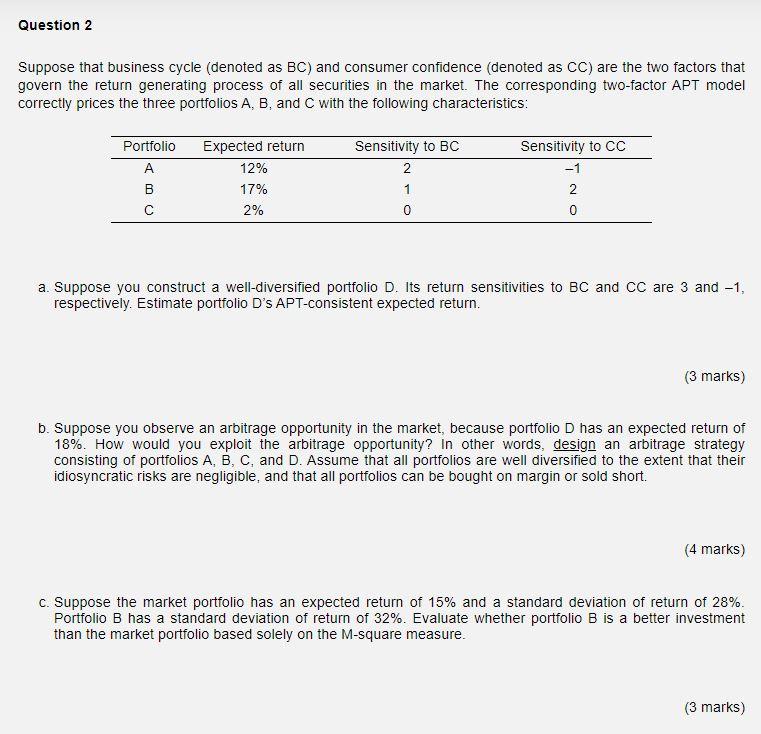

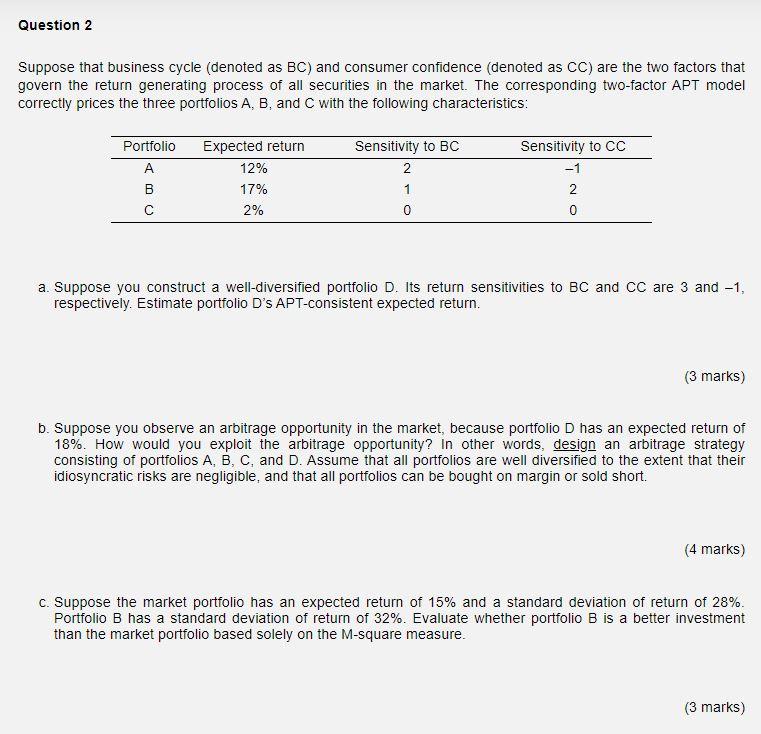

Question 2 Suppose that business cycle (denoted as BC) and consumer confidence (denoted as CC) are the two factors that govern the return generating process of all securities in the market. The corresponding two-factor APT model correctly prices the three portfolios A, B, and C with the following characteristics: Portfolio B Expected return 12% 17% 2% Sensitivity to BC 2 1 Sensitivity to CC -1 2 0 0 a. Suppose you construct a well-diversified portfolio D. Its return sensitivities to BC and CC are 3 and -1, respectively. Estimate portfolio D's APT-consistent expected return. (3 marks) b. Suppose you observe an arbitrage opportunity in the market, because portfolio D has an expected return of 18%. How would you exploit the arbitrage opportunity? In other words, design an arbitrage strategy consisting of portfolios A, B, C, and D. Assume that all portfolios are well diversified to the extent that their idiosyncratic risks are negligible, and that all portfolios can be bought on margin or sold short. (4 marks) c. Suppose the market portfolio has an expected return of 15% and a standard deviation of return of 28%. Portfolio B has a standard deviation of return of 32%. Evaluate whether portfolio B is a better investment than the market portfolio based solely on the M-square measure. (3 marks) Question 2 Suppose that business cycle (denoted as BC) and consumer confidence (denoted as CC) are the two factors that govern the return generating process of all securities in the market. The corresponding two-factor APT model correctly prices the three portfolios A, B, and C with the following characteristics: Portfolio B Expected return 12% 17% 2% Sensitivity to BC 2 1 Sensitivity to CC -1 2 0 0 a. Suppose you construct a well-diversified portfolio D. Its return sensitivities to BC and CC are 3 and -1, respectively. Estimate portfolio D's APT-consistent expected return. (3 marks) b. Suppose you observe an arbitrage opportunity in the market, because portfolio D has an expected return of 18%. How would you exploit the arbitrage opportunity? In other words, design an arbitrage strategy consisting of portfolios A, B, C, and D. Assume that all portfolios are well diversified to the extent that their idiosyncratic risks are negligible, and that all portfolios can be bought on margin or sold short. (4 marks) c. Suppose the market portfolio has an expected return of 15% and a standard deviation of return of 28%. Portfolio B has a standard deviation of return of 32%. Evaluate whether portfolio B is a better investment than the market portfolio based solely on the M-square measure