Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 The following are the financial statements, with an extract from the notes, of XYZ Sales Cost of sales Gross profit Distribution costs

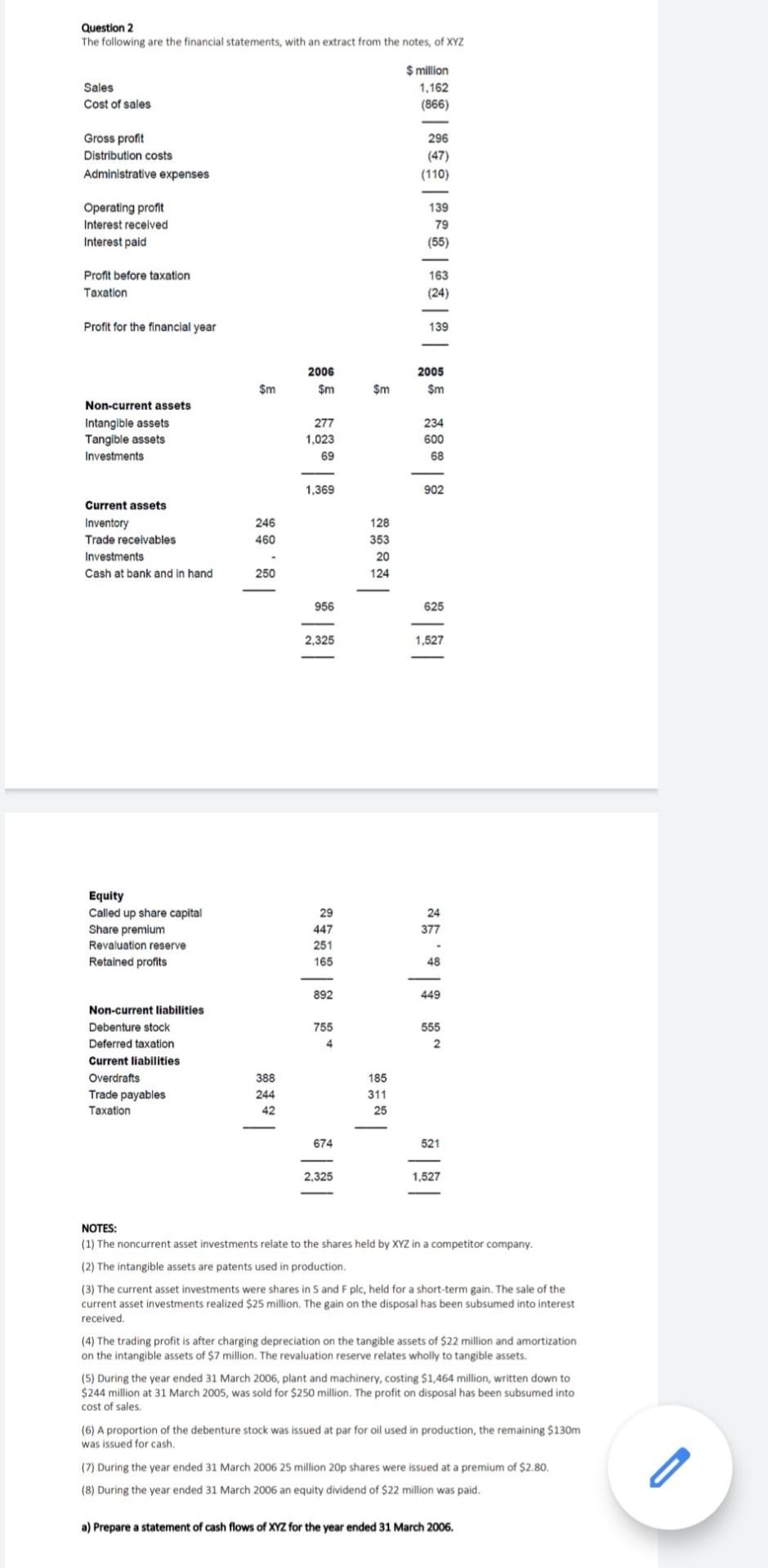

Question 2 The following are the financial statements, with an extract from the notes, of XYZ Sales Cost of sales Gross profit Distribution costs Administrative expenses Operating profit Interest received Interest paid Profit before taxation Taxation Profit for the financial year Non-current assets Intangible assets Tangible assets Investments Current assets Inventory Trade receivables Investments Cash at bank and in hand Equity Called up share capital Share premium Revaluation reserve Retained profits Non-current liabilities Debenture stock Deferred taxation Current liabilities Overdrafts Trade payables Taxation $m 246 460 250 388 244 42 2006 $m 277 1,023 69 1,369 956 2,325 29 447 251 165 892 755 4 674 2,325 $m 128 353 20 124 185 311 25 $ million 1,162 (866) 296 (47) (110) 139 79 (55) 163 (24) 139 2005 $m 234 600 68 902 625 1,527 24 377 48 449 555 2 521 1,527 NOTES: (1) The noncurrent asset investments relate to the shares held by XYZ in a competitor company. (2) The intangible assets are patents used in production. (3) The current asset investments were shares in S and F plc, held for a short-term gain. The sale of the current asset investments realized $25 million. The gain on the disposal has been subsumed into interest received. (4) The trading profit is after charging depreciation on the tangible assets of $22 million and amortization on the intangible assets of $7 million. The revaluation reserve relates wholly to tangible assets. (5) During the year ended 31 March 2006, plant and machinery, costing $1,464 million, written down to $244 million at 31 March 2005, was sold for $250 million. The profit on disposal has been subsumed into cost of sales. (6) A proportion of the debenture stock was issued at par for oil used in production, the remaining $130m was issued for cash. (7) During the year ended 31 March 2006 25 million 20p shares were issued at a premium of $2.80. (8) During the year ended 31 March 2006 an equity dividend of $22 million was paid. a) Prepare a statement of cash flows of XYZ for the year ended 31 March 2006.

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Statement of cash flow for the year ended 31 March 2006 000 Operating activities Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started