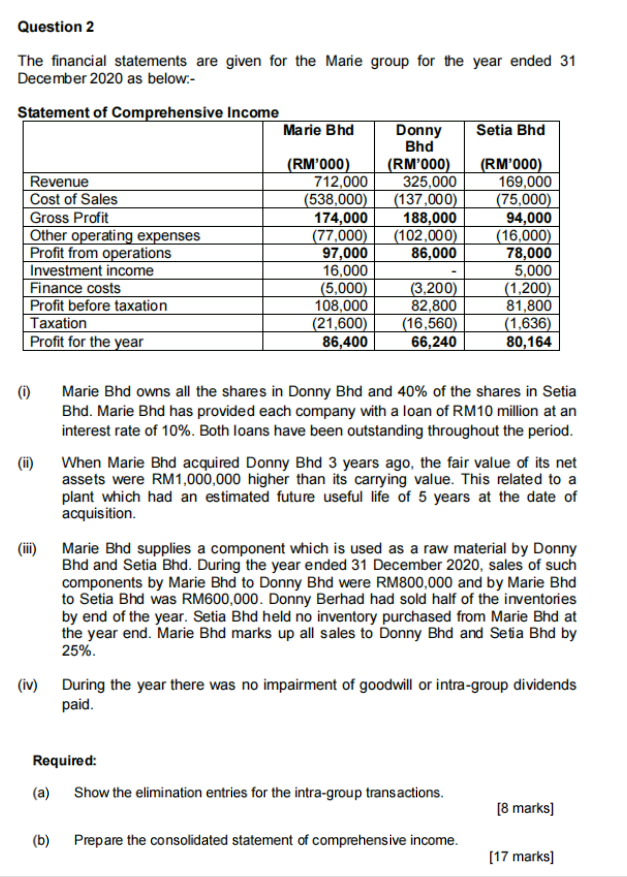

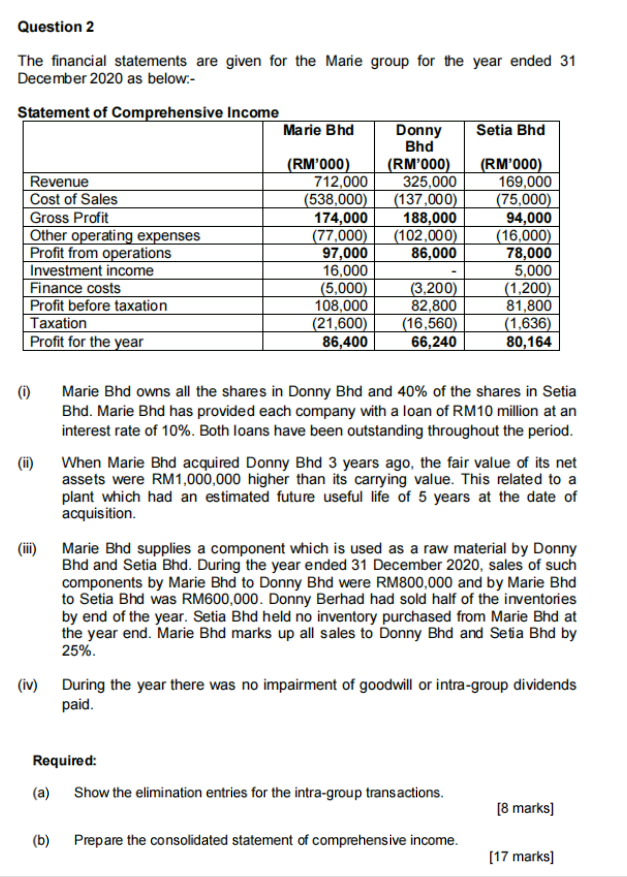

Question 2 The financial statements are given for the Marie group for the year ended 31 December 2020 as below:- Setia Bhd Statement of Comprehensive Income Marie Bhd Donny Bhd (RM'000) (RM'000) Revenue 712,000 325,000 Cost of Sales (538,000) (137,000) Gross Profit 174,000 188,000 Other operating expenses (77,000) (102,000) Profit from operations 97,000 86,000 Investment income 16,000 Finance costs (5,000) (3,200) Profit before taxation 108,000 82,800 Taxation (21,600) (16,560) Profit for the year 86,400 66,240 (RM'000) 169,000 (75,000) 94,000 (16,000) 78,000 5,000 (1,200) 81,800 (1,636) 80,164 (0) Marie Bhd owns all the shares in Donny Bhd and 40% of the shares in Setia Bhd. Marie Bhd has provided each company with a loan of RM10 million at an interest rate of 10%. Both loans have been outstanding throughout the period. When Marie Bhd acquired Donny Bhd 3 years ago, the fair value of its net assets were RM1,000,000 higher than its carrying value. This related to a plant which had an estimated future useful life of 5 years at the date of acquisition. Marie Bhd supplies a component which is used as a raw material by Donny Bhd and Setia Bhd. During the year ended 31 December 2020, sales of such components by Marie Bhd to Donny Bhd were RM800,000 and by Marie Bhd to Setia Bhd was RM600,000. Donny Berhad had sold half of the inventories by end of the year. Setia Bhd held no inventory purchased from Marie Bhd at the year end. Marie Bhd marks up all sales to Donny Bhd and Setia Bhd by 25% (iv) During the year there was no impairment of goodwill or intra-group dividends paid. Required: (a) Show the elimination entries for the intra-group transactions. [8 marks) (b) Prepare the consolidated statement of comprehensive income. [17 marks] Question 2 The financial statements are given for the Marie group for the year ended 31 December 2020 as below:- Setia Bhd Statement of Comprehensive Income Marie Bhd Donny Bhd (RM'000) (RM'000) Revenue 712,000 325,000 Cost of Sales (538,000) (137,000) Gross Profit 174,000 188,000 Other operating expenses (77,000) (102,000) Profit from operations 97,000 86,000 Investment income 16,000 Finance costs (5,000) (3,200) Profit before taxation 108,000 82,800 Taxation (21,600) (16,560) Profit for the year 86,400 66,240 (RM'000) 169,000 (75,000) 94,000 (16,000) 78,000 5,000 (1,200) 81,800 (1,636) 80,164 (0) Marie Bhd owns all the shares in Donny Bhd and 40% of the shares in Setia Bhd. Marie Bhd has provided each company with a loan of RM10 million at an interest rate of 10%. Both loans have been outstanding throughout the period. When Marie Bhd acquired Donny Bhd 3 years ago, the fair value of its net assets were RM1,000,000 higher than its carrying value. This related to a plant which had an estimated future useful life of 5 years at the date of acquisition. Marie Bhd supplies a component which is used as a raw material by Donny Bhd and Setia Bhd. During the year ended 31 December 2020, sales of such components by Marie Bhd to Donny Bhd were RM800,000 and by Marie Bhd to Setia Bhd was RM600,000. Donny Berhad had sold half of the inventories by end of the year. Setia Bhd held no inventory purchased from Marie Bhd at the year end. Marie Bhd marks up all sales to Donny Bhd and Setia Bhd by 25% (iv) During the year there was no impairment of goodwill or intra-group dividends paid. Required: (a) Show the elimination entries for the intra-group transactions. [8 marks) (b) Prepare the consolidated statement of comprehensive income. [17 marks]