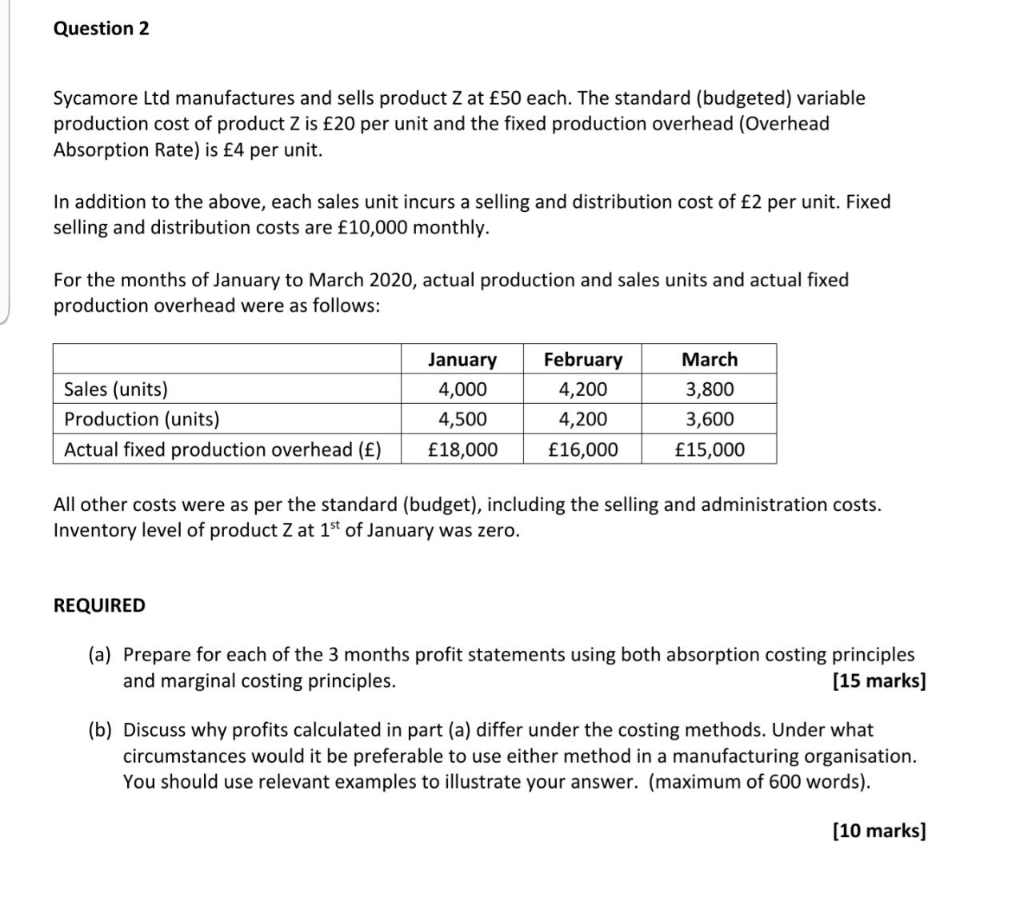

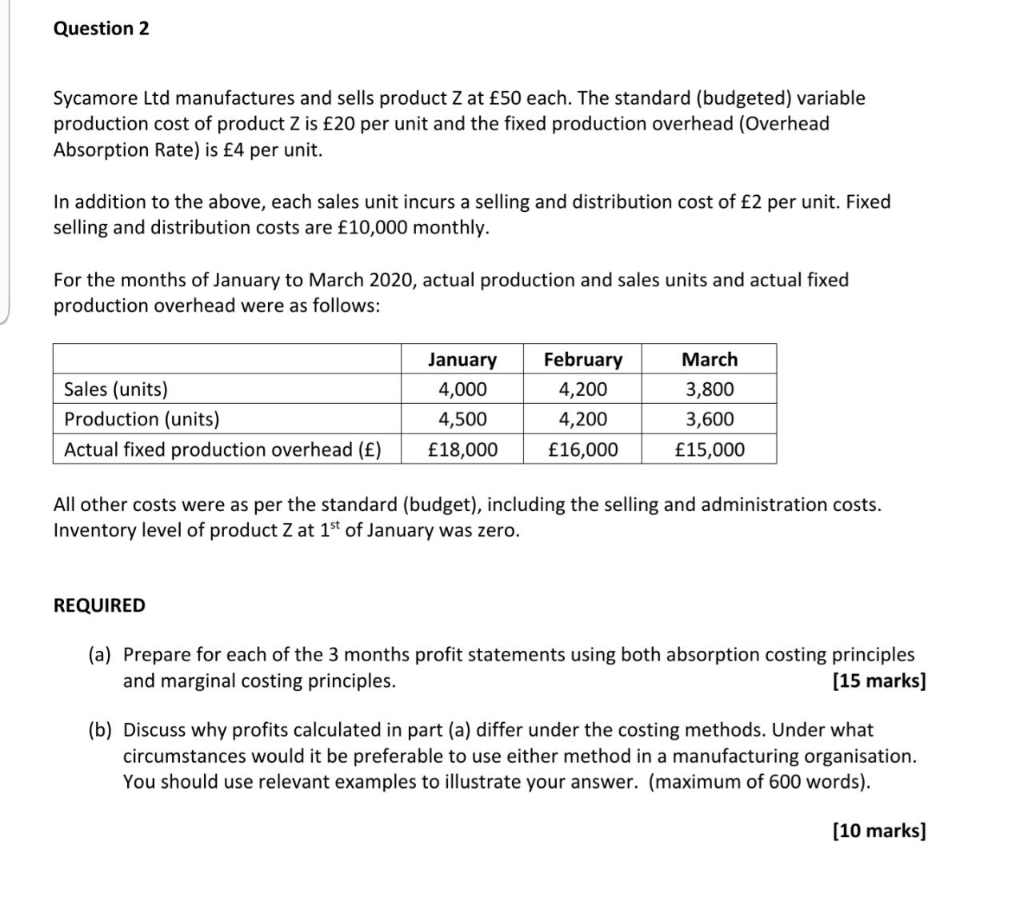

Question 2 Sycamore Ltd manufactures and sells product Z at 50 each. The standard (budgeted) variable production cost of product Z is 20 per unit and the fixed production overhead (Overhead Absorption Rate) is 4 per unit. In addition to the above, each sales unit incurs a selling and distribution cost of 2 per unit. Fixed selling and distribution costs are 10,000 monthly. For the months of January to March 2020, actual production and sales units and actual fixed production overhead were as follows: Sales (units) Production (units) Actual fixed production overhead () January 4,000 4,500 18,000 February 4,200 4,200 16,000 March 3,800 3,600 15,000 All other costs were as per the standard (budget), including the selling and administration costs. Inventory level of product Z at 1st of January was zero. REQUIRED (a) Prepare for each of the 3 months profit statements using both absorption costing principles and marginal costing principles. (15 marks] (b) Discuss why profits calculated in part (a) differ under the costing methods. Under what circumstances would it be preferable to use either method in a manufacturing organisation. You should use relevant examples to illustrate your answer. (maximum of 600 words). (10 marks] Question 2 Sycamore Ltd manufactures and sells product Z at 50 each. The standard (budgeted) variable production cost of product Z is 20 per unit and the fixed production overhead (Overhead Absorption Rate) is 4 per unit. In addition to the above, each sales unit incurs a selling and distribution cost of 2 per unit. Fixed selling and distribution costs are 10,000 monthly. For the months of January to March 2020, actual production and sales units and actual fixed production overhead were as follows: Sales (units) Production (units) Actual fixed production overhead () January 4,000 4,500 18,000 February 4,200 4,200 16,000 March 3,800 3,600 15,000 All other costs were as per the standard (budget), including the selling and administration costs. Inventory level of product Z at 1st of January was zero. REQUIRED (a) Prepare for each of the 3 months profit statements using both absorption costing principles and marginal costing principles. (15 marks] (b) Discuss why profits calculated in part (a) differ under the costing methods. Under what circumstances would it be preferable to use either method in a manufacturing organisation. You should use relevant examples to illustrate your answer. (maximum of 600 words). (10 marks]