Answered step by step

Verified Expert Solution

Question

1 Approved Answer

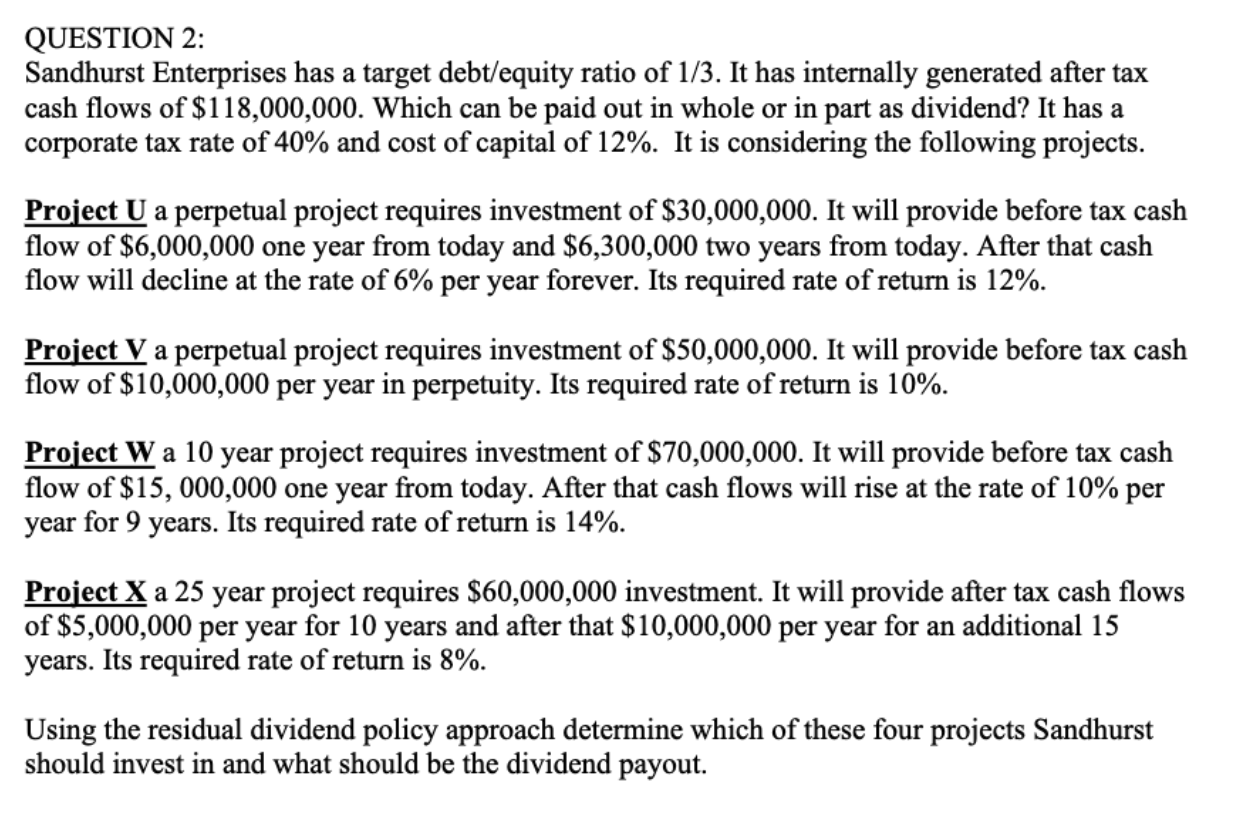

QUESTION 2 : Sandhurst Enterprises has a target debt / equity ratio of 1 3 . It has internally generated after tax cash flows of

QUESTION :

Sandhurst Enterprises has a target debtequity ratio of It has internally generated after tax

cash flows of $ Which can be paid out in whole or in part as dividend? It has a

corporate tax rate of and cost of capital of It is considering the following projects.

Project a perpetual project requires investment of $ It will provide before tax cash

flow of $ one year from today and $ two years from today. After that cash

flow will decline at the rate of per year forever. Its required rate of return is

Project V a perpetual project requires investment of $ It will provide before tax cash

flow of $ per year in perpetuity. Its required rate of return is

Project a year project requires investment of $ It will provide before tax cash

flow of $ one year from today. After that cash flows will rise at the rate of per

year for years. Its required rate of return is

Project X a year project requires $ investment. It will provide after tax cash flows

of $ per year for years and after that $ per year for an additional

years. Its required rate of return is

Using the residual dividend policy approach determine which of these four projects Sandhurst

should invest in and what should be the dividend payout.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started