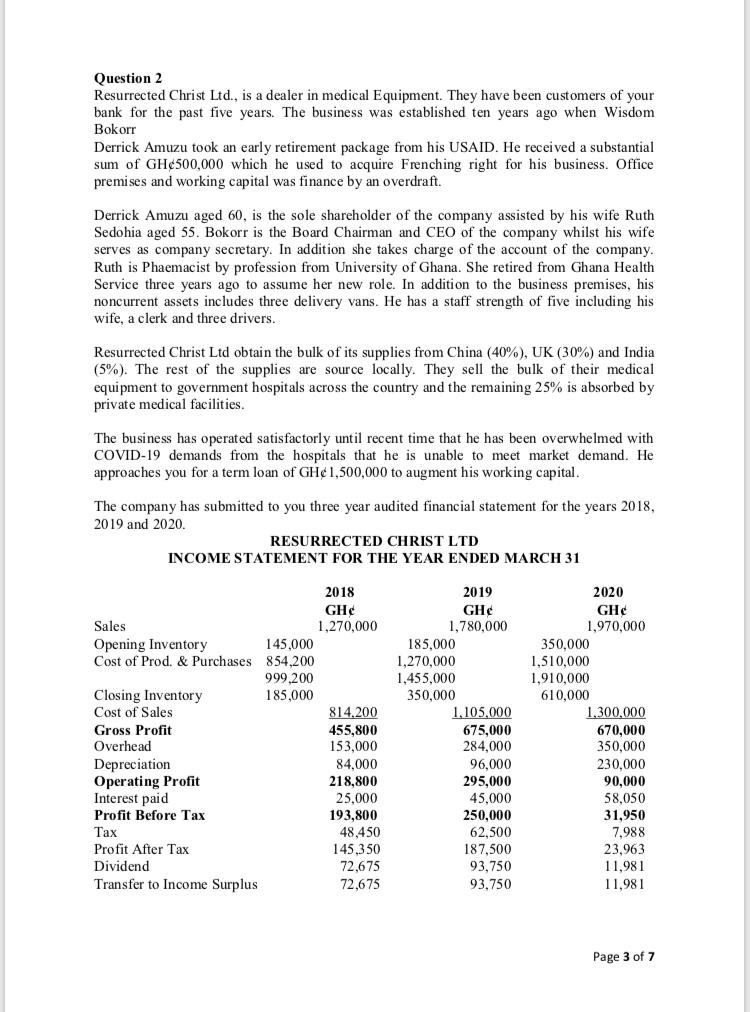

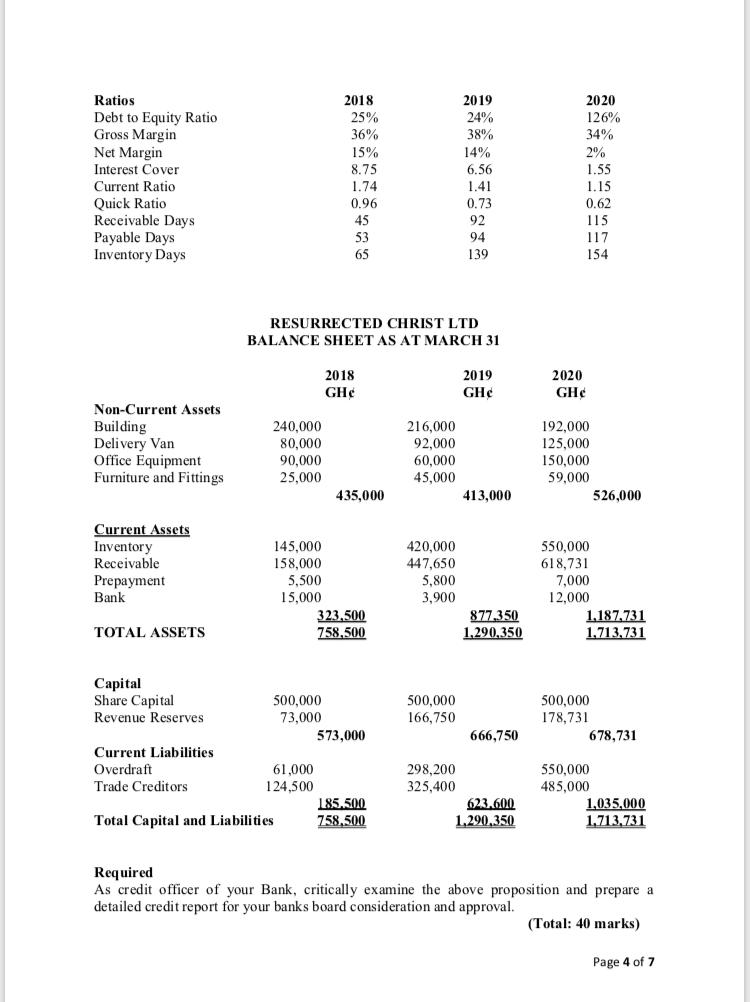

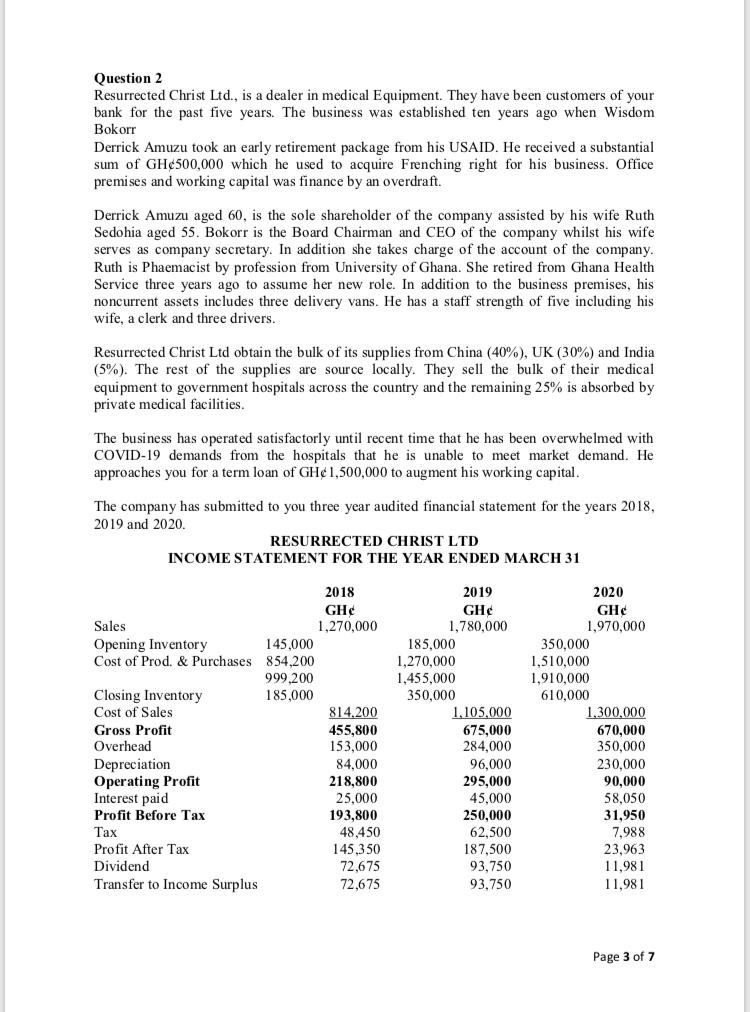

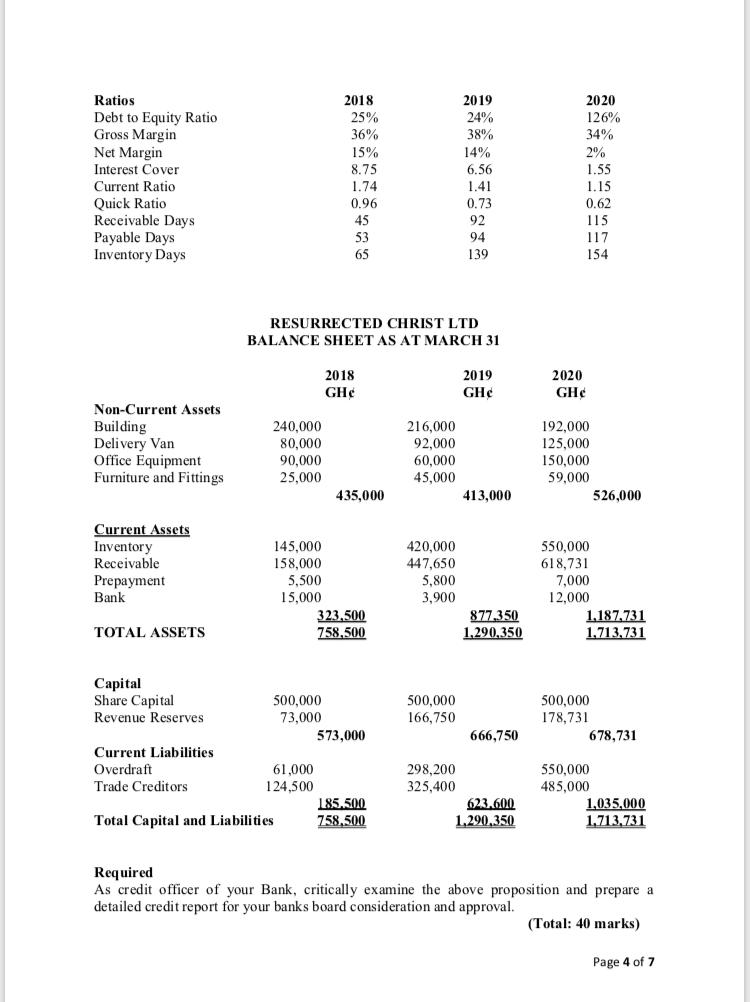

Question 2 Resurrected Christ Ltd., is a dealer in medical Equipment. They have been customers of your bank for the past five years. The business was established ten years ago when Wisdom Bokorr Derrick Amuzu took an early retirement package from his USAID. He received a substantial sum of GH500,000 which he used to acquire Frenching right for his business, Office premises and working capital was finance by an overdraft. Derrick Amuzu aged 60, is the sole shareholder of the company assisted by his wife Ruth Sedohia aged 55. Bokorr is the Board Chairman and CEO of the company whilst his wife serves as company secretary. In addition she takes charge of the account of the company. Ruth is Phaemacist by profession from University of Ghana. She retired from Ghana Health Service three years ago to assume her new role. In addition to the business premises, his noncurrent assets includes three delivery vans. He has a staff strength of five including his wife, a clerk and three drivers. Resurrected Christ Ltd obtain the bulk of its supplies from China (40%), UK (30%) and India (5%). The rest of the supplies are source locally. They sell the bulk of their medical equipment to government hospitals across the country and the remaining 25% is absorbed by private medical facilities. The business has operated satisfactorly until recent time that he has been overwhelmed with COVID-19 demands from the hospitals that he is unable to meet market demand. He approaches you for a term loan of GH 1,500,000 to augment his working capital. The company has submitted to you three year audited financial statement for the years 2018, 2019 and 2020. RESURRECTED CHRIST