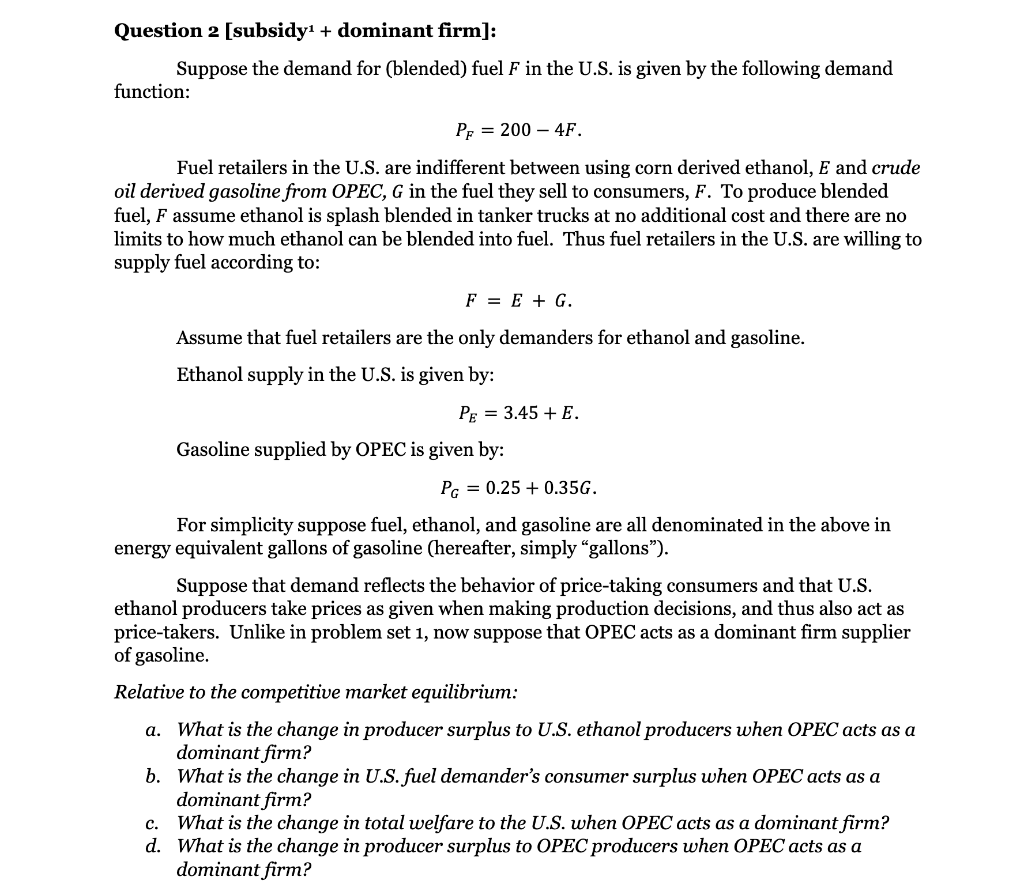

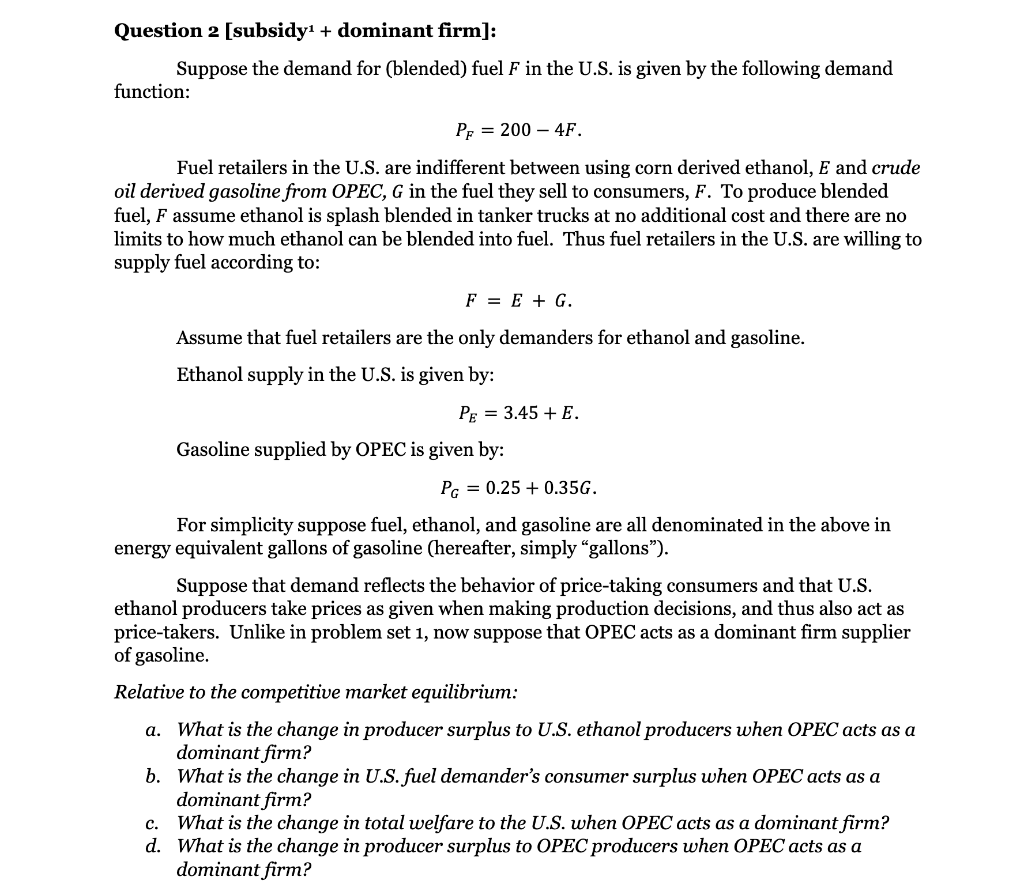

Question 2 [subsidy1 + dominant firm]: Suppose the demand for (blended) fuel F in the U.S. is given by the following demand function: Pe = 200 - 4F. Fuel retailers in the U.S. are indifferent between using corn derived ethanol, E and crude oil derived gasoline from OPEC, G in the fuel they sell to consumers, F. To produce blended fuel, F assume ethanol is splash blended in tanker trucks at no additional cost and there are no limits to how much ethanol can be blended into fuel. Thus fuel retailers in the U.S. are willing to supply fuel according to: F = E + G. Assume that fuel retailers are the only demanders for ethanol and gasoline. Ethanol supply in the U.S. is given by: Pe = 3.45 + E. Gasoline supplied by OPEC is given by: Pc = 0.25 +0.35G. For simplicity suppose fuel, ethanol, and gasoline are all denominated in the above in energy equivalent gallons of gasoline (hereafter, simply gallons). Suppose that demand reflects the behavior of price-taking consumers and that U.S. ethanol producers take prices as given when making production decisions, and thus also act as price-takers. Unlike in problem set 1, now suppose that OPEC acts as a dominant firm supplier of gasoline. Relative to the competitive market equilibrium: a. What is the change in producer surplus to U.S. ethanol producers when OPEC acts as a dominant firm? b. What is the change in U.S. fuel demander's consumer surplus when OPEC acts as dominant firm? C. What is the change in total welfare to the U.S. when OPEC acts as a dominant firm? d. What is the change in producer surplus to OPEC