Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 The company Ingeniero Prez, in its construction vehicle production division, uses traditional accounting methods to assign the production and management costs supported by

Question 2

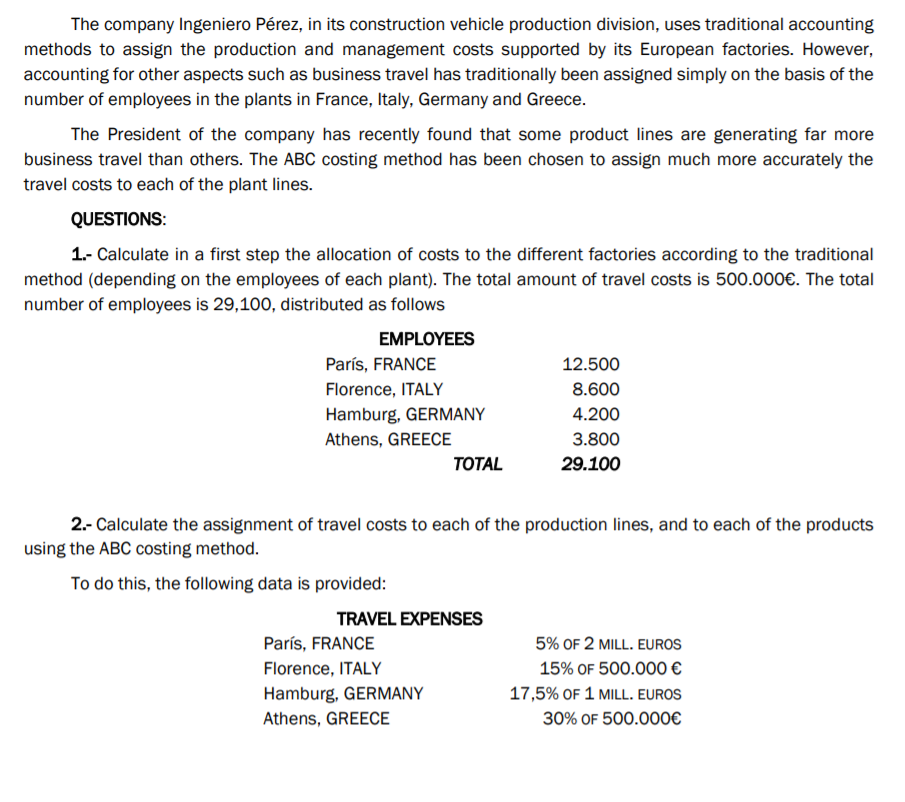

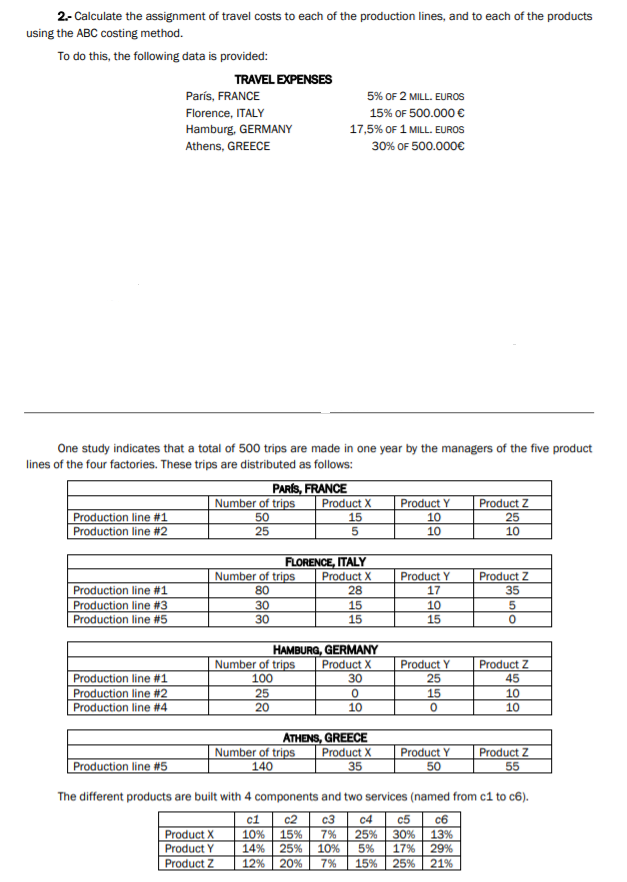

The company Ingeniero Prez, in its construction vehicle production division, uses traditional accounting methods to assign the production and management costs supported by its European factories. However, accounting for other aspects such as business travel has traditionally been assigned simply on the basis of the number of employees in the plants in France, Italy, Germany and Greece. The President of the company has recently found that some product lines are generating far more business travel than others. The ABC costing method has been chosen to assign much more accurately the travel costs to each of the plant lines. QUESTIONS: 1.- Calculate in a first step the allocation of costs to the different factories according to the traditional method (depending on the employees of each plant). The total amount of travel costs is 500.000. The total number of employees is 29,100, distributed as follows EMPLOYEES Pars, FRANCE Florence, ITALY Hamburg, GERMANY Athens, GREECE TOTAL 12.500 8.600 4.200 3.800 29.100 2.- Calculate the assignment of travel costs to each of the production lines, and to each of the products using the ABC costing method. To do this, the following data is provided: TRAVEL EXPENSES Pars, FRANCE 5% OF 2 MILL. EUROS Florence, ITALY 15% OF 500.000 Hamburg, GERMANY 17,5% OF 1 MILL. EUROS Athens, GREECE 30% OF 500.000 2.- Calculate the assignment of travel costs to each of the production lines, and to each of the products using the ABC costing method. To do this, the following data is provided: TRAVEL EXPENSES Pars, FRANCE 5% OF 2 MILL. EUROS Florence, ITALY 15% OF 500.000 Hamburg, GERMANY 17,5% OF 1 MILL. EUROS Athens, GREECE 30% OF 500.000 One study indicates that a total of 500 trips are made in one year by the managers of the five product lines of the four factories. These trips are distributed as follows: PARIS, FRANCE Number of trips Product Product Y Product Z Production line #1 50 15 10 25 Production line # 2 2 5 5 1 10 10 Production line #1 Production line #3 Production line #5 FLORENCE, ITALY Number of trips Product X 80 28 30 15 30 15 Product Y 17 10 1 5 Product Z 35 5 0 Production line #1 Production line #2 Production line #4 HAMBURG, GERMANY Number of trips Product X Product Y 100 30 25 25 0 15 20 1 0 20 Product Z 45 10 1 0 ATHENS, GREECE Number of trips Product X 140 Product Y 50 Product Z | 55 Production line #5 The different products are built with 4 components and two services (named