LTD INCOME STATEMENT FOR THE YEAR ENDED MARCH 31 2018 GH Sales 1,270,000 Opening Inventory 145,000 Cost of Prod. & Purchases 854,200 999,200 Closing Inventory 185,000 Cost of Sales 814,200 Gross Profit 455,800 Overhead 153,000 Depreciation 84,000 Operating Profit 218,800 Interest paid 25,000 Profit Before Tax 193.800 Tax 48,450 Profit After Tax 145,350 Dividend 72,675 Transfer to Income Surplus 72,675 2019 GH 1,780,000 185.000 1,270,000 1,455,000 350,000 1,105,000 675,000 284,000 96,000 295,000 45,000 250,000 62.500 187,500 93,750 93.750 2020 GH 1,970,000 350,000 1,510,000 1,910,000 610,000 1.300.000 670,000 350.000 230,000 90,000 58,050 31,950 7.988 23,963 11,981 11.981 Page 3 of 7 Ratios Debt to Equity Ratio Gross Margin Net Margin Interest Cover Current Ratio Quick Ratio Receivable Days Payable Days Inventory Days 2018 25% 36% 15% 8.75 1.74 0.96 45 53 65 2019 24% 38% 14% 6.56 1.41 0.73 92 94 139 2020 126% 34% 2% 1.55 1.15 0.62 115 117 154 RESURRECTED CHRIST LTD BALANCE SHEET AS AT MARCH 31 2018 GH 2019 GH 2020 GH Non-Current Assets Building Delivery Van Office Equipment Furniture and Fittings 240,000 80,000 90.000 25,000 216,000 92,000 60,000 45,000 413,000 192,000 125,000 150,000 59,000 526,000 435,000 Current Assets Inventory Receivable Prepayment Bank 420,000 447,650 5,800 145,000 158,000 5,500 15,000 323,500 758,500 550,000 618,731 7,000 12,000 1.187.731 1.713.731 3,900 877,350 1,290.350 TOTAL ASSETS 500,000 166,750 500,000 178,731 678,731 666,750 Capital Share Capital 500,000 Revenue Reserves 73,000 573,000 Current Liabilities Overdraft 61,000 Trade Creditors 124,500 185.500 Total Capital and Liabilities 758,500 298,200 325,400 623.600 1.290,350 550,000 485,000 1,035,000 1.713,731 Required As credit officer of your Bank, critically examine the above proposition and prepare a detailed credit