Question 2 , sub parts a,b,c

Question 2 , sub parts a,b,c please

Question 2 , sub parts a,b,c please

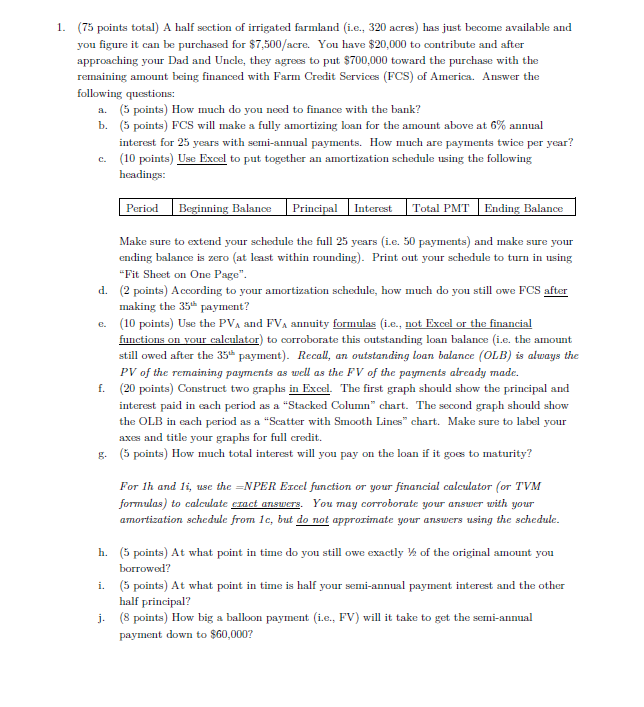

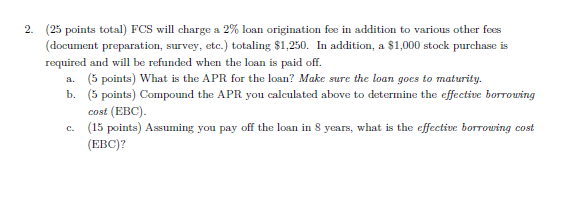

1. (75 points total) A half section of irrigated farmland (i.e., 320 acres) has just become available and you figure it can be purchased for $7,500/acre. You have $20,000 to contribute and after approaching your Dad and Uncle, they agrees to put $700,000 toward the purchase with the remaining amount being financed with Farm Credit Services (FCS) of America. Answer the following questions: a. (5 points) How much do you need to finance with the bank? b. 5 points) FCS will make a fully amortizing loan for the amount above at 6% annual interest for 25 years with semi-annual payments. How much are payments twice per year? c. (10 points) Use Excel to put together an amortization schedule using the following headings: Period Beginning Balance Principal Interest Total PMT Ending Balance Make sure to extend your schedule the full 25 years (i.e. 50 payments) and make sure your ending balance is zero (at least within rounding). Print out your schedule to turn in using "Fit Sheet on One Page". d. 2 points) According to your amortization schedule, how much do you still owe FCS after making the 35 payment? e. (10 points) Use the PVA and FVA annuity formulas (i.c., not Excel or the financial functions on your calculator) to corroborate this outstanding loan balance (i.e. the amount still owed after the 35 payment). Recall, an outstanding loan balance (OLB) is always the PV of the remaining payments as well as the FV of the payments already made. f. (20 points) Construct two graphs in Excel. The first graph should show the principal and interest paid in each period as a "Stacked Column" chart. The second graph should show the OLB in each period as a "Scatter with Smooth Lines chart. Make sure to label your axes and title your graphs for full credit. g. (5 points) How much total interest will you pay on the loan if it goes to maturity? For 1h and li, use the =NPER Excel function or your financial calculator (or T'VM formulas) to calculate eract answers. You may corroborate your answer with your amortization schedule from 1c, but do not approximate your answers using the schedule. h. (points) At what point in time do you still owe exactly 1 of the original amount you borrowed? i. (5 points) At what point in time is half your semi-annual payment interest and the other half principal? j. (8 points) How big a balloon payment (i.e., FV) will it take to get the semi-annual payment down to $60,000? 2. (25 points total) FCS will charge a 2% loan origination fee in addition to various other fees (document preparation, survey, etc.) totaling $1,250. In addition, a $1,000 stock purchase is required and will be refunded when the loan is paid off. a. (5 points) What is the APR for the loan? Make sure the loan goes to maturity. b. (5 points) Compound the APR you calculated above to determine the effective borrowing cost (EBC) c. (15 points) Assuming you pay off the loan in 8 years, what is the effective borrowing cost (EBC)? 1. (75 points total) A half section of irrigated farmland (i.e., 320 acres) has just become available and you figure it can be purchased for $7,500/acre. You have $20,000 to contribute and after approaching your Dad and Uncle, they agrees to put $700,000 toward the purchase with the remaining amount being financed with Farm Credit Services (FCS) of America. Answer the following questions: a. (5 points) How much do you need to finance with the bank? b. 5 points) FCS will make a fully amortizing loan for the amount above at 6% annual interest for 25 years with semi-annual payments. How much are payments twice per year? c. (10 points) Use Excel to put together an amortization schedule using the following headings: Period Beginning Balance Principal Interest Total PMT Ending Balance Make sure to extend your schedule the full 25 years (i.e. 50 payments) and make sure your ending balance is zero (at least within rounding). Print out your schedule to turn in using "Fit Sheet on One Page". d. 2 points) According to your amortization schedule, how much do you still owe FCS after making the 35 payment? e. (10 points) Use the PVA and FVA annuity formulas (i.c., not Excel or the financial functions on your calculator) to corroborate this outstanding loan balance (i.e. the amount still owed after the 35 payment). Recall, an outstanding loan balance (OLB) is always the PV of the remaining payments as well as the FV of the payments already made. f. (20 points) Construct two graphs in Excel. The first graph should show the principal and interest paid in each period as a "Stacked Column" chart. The second graph should show the OLB in each period as a "Scatter with Smooth Lines chart. Make sure to label your axes and title your graphs for full credit. g. (5 points) How much total interest will you pay on the loan if it goes to maturity? For 1h and li, use the =NPER Excel function or your financial calculator (or T'VM formulas) to calculate eract answers. You may corroborate your answer with your amortization schedule from 1c, but do not approximate your answers using the schedule. h. (points) At what point in time do you still owe exactly 1 of the original amount you borrowed? i. (5 points) At what point in time is half your semi-annual payment interest and the other half principal? j. (8 points) How big a balloon payment (i.e., FV) will it take to get the semi-annual payment down to $60,000? 2. (25 points total) FCS will charge a 2% loan origination fee in addition to various other fees (document preparation, survey, etc.) totaling $1,250. In addition, a $1,000 stock purchase is required and will be refunded when the loan is paid off. a. (5 points) What is the APR for the loan? Make sure the loan goes to maturity. b. (5 points) Compound the APR you calculated above to determine the effective borrowing cost (EBC) c. (15 points) Assuming you pay off the loan in 8 years, what is the effective borrowing cost (EBC)

Question 2 , sub parts a,b,c please

Question 2 , sub parts a,b,c please