Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 2 Section B: Answer Three questions from 4. All questions carry equal marks Question 2 Part A Cherry Co has two independent divisions, A

question 2

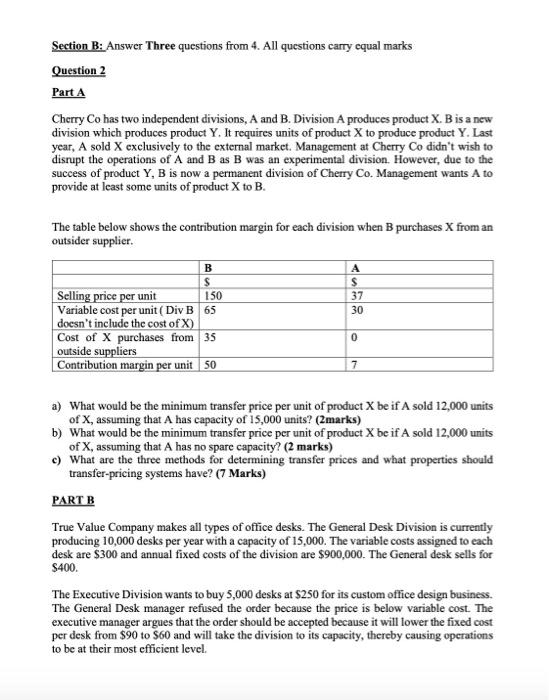

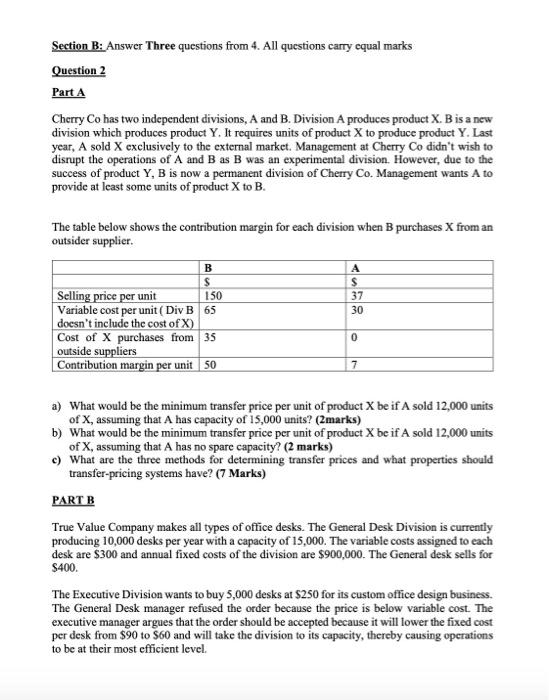

Section B: Answer Three questions from 4. All questions carry equal marks Question 2 Part A Cherry Co has two independent divisions, A and B. Division A produces product X. B is a new division which produces product Y. It requires units of product X to produce product Y. Last year, A sold X exclusively to the external market. Management at Cherry Co didn't wish to disrupt the operations of A and B as B was an experimental division. However, due to the success of product Y, B is now a permanent division of Cherry Co. Management wants A to provide at least some units of product X to B. The table below shows the contribution margin for each division when B purchases X from an outsider supplier. B $ S Selling price per unit 150 37 Variable cost per unit (Div B 65 30 doesn't include the cost of X) Cost of X purchases from 35 outside suppliers Contribution margin per unit 50 7 0 a) What would be the minimum transfer price per unit of product X be if A sold 12,000 units of X, assuming that A has capacity of 15,000 units? (Zmarks) b) What would be the minimum transfer price per unit of product X be if A sold 12,000 units of X, assuming that A has no spare capacity? (2 marks) c) What are the three methods for determining transfer prices and what properties should transfer pricing systems have? (7 Marks) PART B True Value Company makes all types of office desks. The General Desk Division is currently producing 10,000 desks per year with a capacity of 15,000. The variable costs assigned to each desk are $300 and annual fixed costs of the division are $900,000. The General desk sells for $400 The Executive Division wants to buy 5,000 desks at $250 for its custom office design business. The General Desk manager refused the order because the price is below variable cost. The executive manager argues that the order should be accepted because it will lower the fixed cost per desk from $90 to S60 and will take the division to its capacity, thereby causing operations to be at their most efficient level Required: a. Should the order from the Executive Division be accepted by the General Desk Division? Why? (5 Marks) b. From the perspective of the General Desk Division and the company, should the order be accepted if the Executive Division plans on selling the desks in the outside market for $420 after incurring additional costs of $100 per desk? (5 Marks) c. What action should the company president take? (4 Marks) Section B: Answer Three questions from 4. All questions carry equal marks Question 2 Part A Cherry Co has two independent divisions, A and B. Division A produces product X. B is a new division which produces product Y. It requires units of product X to produce product Y. Last year, A sold X exclusively to the external market. Management at Cherry Co didn't wish to disrupt the operations of A and B as B was an experimental division. However, due to the success of product Y, B is now a permanent division of Cherry Co. Management wants A to provide at least some units of product X to B. The table below shows the contribution margin for each division when B purchases X from an outsider supplier. B $ S Selling price per unit 150 37 Variable cost per unit (Div B 65 30 doesn't include the cost of X) Cost of X purchases from 35 outside suppliers Contribution margin per unit 50 7 0 a) What would be the minimum transfer price per unit of product X be if A sold 12,000 units of X, assuming that A has capacity of 15,000 units? (Zmarks) b) What would be the minimum transfer price per unit of product X be if A sold 12,000 units of X, assuming that A has no spare capacity? (2 marks) c) What are the three methods for determining transfer prices and what properties should transfer pricing systems have? (7 Marks) PART B True Value Company makes all types of office desks. The General Desk Division is currently producing 10,000 desks per year with a capacity of 15,000. The variable costs assigned to each desk are $300 and annual fixed costs of the division are $900,000. The General desk sells for $400 The Executive Division wants to buy 5,000 desks at $250 for its custom office design business. The General Desk manager refused the order because the price is below variable cost. The executive manager argues that the order should be accepted because it will lower the fixed cost per desk from $90 to S60 and will take the division to its capacity, thereby causing operations to be at their most efficient level Required: a. Should the order from the Executive Division be accepted by the General Desk Division? Why? (5 Marks) b. From the perspective of the General Desk Division and the company, should the order be accepted if the Executive Division plans on selling the desks in the outside market for $420 after incurring additional costs of $100 per desk? (5 Marks) c. What action should the company president take? (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started