report for your banks board consideration and approval. (Total: 40 marks) Page 4 of 7 Question 2 Resurrected Christ Ltd., is a dealer in medical Equipment. They have been customers of your bank for the past five years. The business was established ten years ago when Wisdom Bokorr Derrick Amuzu took an early retirement package from his USAID. He received a substantial sum of GH500,000 which he used to acquire Frenching right for his business, Office premises and working capital was finance by an overdraft. Derrick Amuzu aged 60, is the sole shareholder of the company assisted by his wife Ruth Sedohia aged 55. Bokorr is the Board Chairman and CEO of the company whilst his wife serves as company secretary. In addition she takes charge of the account of the company. Ruth is Phaemacist by profession from University of Ghana. She retired from Ghana Health Service three years ago to assume her new role. In addition to the business premises, his noncurrent assets includes three delivery vans. He has a staff strength of five including his wife, a clerk and three drivers. Resurrected Christ Ltd obtain the bulk of its supplies from China (40%), UK (30%) and India (5%). The rest of the supplies are source locally. They sell the bulk of their medical equipment to government hospitals across the country and the remaining 25% is absorbed by private medical facilities. The business has operated satisfactorly until recent time that he has been overwhelmed with COVID-19 demands from the hospitals that he is unable to meet market demand. He approaches you for a term loan of GH 1,500,000 to augment his working capital. The company has submitted to you three year audited financial statement for the years 2018, 2019 and 2020. RESURRECTED CHRIST LTD INCOME STATEMENT FOR THE YEAR ENDED MARCH 31 2018 GH Sales 1,270,000 Opening