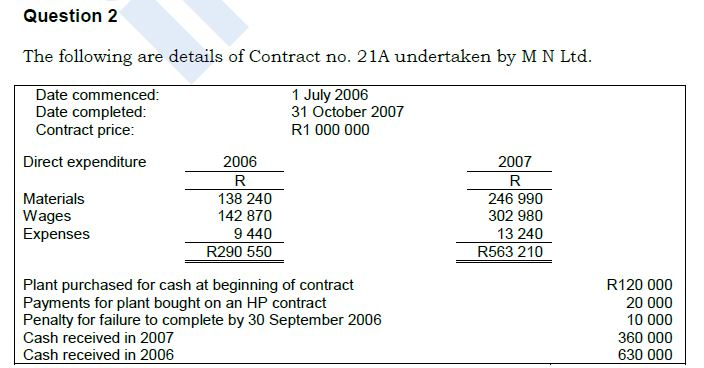

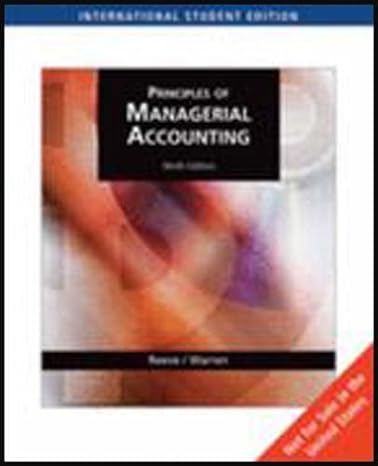

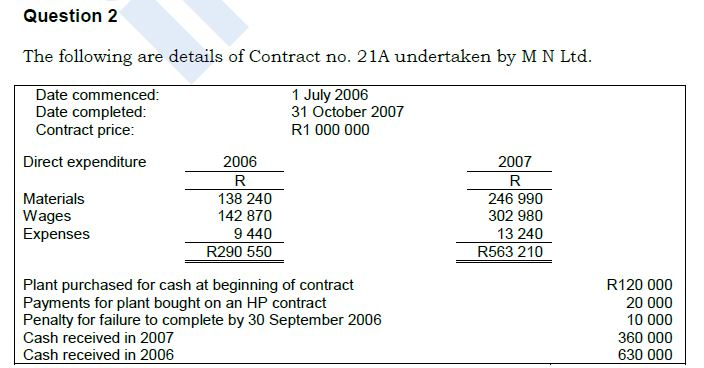

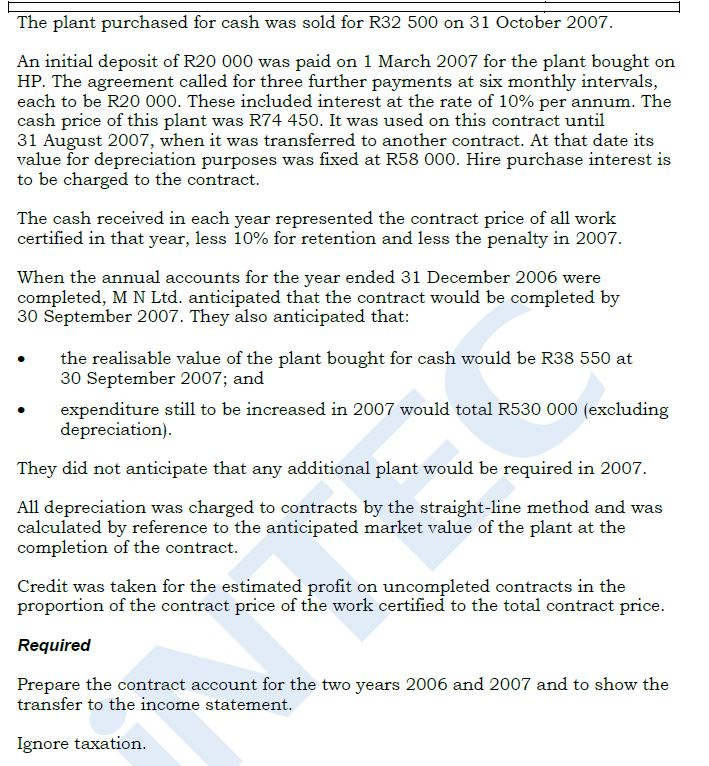

Question 2 The following are details of Contract no. 21A undertaken by M N Ltd. Date commenced: Date completed: Contract price: Direct expenditure 1 July 2006 31 October 2007 R1 000 000 Materials Wages Expenses 2006 R 138 240 142 870 9 440 R290 550 2007 R 246 990 302 980 13 240 R563 210 Plant purchased for cash at beginning of contract Payments for plant bought on an HP contract Penalty for failure to complete by 30 September 2006 Cash received in 2007 Cash received in 2006 R120 000 20 000 10 000 360 000 630 000 The plant purchased for cash was sold for R32 500 on 31 October 2007. An initial deposit of R20 000 was paid on 1 March 2007 for the plant bought on HP. The agreement called for three further payments at six monthly intervals, each to be R20 000. These included interest at the rate of 10% per annum. The cash price of this plant was R74 450. It was used on this contract until 31 August 2007, when it was transferred to another contract. At that date its value for depreciation purposes was fixed at R58 000. Hire purchase interest is to be charged to the contract. The cash received in each year represented the contract price of all work certified in that year, less 10% for retention and less the penalty in 2007. When the annual accounts for the year ended 31 December 2006 were completed, M N Ltd. anticipated that the contract would be completed by 30 September 2007. They also anticipated that: the realisable value of the plant bought for cash would be R38 550 at 30 September 2007; and expenditure still to be increased in 2007 would total R530 000 (excluding depreciation). They did not anticipate that any additional plant would be required in 2007. All depreciation was charged to contracts by the straight-line method and was calculated by reference to the anticipated market value of the plant at the completion of the contract. Credit was taken for the estimated profit on uncompleted contracts in the proportion of the contract price of the work certified to the total contract price. Required Prepare the contract account for the two