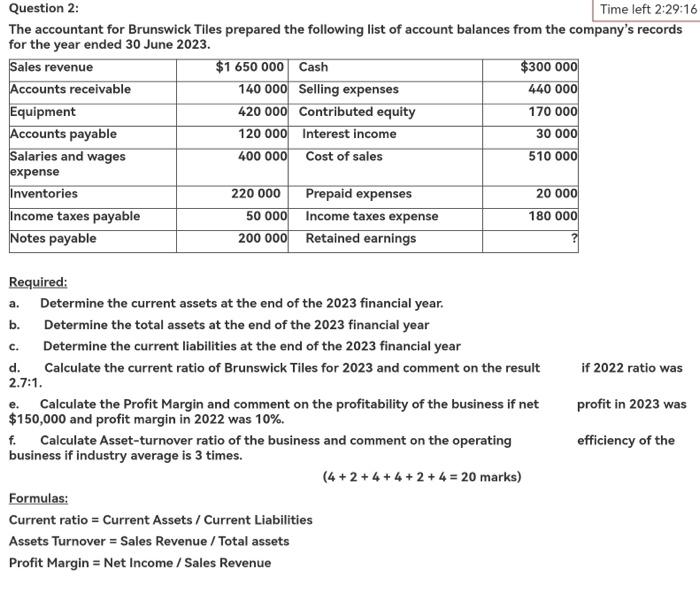

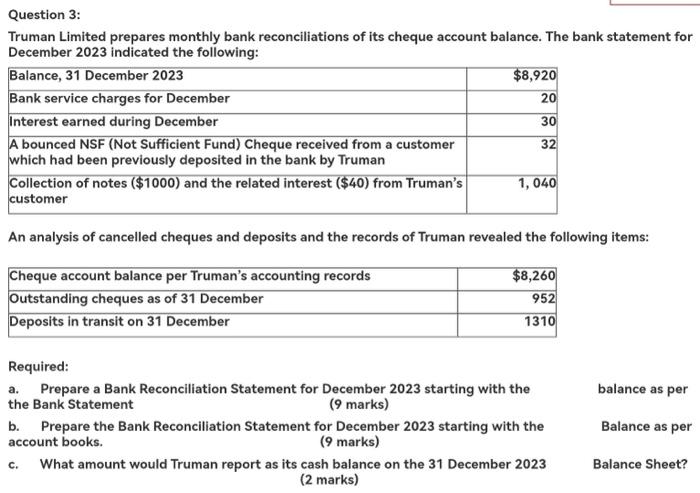

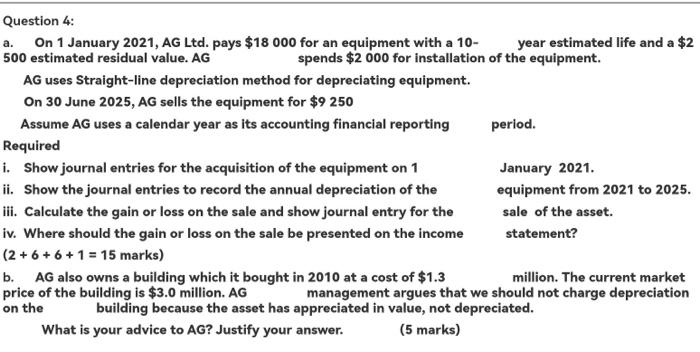

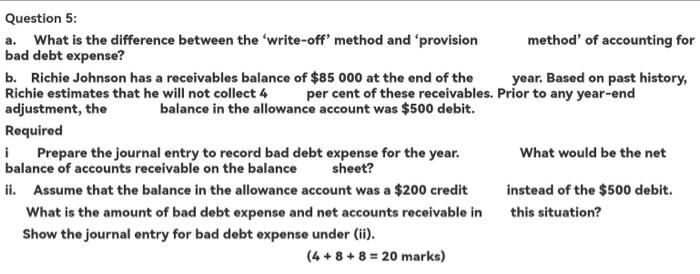

Question 2: The accountant for Brunswick Tiles prepared the following list of account balances from the company's records for the year ended 30 June 2023. Required: a. Determine the current assets at the end of the 2023 financial year. b. Determine the total assets at the end of the 2023 financial year c. Determine the current liabilities at the end of the 2023 financial year d. Calculate the current ratio of Brunswick Tiles for 2023 and comment on the result 2022 ratio was 2.7:1. e. Calculate the Profit Margin and comment on the profitability of the business if net profit in 2023 was $150,000 and profit margin in 2022 was 10%. f. Calculate Asset-turnover ratio of the business and comment on the operating efficiency of the business if industry average is 3 times. (4+2+4+4+2+4=20marks) Formulas: Current ratio = Current Assets / Current Liabilities Assets Turnover = Sales Revenue / Total assets Profit Margin = Net Income / Sales Revenue Question 3: Truman Limited prepares monthly bank reconciliations of its cheque account balance. The bank statement for December 2023 indicated the following: An analysis of cancelled cheques and deposits and the records of Truman revealed the following items: Required: a. Prepare a Bank Reconciliation Statement for December 2023 starting with the balance as per the Bank Statement (9 marks) b. Prepare the Bank Reconciliation Statement for December 2023 starting with the account books. (9 marks) c. What amount would Truman report as its cash balance on the 31 December 2023 Balance as per (2 marks) Question 4: a. On 1 January 2021, AG Ltd. pays $18000 for an equipment with a 10 - year estimated life and a $2 500 estimated residual value. AG spends $2000 for installation of the equipment. AG uses Straight-line depreciation method for depreciating equipment. On 30 June 2025, AG sells the equipment for $9250 Assume AG uses a calendar year as its accounting financial reporting period. Required i. Show journal entries for the acquisition of the equipment on 1 January 2021. ii. Show the journal entries to record the annual depreciation of the 2025. iii. Calculate the gain or loss on the sale and show journal entry for the sale of the asset. iv. Where should the gain or loss on the sale be presented on the income statement? (2+6+6+1=15 marks) b. AG also owns a building which it bought in 2010 at a cost of $1.3 million. The current market price of the building is $3.0 million. AG management argues that we should not charge depreciation on the building because the asset has appreciated in value, not depreciated. What is your advice to AG? Justify your answer. (5 marks) Question 5: a. What is the difference between the 'write-off' method and 'provision method' of accounting for bad debt expense? b. Richie Johnson has a receivables balance of $85000 at the end of the year. Based on past history, Richie estimates that he will not collect 4 per cent of these receivables. Prior to any year-end adjustment, the balance in the allowance account was $500 debit. Required i Prepare the journal entry to record bad debt expense for the year. What would be the net balance of accounts receivable on the balance sheet? ii. Assume that the balance in the allowance account was a $200 credit instead of the $500 debit. What is the amount of bad debt expense and net accounts receivable in this situation? Show the journal entry for bad debt expense under (ii). (4+8+8=20marks)