Inventory 145,000 Cost of Prod. & Purchases 854,200 999,200 Closing Inventory 185,000 Cost of Sales 814,200 Gross Profit 455,800 Overhead 153,000 Depreciation 84,000 Operating Profit 218,800 Interest paid 25,000 Profit Before Tax 193.800 Tax 48,450 Profit After Tax 145,350 Dividend 72,675 Transfer to Income Surplus 72,675 2019 GH 1,780,000 185.000 1,270,000 1,455,000 350,000 1,105,000 675,000 284,000 96,000 295,000 45,000 250,000 62.500 187,500 93,750 93.750 2020 GH 1,970,000 350,000 1,510,000 1,910,000 610,000 1.300.000 670,000 350.000 230,000 90,000 58,050 31,950 7.988 23,963 11,981 11.981 Page 3 of 7 Ratios Debt to Equity Ratio Gross Margin Net Margin Interest Cover Current Ratio Quick Ratio Receivable Days Payable Days Inventory Days 2018 25% 36% 15% 8.75 1.74 0.96 45 53 65 2019 24% 38% 14% 6.56 1.41 0.73 92 94 139 2020 126% 34% 2% 1.55 1.15 0.62 115 117 154 RESURRECTED CHRIST LTD BALANCE SHEET AS AT MARCH 31 2018 GH 2019 GH 2020 GH Non-Current Assets Building Delivery Van Office Equipment Furniture and Fittings 240,000 80,000 90.000 25,000 216,000 92,000 60,000 45,000 413,000 192,000 125,000 150,000 59,000 526,000 435,000 Current Assets Inventory Receivable Prepayment Bank 420,000 447,650 5,800 145,000 158,000 5,500 15,000 323,500 758,500 550,000 618,731 7,000 12,000 1.187.731 1.713.731 3,900 877,350 1,290.350 TOTAL ASSETS 500,000 166,750 500,000 178,731 678,731 666,750 Capital Share Capital 500,000 Revenue Reserves 73,000 573,000 Current Liabilities Overdraft 61,000 Trade Creditors 124,500 185.500 Total Capital and Liabilities 758,500 298,200 325,400 623.600 1.290,350 550,000 485,000 1,035,000 1.713,731 Required As credit officer of your Bank, critically examine the above proposition and prepare a detailed credit report for your banks board consideration and approval. (Total: 40 marks) Page 4 of 7