from ci to c6). Tc1c2 03 04 05 06 Product X 10% 15% 7% 25% 30% 13% Product Y 14% 25% 10% 5% 17% 29% Product Z 12% 20% 7% 15% 25% 21% The company Ingeniero Prez, in its construction vehicle production division, uses traditional accounting methods to assign the production and management costs supported by its European factories. However, accounting for other aspects such as business travel has traditionally been assigned simply on the basis of the number of employees in the plants in France, Italy, Germany and Greece. The President of the company has recently found that some product lines are generating far more business travel than others. The ABC costing method has been chosen to assign much more accurately the travel costs to each of the plant lines. QUESTIONS: 1.- Calculate in a first step the allocation of costs to the different factories according to the traditional method (depending on the employees of each plant). The total amount of travel costs is 500.000. The total number of employees is 29,100, distributed as follows EMPLOYEES Pars, FRANCE Florence, ITALY Hamburg, GERMANY Athens, GREECE TOTAL 12.500 8.600 4.200 3.800 29.100 2.- Calculate the assignment of travel costs to each of the production lines, and to each of the products using the ABC costing method. To do this, the following data is provided: TRAVEL EXPENSES Pars, FRANCE 5% OF 2 MILL. EUROS Florence, ITALY 15% OF 500.000 Hamburg, GERMANY 17,5% OF 1 MILL. EUROS Athens, GREECE 30% OF 500.000 2.- Calculate the assignment of travel costs to each of the production lines, and to each of the products using the ABC costing method. To do this, the following data is provided: TRAVEL EXPENSES Pars, FRANCE 5% OF 2 MILL. EUROS Florence, ITALY 15% OF 500.000 Hamburg, GERMANY 17,5% OF 1 MILL. EUROS Athens, GREECE 30% OF 500.000 One study indicates that a total of 500 trips are made in one year by the managers of the five product lines of the four factories. These trips are distributed as follows: PARIS, FRANCE Number of trips Product Product Y Product Z Production line #1 50 15 10 25 Production line # 2 2 5 5 1 10 10 Production line #1 Production line #3 Production line #5 FLORENCE, ITALY Number of trips Product X 80 28 30 15 30 15 Product Y 17 10 1 5 Product Z 35 5 0 Production line #1 Production line #2 Production line #4 HAMBURG, GERMANY Number of trips Product X Product Y 100 30 25 25 0 15 20 1 0 20 Product Z 45 10 1 0 ATHENS, GREECE Number of trips Product X 140 Product Y 50 Product Z | 55 Production line #5 The different products are built with 4 components and two services (named from ci to c6). Tc1c2 03 04 05 06 Product X 10% 15% 7% 25% 30% 13% Product Y 14% 25% 10% 5% 17% 29% Product Z 12% 20% 7% 15% 25% 21%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started