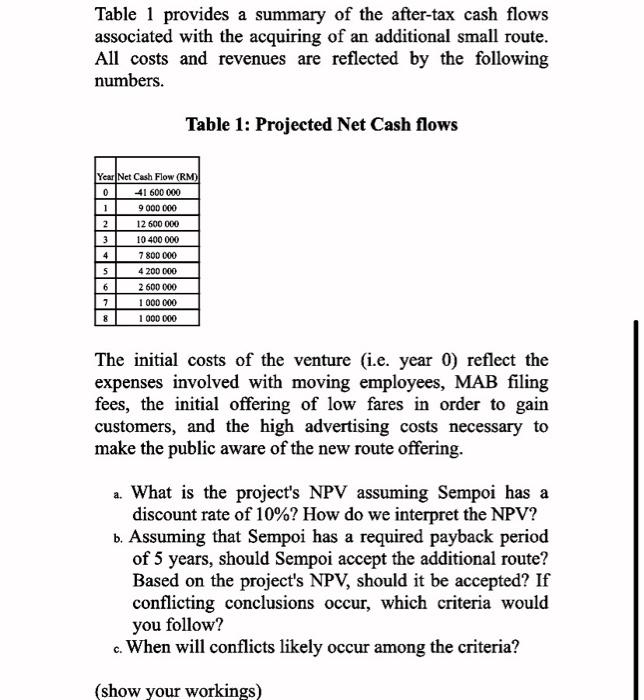

Question 2: The airline industry is extremely cyclical. For instance, due to a pandemic of Corvid 19, the airline industry has found itself with too many seats and too few passengers as people afraid to travel. Several airlines have filed for bankruptcy. Some have fully recovered, while others have been forced to liquidate. Narrowing profit margins have prompted airlines to develop creative survival tactics. Sempoi Airlines has successfully found its niche in the industry by providing direct flight service to less traveled routes such as those to and from smaller cities and to focus on low-cost carriers. Since these routes do not generate nearly as much revenue as major city routes, Sempoi has found ways to reduce its costs. Costs are reduced by following a no-frills policy that the travelers refer to as "peanut flights." This means that instead of serving costly meals (the quality of which passengers have historically complained about anyway), Sempoi serves just a bag of peanuts and a soft drink. With the recent success of short, direct flights, Sempoi is considering the purchase of one such additional route. Before an airline applies to the federal government for a new route, a lengthy analysis is performed to determine the feasibility of the route. Expenses to consider include airport costs such as gate and landing fees and labor costs such as local baggage handlers and maintenance workers. Many times, the airline will provide its own employees to load and unload luggage or to provide upkeep for their planes, but in the case of Sempoi, they have so many small cities to service that the outsourcing of these jobs is not uncommon. Table 1 provides a summary of the after-tax cash flows associated with the acquiring of an additional small route. All costs and revenues are reflected by the following numbers. Table 1: Projected Net Cash flows Year Net Cash Flow (RM) 0 41 600 000 1 9 000 000 2 12 600 000 3 10 400 000 4 7 800 000 5 4 200 000 6 2 600 000 7 1 000 000 8 1 000 000 The initial costs of the venture (i.e. year 0) reflect the expenses involved with moving employees, MAB filing fees, the initial offering of low fares in order to gain customers, and the high advertising costs necessary to make the public aware of the new route offering. a. What is the project's NPV assuming Sempoi has a discount rate of 10%? How do we interpret the NPV? b. Assuming that Sempoi has a required payback period of 5 years, should Sempoi accept the additional route? Based on the project's NPV, should it be accepted? If conflicting conclusions occur, which criteria would you follow? c. When will conflicts likely occur among the criteria? (show your workings)