Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Saadi Ventures Ltd produces general merchandise and has prepared the following flexed budget for no3 The company currently operates at 40% capacity but

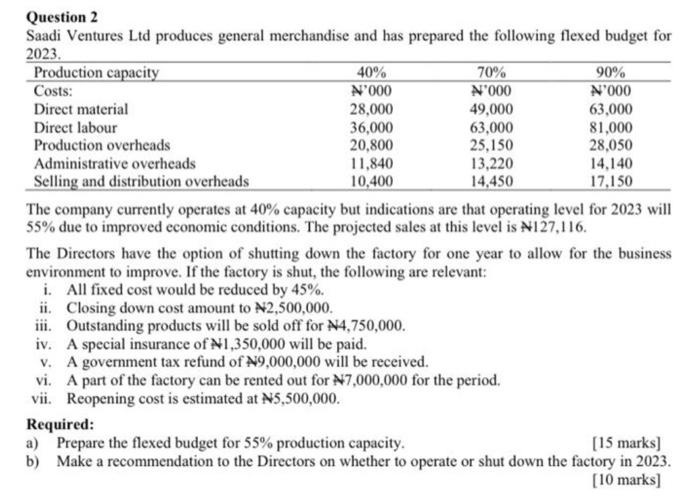

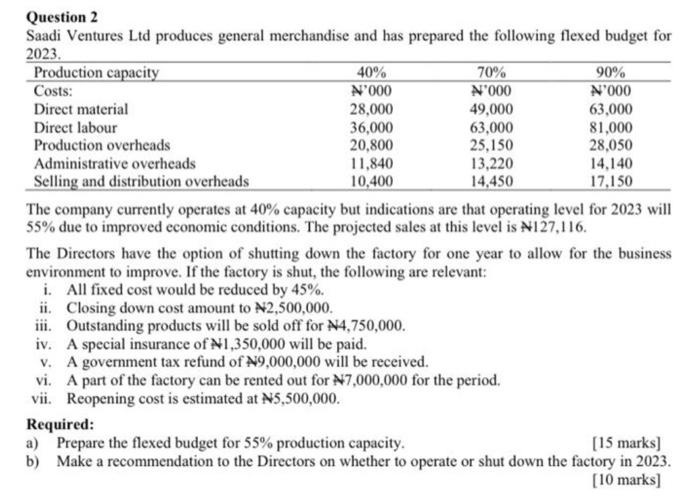

Question 2 Saadi Ventures Ltd produces general merchandise and has prepared the following flexed budget for no3 The company currently operates at 40% capacity but indications are that operating level for 2023 will 55% due to improved economic conditions. The projected sales at this level is N127,116. The Directors have the option of shutting down the factory for one year to allow for the business environment to improve. If the factory is shut, the following are relevant: i. All fixed cost would be reduced by 45%. ii. Closing down cost amount to N2,500,000. iii. Outstanding products will be sold off for N4,750,000. iv. A special insurance of N1,350,000 will be paid. v. A government tax refund of N9,000,000 will be received. vi. A part of the factory can be rented out for N7,000,000 for the period. vii. Reopening cost is estimated at N5,500,000. Required: a) Prepare the flexed budget for 55% production capacity. [15 marks] b) Make a recommendation to the Directors on whether to operate or shut down the factory in 2023. [10 marks]

Question 2 Saadi Ventures Ltd produces general merchandise and has prepared the following flexed budget for no3 The company currently operates at 40% capacity but indications are that operating level for 2023 will 55% due to improved economic conditions. The projected sales at this level is N127,116. The Directors have the option of shutting down the factory for one year to allow for the business environment to improve. If the factory is shut, the following are relevant: i. All fixed cost would be reduced by 45%. ii. Closing down cost amount to N2,500,000. iii. Outstanding products will be sold off for N4,750,000. iv. A special insurance of N1,350,000 will be paid. v. A government tax refund of N9,000,000 will be received. vi. A part of the factory can be rented out for N7,000,000 for the period. vii. Reopening cost is estimated at N5,500,000. Required: a) Prepare the flexed budget for 55% production capacity. [15 marks] b) Make a recommendation to the Directors on whether to operate or shut down the factory in 2023. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started