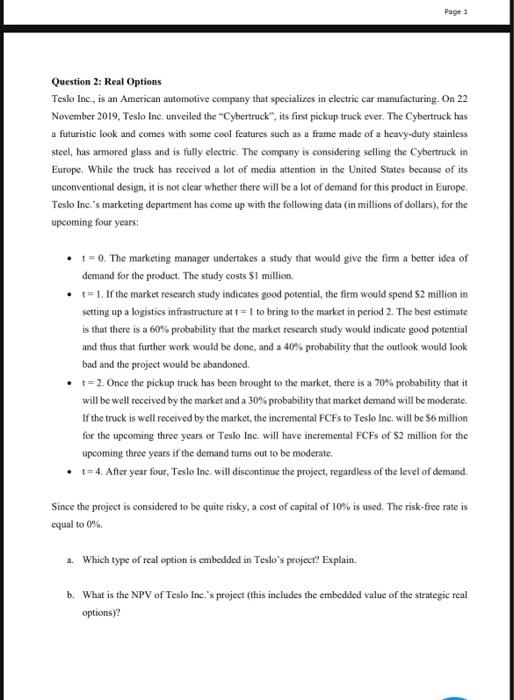

Question 2: Real Options Teslo lnc., is an American automotive company that specializes in electric car manufacturing. On 22 November 2019, Teslo Inc. unveiled the "Cybertruck", its first pickup truck ever. The Cybertruck has a futuristic look and comes with some cool features such as a frame made of a heavy-duty stainless steel, has armored glass and is fully electric. The company is considering selling the Cybertruck in Europe. While the truck has reccived a lot of media attention in the United States becanse of its unconventional design, it is not clear whether there will be a lot of demand for this product in Europe. Teslo Inc. 's marketing department has cone up with the following data (in millions of dollars), for the upcoming four years: - t=0. The marketing manager undertakes a study that would give the firm a benter idea of demand for the product. The study costs $1 million. - t=1. If the market research study indicates good potential, the firm would spend $2 million in setting up a logisties infrastructure at t=1 to bring to the market in period 2. The best estimate is that there is a 60% probability that the market research study would indicate good potential and thus that further work would be done, and a 40% probability that the outlook would look bad and the project would be abandoned. - t=2. Once the pickup truck has been brought to the market, there is a 70% probability that it will be well received by the market and a 30% probability that market demand will be moderate. If the truck is well received by the market, the ineremental FCFs to Teslo Inc, will be $6 million for the upcoming three years or Teslo Inc. will bave incremental FCFs of $2 million for the upcoming three years if the demand tums out to be moderate. - t=4. After year four, Teslo Inc, will discontinue the project, regardless of the level of demand. Since the project is considered to be quite risky, a cost of capital of 10% is used. The risk-free rate is cqual to 0%. a. Which type of real option is embedded in Teslo's project? Explain. b. What is the NPV of Teslo Inc."s project (this includes the embedded value of the strategic real options)