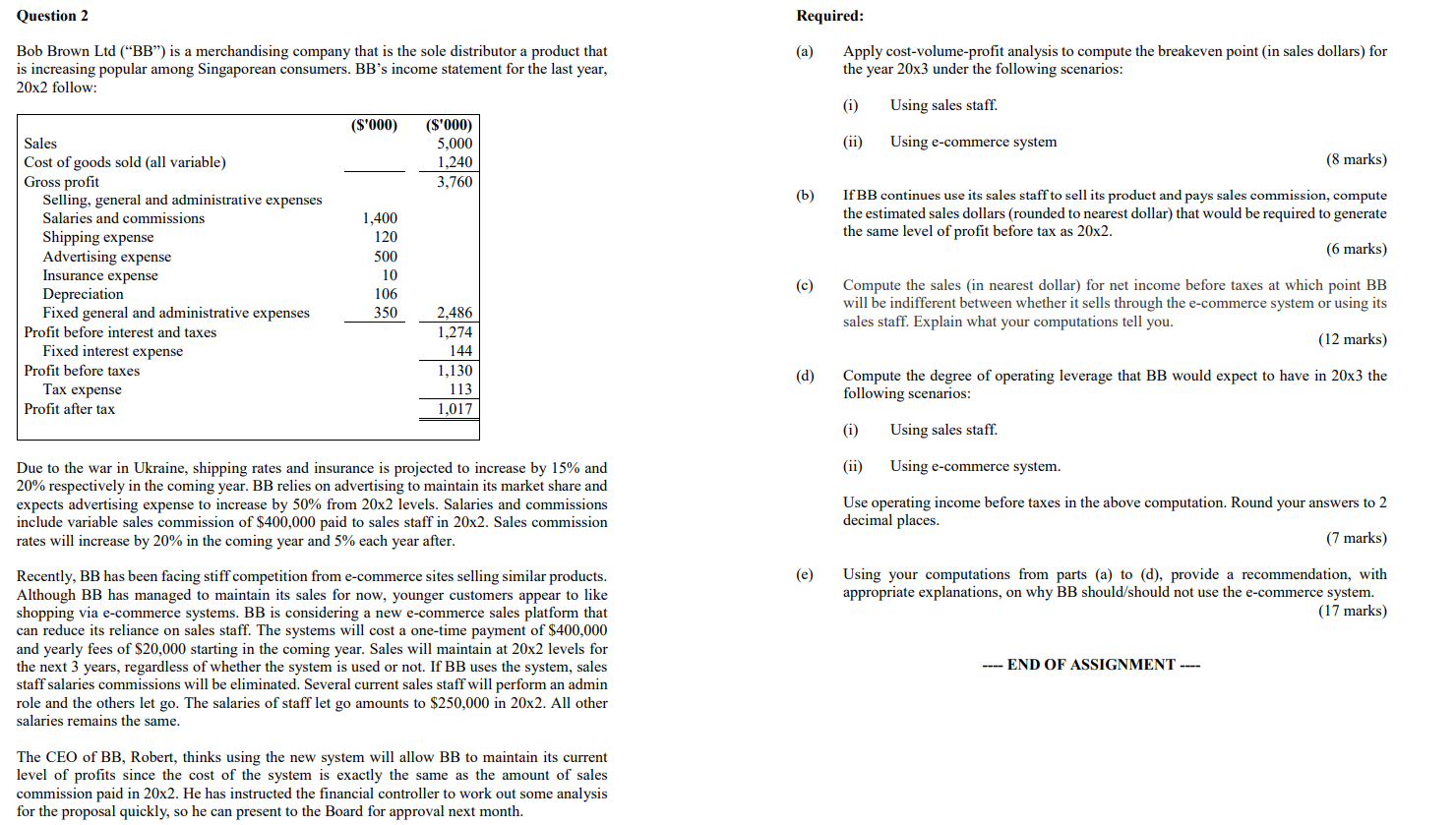

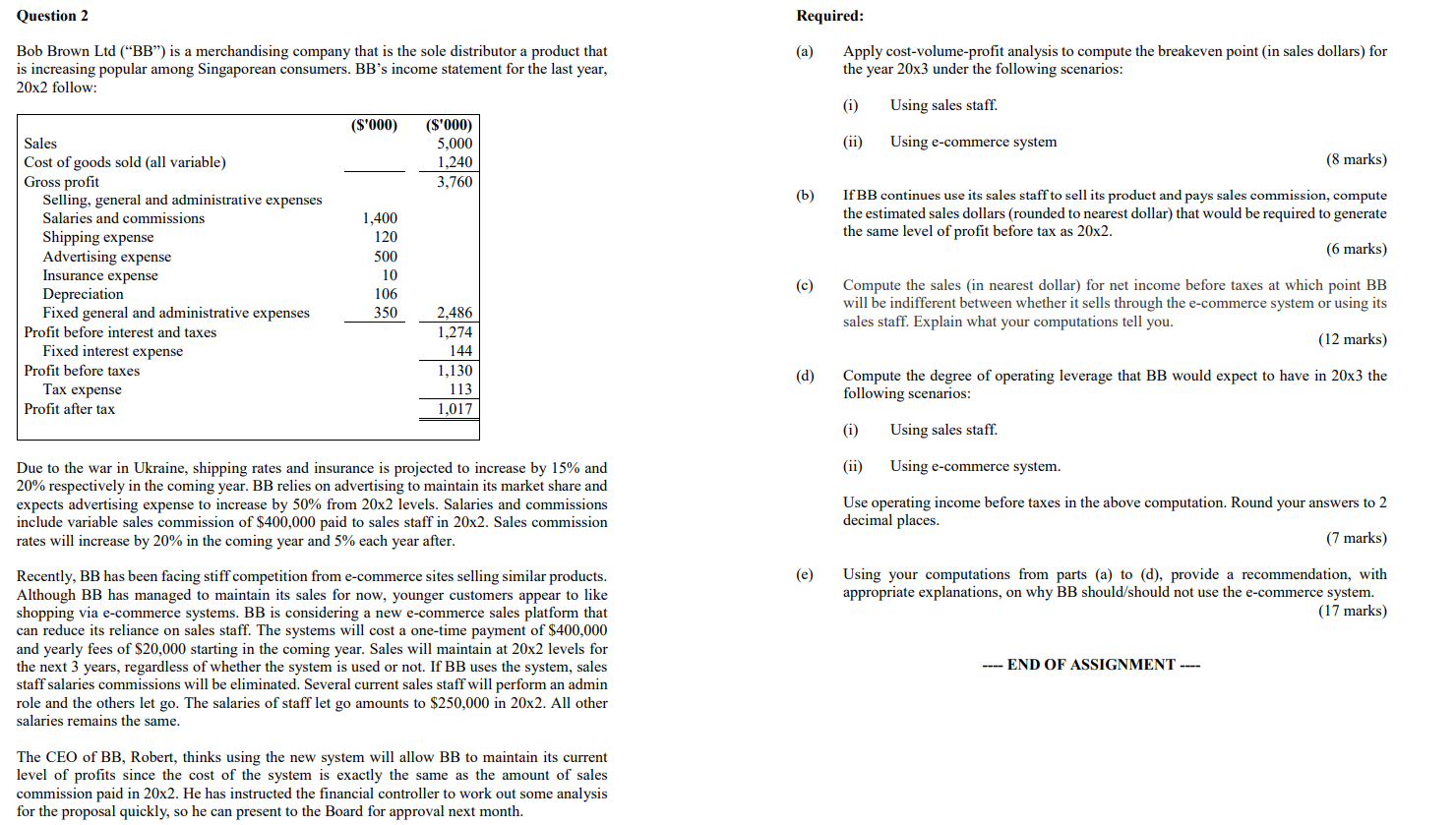

Question 2 Required: Bob Brown Ltd ("BB") is a merchandising company that is the sole distributor a product that (a) Apply cost-volume-profit analysis to compute the breakeven point (in sales dollars) for is increasing popular among Singaporean consumers. BB's income statement for the last year, the year 203 under the following scenarios: 202 follow: (i) Using sales staff. (ii) Using e-commerce system ( 8 marks) (b) If BB continues use its sales staff to sell its product and pays sales commission, compute the estimated sales dollars (rounded to nearest dollar) that would be required to generate the same level of profit before tax as 202. (6 marks) (c) Compute the sales (in nearest dollar) for net income before taxes at which point BB will be indifferent between whether it sells through the e-commerce system or using its sales staff. Explain what your computations tell you. (12 marks) (d) Compute the degree of operating leverage that BB would expect to have in 203 the following scenarios: (i) Using sales staff. Due to the war in Ukraine, shipping rates and insurance is projected to increase by 15% and (ii) Using e-commerce system. 20% respectively in the coming year. BB relies on advertising to maintain its market share and expects advertising expense to increase by 50% from 202 levels. Salaries and commissions Use operating income before taxes in the above computation. Round your answers to 2 decimal places. rates will increase by 20% in the coming year and 5% each year after. (7 marks) Recently, BB has been facing stiff competition from e-commerce sites selling similar products. (e) Using your computations from parts (a) to (d), provide a recommendation, with Although BB has managed to maintain its sales for now, younger customers appear to like appropriate explanations, on why BB should/should not use the e-commerce system. shopping via e-commerce systems. BB is considering a new e-commerce sales platform that (17 marks) can reduce its reliance on sales staff. The systems will cost a one-time payment of $400,000 and yearly fees of $20,000 starting in the coming year. Sales will maintain at 202 levels for the next 3 years, regardless of whether the system is used or not. If BB uses the system, sales --- END OF ASSIGNMENT --staff salaries commissions will be eliminated. Several current sales staff will perform an admin role and the others let go. The salaries of staff let go amounts to $250,000 in 20x2. All other salaries remains the same. The CEO of BB, Robert, thinks using the new system will allow BB to maintain its current level of profits since the cost of the system is exactly the same as the amount of sales commission paid in 20x2. He has instructed the financial controller to work out some analysis for the proposal quickly, so he can present to the Board for approval next month