Answered step by step

Verified Expert Solution

Question

1 Approved Answer

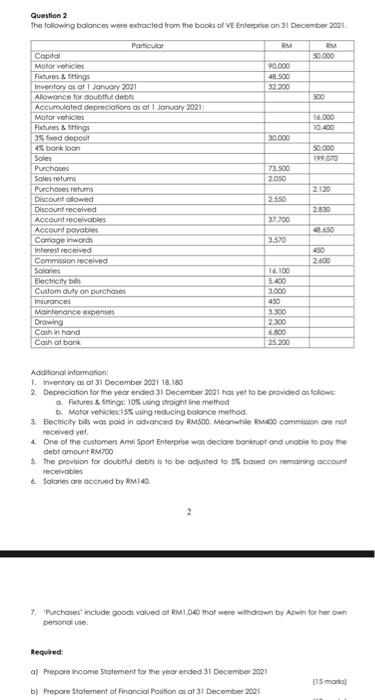

Question 2 The following balances were extracted from the books of VE Enterprise on 31 December 2021. Capital Motor vehicles Fixtures & fittings Inventory as

Question 2 The following balances were extracted from the books of VE Enterprise on 31 December 2021. Capital Motor vehicles Fixtures & fittings Inventory as at 1 January 2021 Allowance for doubtful debts Accumulated depreciations as at 1 January 2021: Motor vehicles Fixtures & fittings 3% fixed deposit 4% bank loan Sales Purchases Sales returns Purchases returns Discount allowed Discount received Account receivables Account payables Carriage inwards Interest received Commission received Salaries Electricity bills Custom duty on purchases Insurances Maintenance expenses Drawing Cash in hand Cash at bank Particular Required: 2 RM 90,000 48,500 32,200 a) Prepare Income Statement for the year ended 31 December 2021 30,000 b) Prepare Statement of Financial Position as at 31 December 2021 73,500 2,050 2,550 37,700 3,570 16,100 5,400 3,000 450 3,300 2,300 6,800 25,200 RM 50,000 500 16,000 10,400 50,000 199,070 2,120 Additional information: 1. Inventory as at 31 December 2021 18,180 2. Depreciation for the year ended 31 December 2021 has yet to be provided as follows: a. Fixtures & fittings: 10% using straight line method b. Motor vehicles: 15% using reducing balance method. 3. Electricity bills was paid in advanced by RM500. Meanwhile RM400 commission are not received yet. 2,830 4. One of the customers Amri Sport Enterprise was declare bankrupt and unable to pay the debt amount RM700 5. The provision for doubtful debts is to be adjusted to 5% based on remaining account receivables 6. Salaries are accrued by RM140. 48,650 450 2,600 7. 'Purchases' include goods valued at RM1,040 that were withdrawn by Azwin for her own personal use. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started