Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 : Solar is a brand - new trader on the bond trading desk of Sun & Moon Bank. Solar sees that a company,

Question :

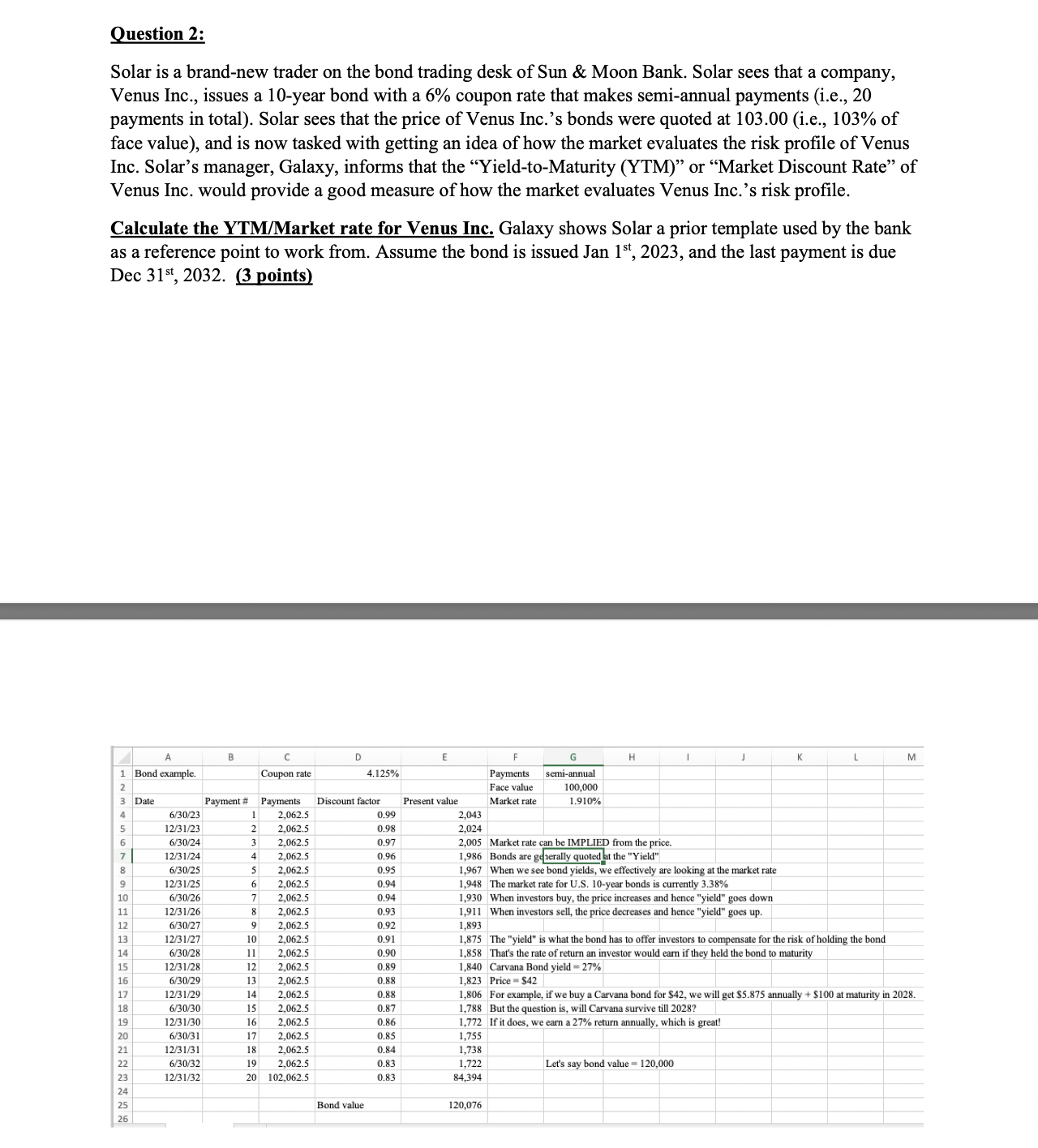

Solar is a brandnew trader on the bond trading desk of Sun & Moon Bank. Solar sees that a company,

Venus Inc., issues a year bond with a coupon rate that makes semiannual payments ie

payments in total Solar sees that the price of Venus Inc.s bonds were quoted at ie of

face value and is now tasked with getting an idea of how the market evaluates the risk profile of Venus

Inc. Solar's manager, Galaxy, informs that the "YieldtoMaturity YTM or "Market Discount Rate" of

Venus Inc. would provide a good measure of how the market evaluates Venus Inc.s risk profile.

Calculate the YTMMarket rate for Venus Inc. Galaxy shows Solar a prior template used by the bank

as a reference point to work from. Assume the bond is issued Jan and the last payment is due

Dec pointsQuestion :

Solar is a brandnew trader on the bond trading desk of Sun & Moon Bank. Solar sees that a company,

Venus Inc., issues a year bond with a coupon rate that makes semiannual payments ie

payments in total Solar sees that the price of Venus Inc.s bonds were quoted at ie of

face value and is now tasked with getting an idea of how the market evaluates the risk profile of Venus

Inc. Solar's manager, Galaxy, informs that the "YieldtoMaturity YTM or "Market Discount Rate" of

Venus Inc. would provide a good measure of how the market evaluates Venus Inc.s risk profile.

Calculate the YTMMarket rate for Venus Inc. Galaxy shows Solar a prior template used by the bank

as a reference point to work from. Assume the bond is issued Jan and the last payment is due

Dec points Question :

Solar is a brandnew trader on the bond trading desk of Sun & Moon Bank. Solar sees that a company, Venus Inc., issues a year bond with a coupon rate that makes semiannual payments ie payments in total Solar sees that the price of Venus Inc.s bonds were quoted at ie of face value and is now tasked with getting an idea of how the market evaluates the risk profile of Venus Inc. Solars manager, Galaxy, informs that the YieldtoMaturity YTM or Market Discount Rate of Venus Inc. would provide a good measure of how the market evaluates Venus Inc.s risk profile.

Calculate the YTMMarket rate for Venus Inc. Galaxy shows Solar a prior template used by the bank as a reference point to work from. Assume the bond is issued Jan st and the last payment is due Dec st

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started