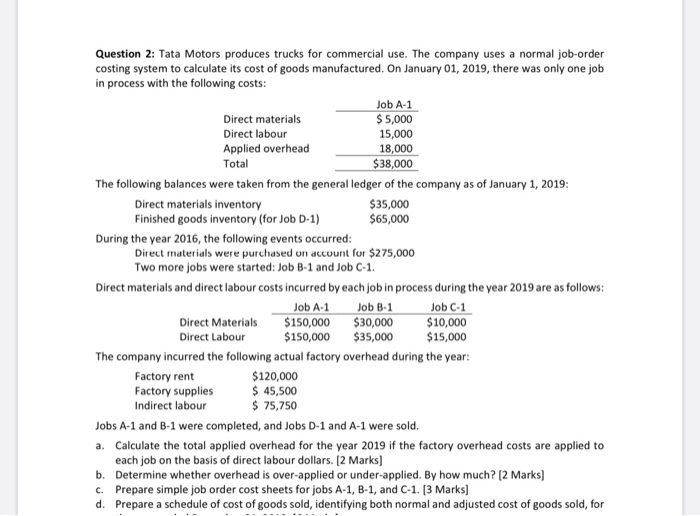

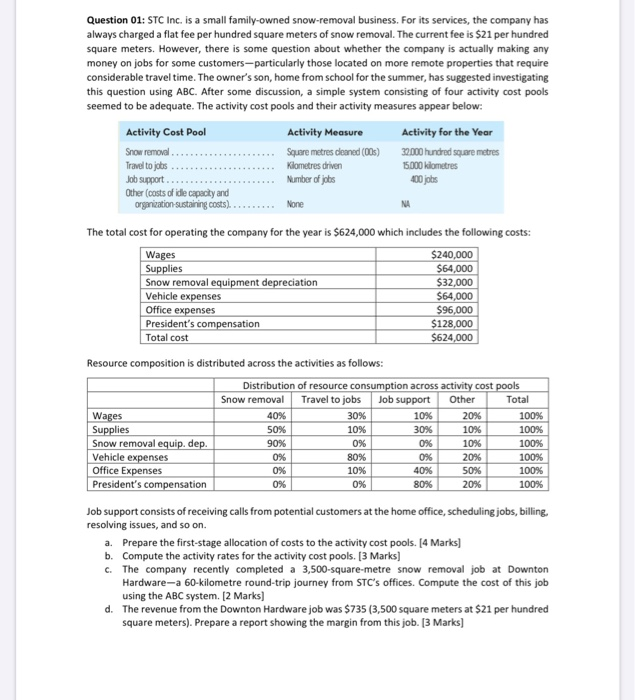

Question 2: Tata Motors produces trucks for commercial use. The company uses a normal job-order costing system to calculate its cost of goods manufactured. On January 01, 2019, there was only one job in process with the following costs: Job A-1 Direct materials $5,000 Direct labour 15,000 Applied overhead 18,000 Total $38,000 The following balances were taken from the general ledger of the company as of January 1, 2019: Direct materials inventory $35,000 Finished goods inventory (for Job D-1) $65,000 During the year 2016, the following events occurred: Direct materials were purchased on account for $275,000 Two more jobs were started: Job B-1 and Job C-1. Direct materials and direct labour costs incurred by each job in process during the year 2019 are as follows: Job A-1 Job B-1 Job C-1 Direct Materials $150,000 $30,000 $10,000 Direct Labour $150,000 $35,000 $15,000 The company incurred the following actual factory overhead during the year: Factory rent $120,000 Factory supplies $ 45,500 Indirect labour $ 75,750 Jobs A-1 and B-1 were completed, and Jobs D-1 and A-1 were sold. a. Calculate the total applied overhead for the year 2019 if the factory overhead costs are applied to each job on the basis of direct labour dollars. [2 marks] b. Determine whether overhead is over-applied or under-applied. By how much? [2 marks] c. Prepare simple job order cost sheets for jobs A-1, B-1, and C-1. [3 Marks) d. Prepare a schedule of cost of goods sold, identifying both normal and adjusted cost of goods sold, for Question 01: STC Inc. is a small family-owned snow-removal business. For its services, the company has always charged a flat fee per hundred square meters of snow removal. The current fee is $21 per hundred square meters. However, there is some question about whether the company is actually making any money on jobs for some customers-particularly those located on more remote properties that require considerable travel time. The owner's son, home from school for the summer, has suggested investigating this question using ABC. After some discussion, a simple system consisting of four activity cost pools seemed to be adequate. The activity cost pools and their activity measures appear below: Activity Cost Pool Activity Measure Activity for the Year Snow removal Square metres cleaned (005) 32000 hundred square metres Travel to jobs Kilometres driven 165.000 kilometres Job support Number of jobs 400 jobs Other (costs of ide capacity and organization sustaining costs). None NA The total cost for operating the company for the year is $624,000 which includes the following costs: Wages $240,000 Supplies $64,000 Snow removal equipment depreciation $32,000 Vehicle expenses $64,000 Office expenses $96,000 President's compensation $128,000 Total cost $624,000 Resource composition is distributed across the activities as follows: Distribution of resource consumption across activity cost pools Snow removal Travel to jobs Job support Other Total Wages 40% 30% 10% 20% 100% Supplies 50% 10% 30% 100% Snow removal equip. dep. 90% 0% 0% 10% 100% Vehicle expenses 0% 80% 20% 100% Office Expenses 0% 10% 40% 50% 100% President's compensation 0% 0% 80% 20% 100% Job support consists of receiving calls from potential customers at the home office, scheduling jobs, billing, resolving issues, and so on. a. Prepare the first-stage allocation of costs to the activity cost pools. [4 Marks) b. Compute the activity rates for the activity cost pools. [3 Marks) c. The company recently completed a 3,500-square-metre snow removal job at Downton Hardware-a 60-kilometre round-trip journey from STC's offices. Compute the cost of this job using the ABC system. (2 marks] d. The revenue from the Downton Hardware job was $735 (3,500 square meters at $21 per hundred square meters). Prepare a report showing the margin from this job. [3 Marks] 10% 0%