Answered step by step

Verified Expert Solution

Question

1 Approved Answer

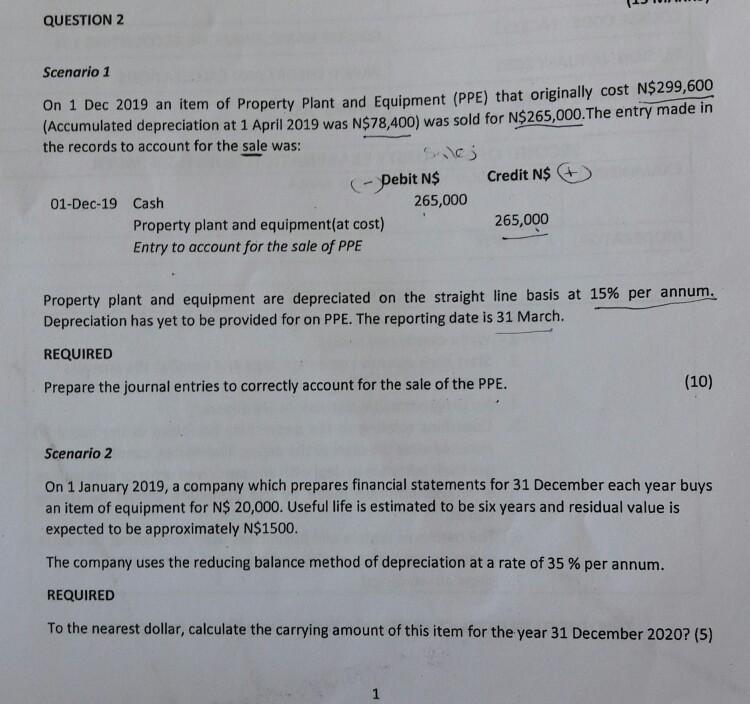

QUESTION 2 Scenario 1 On 1 Dec 2019 an item of Property Plant and Equipment (PPE) that originally cost N$299,600 (Accumulated depreciation at 1 April

QUESTION 2 Scenario 1 On 1 Dec 2019 an item of Property Plant and Equipment (PPE) that originally cost N$299,600 (Accumulated depreciation at 1 April 2019 was N$78,400) was sold for N$265,000. The entry made in the records to account for the sale was: Credit N$ - Debit N$ 265,000 01-Dec-19 Cash Property plant and equipment(at cost) Entry to account for the sale of PPE 265,000 Property plant and equipment are depreciated on the straight line basis at 15% per annum. Depreciation has yet to be provided for on PPE. The reporting date is 31 March. REQUIRED Prepare the journal entries to correctly account for the sale of the PPE. (10) Scenario 2 On 1 January 2019, a company which prepares financial statements for 31 December each year buys an item of equipment for N$ 20,000. Useful life is estimated to be six years and residual value is expected to be approximately N$1500. The company uses the reducing balance method of depreciation at a rate of 35 % per annum. REQUIRED To the nearest dollar, calculate the carrying amount of this item for the year 31 December 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started