Answered step by step

Verified Expert Solution

Question

1 Approved Answer

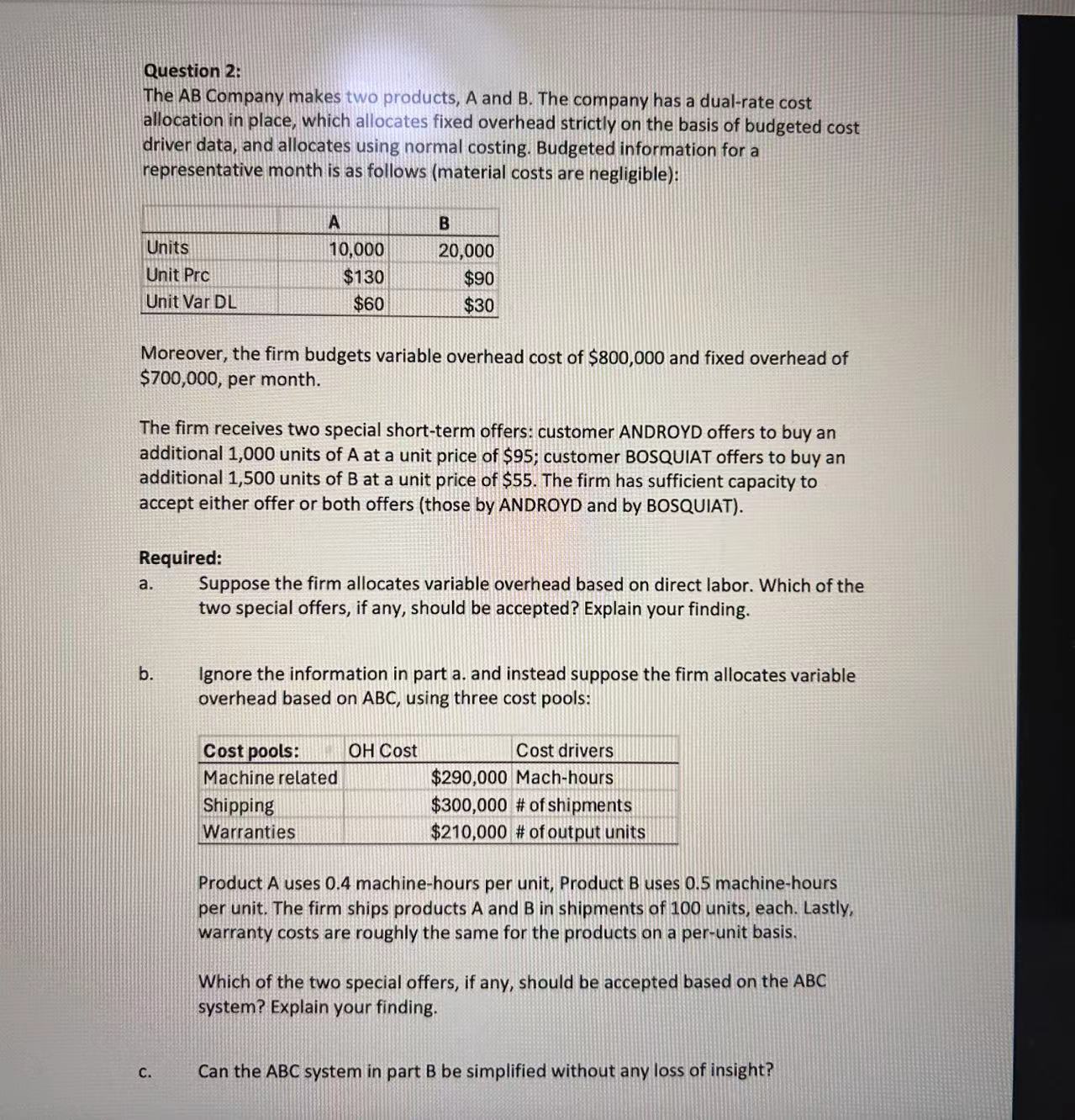

Question 2 : The AB Company makes two products, A and B . The company has a dual - rate cost allocation in place, which

Question :

The AB Company makes two products, A and B The company has a dualrate cost

allocation in place, which allocates fixed overhead strictly on the basis of budgeted cost

driver data, and allocates using normal costing. Budgeted information for a

representative month is as follows material costs are negligible:

Moreover, the firm budgets variable overhead cost of $ and fixed overhead of

$ per month.

The firm receives two special shortterm offers: customer ANDROYD offers to buy an

additional units of at a unit price of $; customer BOSQUIAT offers to buy an

additional units of at a unit price of $ The firm has sufficient capacity to

accept either offer or both offers those by ANDROYD and by BOSQUIAT

Required:

a Suppose the firm allocates variable overhead based on direct labor. Which of the

two special offers, if any, should be accepted? Explain your finding.

b Ignore the information in part a and instead suppose the firm allocates variable

overhead based on ABC, using three cost pools:

Product A uses machinehours per unit, Product uses machinehours

per unit. The firm ships products A and B in shipments of units, each. Lastly,

warranty costs are roughly the same for the products on a perunit basis.

Which of the two special offers, if any, should be accepted based on the ABC

system? Explain your finding.

c Can the ABC system in part be simplified without any loss of insight?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started