years 2006 and 2007 and to show the transfer to the income statement. Ignore taxation. Question 2 The following are details of Contract no. 21A undertaken by M N Ltd. Date commenced: Date completed: Contract price: Direct expenditure 1 July 2006 31 October 2007 R1 000 000 Materials Wages Expenses 2006 R 138 240 142 870 9 440 R290 550 2007 R 246 990 302 980 13 240 R563 210 Plant purchased for cash at beginning of contract Payments for plant bought on an HP contract Penalty for failure to complete by 30 September 2006 Cash received in 2007 Cash received in 2006 R120 000 20 000 10 000 360 000 630 000 The plant purchased for cash was sold for R32 500 on 31 October 2007. An initial deposit of R20 000 was paid on 1 March 2007 for the plant bought on HP. The agreement called for three further payments at six monthly intervals, each to be R20 000. These included interest at the rate of 10% per annum. The cash price of this plant was R74 450. It was used on this contract until 31 August 2007, when it was transferred to another contract. At that date its value for depreciation purposes was fixed at R58 000. Hire purchase interest is to be charged to the contract. The cash received in each year represented the contract price of all work certified in that year, less 10% for retention and less the penalty in 2007. When the annual accounts for the year ended 31 December 2006 were completed, M N Ltd. anticipated that the contract would be completed by 30 September 2007. They also anticipated that: the realisable value of the plant bought for cash would be R38 550 at 30 September 2007; and expenditure still to be increased in 2007 would total R530 000 (excluding depreciation). They did not anticipate that any additional plant would be required in 2007. All depreciation was charged to contracts by the straight-line method and was calculated by reference to the anticipated market value of the plant at the completion of the contract. Credit was taken for the estimated profit on uncompleted contracts in the proportion of the contract price of the work certified to the total contract price. Required Prepare the contract account for the two years 2006 and 2007 and to show the transfer to the income statement. Ignore taxation