Answered step by step

Verified Expert Solution

Question

1 Approved Answer

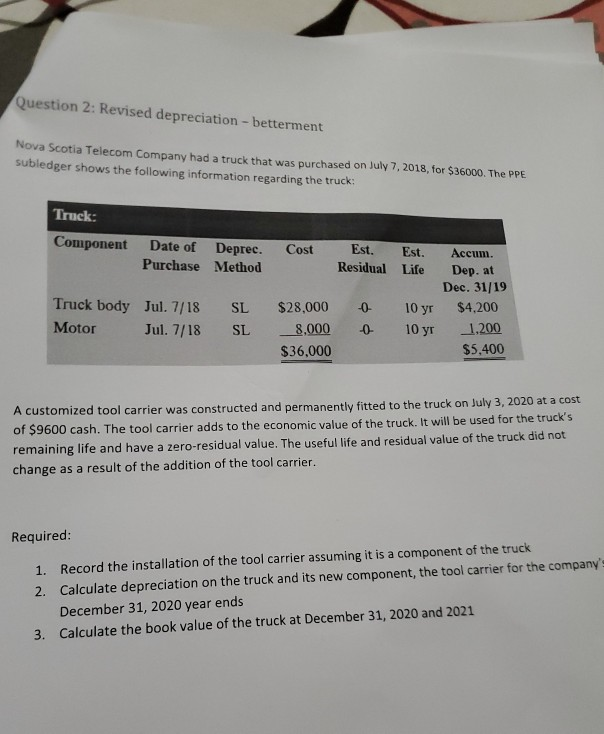

Question 2: Revised depreciation - betterment Nova Scotia Telecom Company had a truck that was purchased on July 7, 2018, for $36000. The PPE subledger

Question 2: Revised depreciation - betterment Nova Scotia Telecom Company had a truck that was purchased on July 7, 2018, for $36000. The PPE subledger shows the following information regarding the truck: Truck: Component Date of Deprec. Purchase Method Cost Est. Residual Est. Life -0- Truck body Jul. 7/18 Motor Jul. 7/18 SL SL $28,000 8,000 $36.000 10 yr 10 yr Accum. Dep.at Dec. 31/19 $4,200 1.200 $5,400 -0- A customized tool carrier was constructed and permanently fitted to the truck on July 3, 2020 at a cost of $9600 cash. The tool carrier adds to the economic value of the truck. It will be used for the truck's remaining life and have a zero-residual value. The useful life and residual value of the truck did not change as a result of the addition of the tool carrier. Required: 1. Record the installation of the tool carrier assuming it is a component of the truck 2. Calculate depreciation on the truck and its new component, the tool carrier for the company's December 31, 2020 year ends 3. Calculate the book value of the truck at December 31, 2020 and 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started