producers when OPEC acts as a dominant firm? Question 2 [subsidy1 + dominant firm]: Suppose the demand for (blended) fuel F in the U.S. is given by the following demand function: Pe = 200 - 4F. Fuel retailers in the U.S. are indifferent between using corn derived ethanol, E and crude oil derived gasoline from OPEC, G in the fuel they sell to consumers, F. To produce blended fuel, F assume ethanol is splash blended in tanker trucks at no additional cost and there are no limits to how much ethanol can be blended into fuel. Thus fuel retailers in the U.S. are willing to supply fuel according to: F = E + G. Assume that fuel retailers are the only demanders for ethanol and gasoline. Ethanol supply in the U.S. is given by: Pe = 3.45 + E. Gasoline supplied by OPEC is given by: Pc = 0.25 +0.35G. For simplicity suppose fuel, ethanol, and gasoline are all denominated in the above in energy equivalent gallons of gasoline (hereafter, simply gallons). Suppose that demand reflects the behavior of price-taking consumers and that U.S. ethanol producers take prices as given when making production decisions, and thus also act as price-takers. Unlike in problem set 1, now suppose that OPEC acts as a dominant firm supplier of gasoline. Relative to the competitive market equilibrium: a. What is the change in producer surplus to U.S. ethanol producers when OPEC acts as a dominant firm? b. What is the change in U.S. fuel demander's consumer surplus when OPEC acts as dominant firm? C. What is the change in total welfare to the U.S. when OPEC acts as a dominant firm? d. What is the change in producer surplus to OPEC producers when OPEC acts as a dominant firm